Bank of Canada revises down growth for the rest of 2012

The Bank of Canada just published its third Monetary Policy Report for the year, the quarterly publication where it discusses growth and inflation projections for Canada and how developments around the world affect both of those. Here are a few highlights:

Share

The Bank of Canada just published its third Monetary Policy Report for the year, the quarterly publication where it discusses growth and inflation projections for Canada and how developments around the world affect both of those. Here are a few highlights:

Growth:

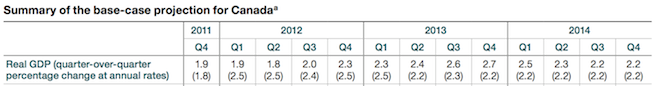

Numbers in parentheses indicate what the BOC was forecasting in the previous report, back in April–note the significant downward revision for growth in the second quarter of this year, down to 1.8 per cent from a previous prediction of 2.5 per cent.

Housing:

“The additional prudent and timely measures recently announced by federal authorities are expected to contribute to a more sustainable evolution of housing market activity in Canada.”

BUT

“Housing investment […] is around historical highs and showing signs of overbuilding.”

THOUGH

“Housing activity is expected to slow from record levels.”

Household debt:

“Continuing high household debt levels in Canada could lead to a sharper- than-expected deceleration in household spending. Relatedly, if there were a sudden weakening in the Canadian housing sector, it could have sizable spillover effects on other areas of the economy.”

Exports:

“Canadian exports are projected to remain below their pre-recession peak until the beginning of 2014, reflecting the dynamics of foreign demand and ongoing competitive- ness challenges, including the persistent strength of the Canadian dollar.”

Read the full text here.