A message for the NDP: profits are people, too

Yours truly, Stephen Gordon

NDP leader Tom Mulcair asks a question during Question Period in the House of Commons on Parliament Hill in Ottawa on Monday, May 14, 2012. THE CANADIAN PRESS/Sean Kilpatrick

Share

The preamble of the NDP’s constitution contains this passage:

The principles of democratic socialism can be defined briefly as:

That the production and distribution of goods and services shall be directed to meeting the social and individual needs of people within a sustainable environment and economy and not to the making of profit; …

This sentiment — usually summarized by the slogans “People before profits” or “People, not profits” — is a ubiquitous theme in politics. But it reflects a fundamental misunderstanding of the role of profits in the modern economy, and the NDP would do well to follow through on the proposal(s) to remove it when the party convenes in Montreal this weekend.

Firstly, profits aren’t sent to another planet once they’re paid out: they stay among the people of Earth. I don’t suppose that revelation surprises anyone — the presumption supposedly is that profits are for the rich.

Equating profits with high incomes made sense for almost all of economic history: wages were too low for workers to save much, and the only way to generate large incomes was to obtain correspondingly large asset holdings, typically land. This was certainly the case when The Communist Manifesto was published in 1848, and still the case, generally, for Canada one hundred years later. In 1948, 47.6 per cent of the income of the top 0.01 per cent came from their capital holdings, another 24.2 per cent was generated by the self-employed; only 28.2 per cent of their income was in the form of wages (Read more on that here).

Two things have changed since then. First, wages have increased, and some people have seen their wages increase by dizzying multiples. The well-documented concentration of income at the top of the distribution in Canada and the United States has been driven by increases in wages and salaries, and not by investment income — wages now account for about 70 per cent of income at the top end. Bank presidents’ 10-figure incomes are being generated by their activities as wage slaves, not their asset holdings.

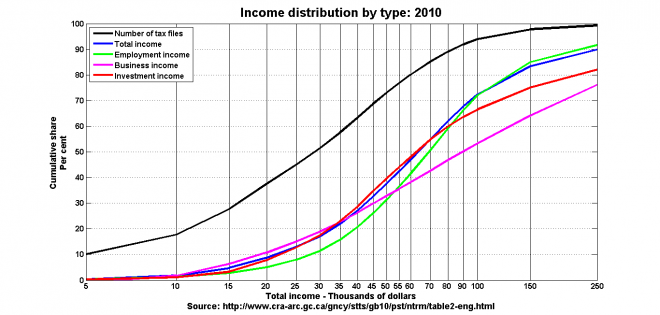

The other thing is that not all profits go to the rich. Below I’ve charted the various types of income according to the cumulative shares for each income group (check here for more details. The 2010 tax data are available here):

- Employment income: wages and salaries account for about two-thirds of total income.

- Investment income: this is passive income generated from asset holdings: dividends, interest payments and pensions. (Since only 50 per cent of capital gains are reported in the tax return, reported capital gains income is multiplied by two.)

- Business income: this is essentially income from self-employment. It is listed separately, because it’s not clear to me how to separate total self-employment income into its wage and investment components.

Roughly 10 per cent of tax files report total incomes of less than $5,000, and about a third of all tax filers report no taxable income: even if you pay no taxes, you must file a return in order to be eligible for tax credit programs like the GST/HST rebate and the Working Income Tax Benefit.

Here’s how to read the chart: The horizontal axis is the total income reported by tax filers, with a log scale. The vertical scale is the cumulative share. Moving horizontally along a given percentage, we can see that (say) 30 per cent of the tax files reported total incomes under $15,000, 30 per cent of total income went to those earning less than $42,000, 30 per cent of business income went to those earning $45,000 or less, 30 per cent of investment income went to those earning less than $40,000, and 30 per cent of wage income went to those earning less than $50,000. Moving vertically, we see that those earning (say) $30,000 or less accounted for 50 per cent of all tax files, 20 per cent of business income, about 18 per cent of investment income and total income, and about 12 per cent of wage income.

Let’s look at the right-hand tail of the income distribution. The graph is truncated at $250,000, which is where the Canada Revenue Agency truncates the data in that table. People with incomes of more than $250,000 account for 0.75 per cent of tax files, 8.3 per cent of employment income and 17.9 per cent of investment income. Equivalently, the bottom 99.25 per cent of tax files account for 91.7 per cent of employment income and 82.1 per cent of investment income. Yet another way of saying the same thing is noting that the red investment cumulative share line is below the green employment cumulative share.

This is what one would expect: the top end gets a big piece of the labour pie and an even bigger piece of the capital pie. But it’s not always the case that higher incomes are associated with a higher share of investment income. Look what happens further to the left: the employment and investment income shares cross at the $80,000 income level. For income levels below $80,000, it is no longer the case that those with higher incomes have investment shares greater then employment shares. For example, people with incomes of $40,000 or less account for 63.4 per cent of tax files, 28.7 per cent of investment income and only 20.8 per cent of employment income. It’s not clear how shifting income from capital to labour is going to help people in the bottom two-thirds or bottom three-quarters of the income distribution: their share of investment income is greater than their share of employment income.

The explanation for this is of course the fact that pensions income is investment income. (This point was explored in depth in the Profit episode of the CBC Radio series The Invisible Hand. Its admittedly provocative hook — ‘your grandmother is a capitalist’ — generated a certain amount of indignation.) Another important consequence of rising wages is that more people can and do save for retirement, even if it’s only in the form of CPP/QPP contributions. These holdings are enormous, and pension plans have become major players in financial markets. Millions of people are counting on these assets to sustain them through retirement, and not all of them are plutocrats. In fact, as a larger fraction of the population ages into retirement, a major policy challenge will be to make sure that investment incomes increase at an even faster rate.

None of this is to say that the NDP should abandon inequality as an issue: the top 10 per cent receive 40 per cent of all investment income. But the top 10 per cent also receive 40 per cent of all employment income, and no-one is chanting “People, not salaries.” Income is income.

I don’t know if a new preamble that doesn’t single out profits as a target for opprobrium will receive the support of the NDP membership (did I tell you about the indignant responses to the profit episode of The Invisible Hand?), but it should.