Canada’s labour market is closer to ‘normal’ than you think

We’re in better shape than the U.S. or the U.K.

Chris Bolin

Share

Economist Chris Ragan, over at the Globe and Mail, recently wondered why the Bank of Canada is no longer using so-called “forward guidance,” promising, that is, that short-term interest rates will stay low as a way of encouraging business and families to borrow and stimulate economic activity. The BoC embraced forward guidance in 2009-2010 and the U.S. Federal Reserve, as well as the Bank of England (now headed by former BoC Governor Marck Carney) are still using it. If the BoC thinks forward guidance is unneeded because the economy is doing OK, Ragan wrote, it might wish to reconsider:

Judging by official unemployment rates, Canada’s recovery has been a little stronger. But the unemployment rate does not capture the problem created when discouraged workers give up their job search and drop out of the labour market. If we look instead at the employment-to-population ratio – a better measure of the economy’s job-creation performance – Canada’s recovery is actually slightly weaker than those of the U.S. and Britain.

But I’m not sure where that conclusion came from.

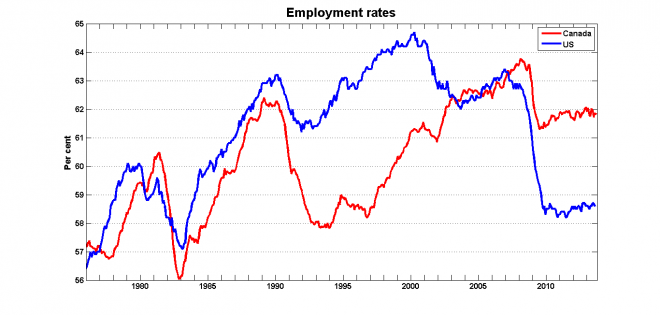

Here is a graph of the Canadian (in red) and the U.S. (blue) employment-population ratio (for more on this see also this recent post from expat Canadian economist David Andolfatto):

Depending on which period you’re looking at, I suppose you can pick out a recent episode in which employment rates in the U.S. increased more than in Canada, but the most striking thing to me in that graph is the much steeper fall in the U.S. employment rate. Canada is much closer to reaching pre-recession levels than the US.

Depending on which period you’re looking at, I suppose you can pick out a recent episode in which employment rates in the U.S. increased more than in Canada, but the most striking thing to me in that graph is the much steeper fall in the U.S. employment rate. Canada is much closer to reaching pre-recession levels than the US.

It’s not clear to me, though, that the proper reference point for judging what’s “normal” should be pre-recession employment rates, for two reasons. The first is that the years immediately preceding the 2008-9 recession were not normal times in Canada; commodity prices were in the stratosphere, and the Bank of Canada’s estimates for the output gap suggest that the economy was operating significantly above capacity. The last time the output gap was near zero for any length of time was 2005-6.

The other factor to consider is population aging. Demographic changes usually occur so slowly that we can ignore them in the short run, but that’s not the case right now. In September 2008, 53.1 per cent of those 15 and over were of prime working age (25-54); by September 2013, that ratio had fallen to 50.8 per cent. This matters, because employment rates vary significantly across age groups.

So it’s a good idea to look at employment rates across age groups. (It’s also a good idea to break it down by sex, as Andolfatto does, but I don’t think it changes the story here.)

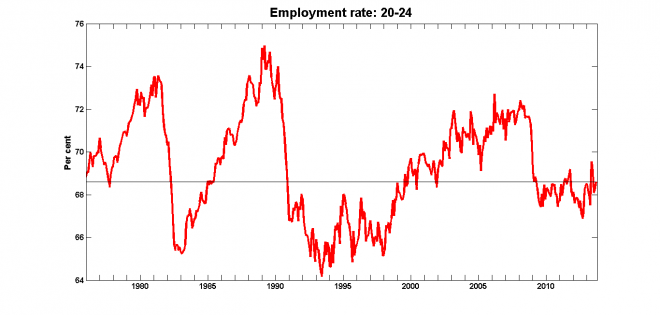

Let’s start with 20-24-year-olds:

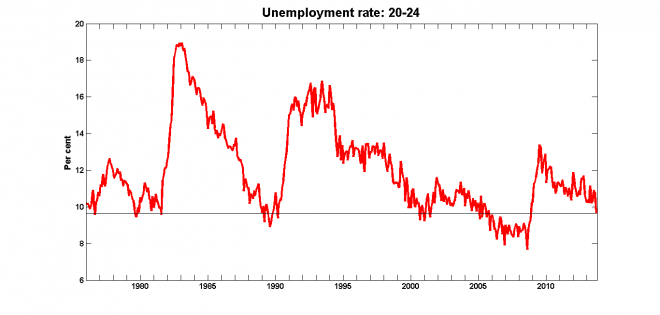

And here’s the unemployment rate:

And here’s the unemployment rate:

Youth unemployment is actually pretty low by historical standards; the only time it was lower was during the boom years just before the recession. On the other hand, employment rates are still low. This is the same thing as saying that youth participation rates have fallen. It’s not immediately obvious whether that’s a bad thing. If young people are going back to school and/or topping up their skills in formal training programs, a lower participation rate now may mean good things for the future.

Youth unemployment is actually pretty low by historical standards; the only time it was lower was during the boom years just before the recession. On the other hand, employment rates are still low. This is the same thing as saying that youth participation rates have fallen. It’s not immediately obvious whether that’s a bad thing. If young people are going back to school and/or topping up their skills in formal training programs, a lower participation rate now may mean good things for the future.

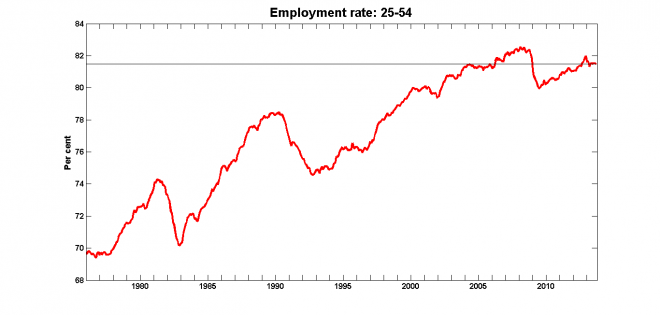

Next, the 25-54 age group:

This graph is probably one of the main reasons why the Bank of Canada is no longer in the forward-guidance game. Prime-age employment rates have recovered quite a bit from the recession and are consistent with what they were in 2005-2006 — which is the last time the output gap was near zero.

This graph is probably one of the main reasons why the Bank of Canada is no longer in the forward-guidance game. Prime-age employment rates have recovered quite a bit from the recession and are consistent with what they were in 2005-2006 — which is the last time the output gap was near zero.

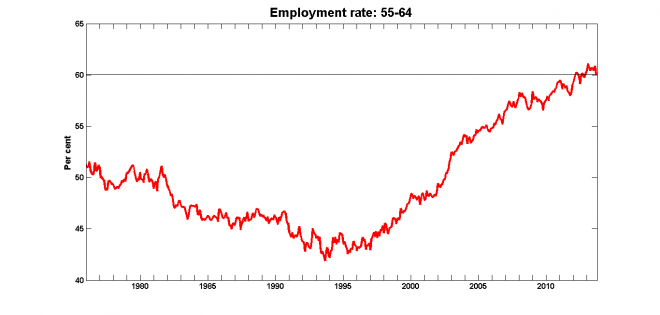

For completeness, and because it’s an interesting development in its own right, here are the employment rates for the 55-64 age group:

Employment rates for those 65 and older have a similar pattern: falling to a low of six per cent in 2001, and increasing to around 13 per cent today.

Employment rates for those 65 and older have a similar pattern: falling to a low of six per cent in 2001, and increasing to around 13 per cent today.

I don’t think the Bank of Canada should be any hurry to remove the monetary stimulus that’s currently in place: There is still some slack in the labour market — particularly among youths — and inflation has been undershooting the Bank’s target for more than a year now. But I don’t think it’s surprising that the Bank does not see fit to offer the sort of forward guidance we’re seeing in the U.S. and the U.K. We’re a lot closer to “back to normal” than they are.