‘Clear evidence of a bubble is lacking’—really?

The CMHC’s optimism about Canada’s housing market seems, well, inflated

Share

Earlier this week the Canadian Housing and Mortgage Corporation published its 2011 Annual Report–which reads like a 184-pages long effort to brush off concerns about Canada’s housing market. “Clear evidence of a bubble is lacking,” the document proclaims at one point, after liberally sprinkling the words “solid,” “sound,” “responsible” and “prudent” throughout the previous 30-some pages.

Well, signs of a bubble are rarely “clear.” As Finn Poschmann, of the C.D. Howe Institute, told Bloomberg on Tuesday, it’s always difficult to tell whether a bubble has formed until it goes “pop.” This is partly why bubbles, especially in real estate, continue to happen even though you’d think someone at some point would have learned the lesson.

But let’s take a closer look at the CMHC’s no-bubble-no-worry argument. The housing agency seems to argue that the housing boom of the last decade was largely warranted by the fundamentals, i.e. important and independent underlying demographic and economic factors. Specifically, among other things, the CMHC notes that:

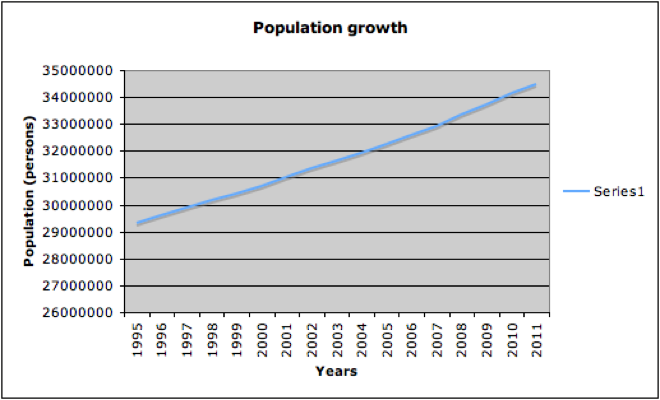

1. There are ever more people living in Canada (who supposedly need a place to live in): Canada’s population has increased by nearly six per cent between 2006 and 2011–the highest rate among G8 economies–and by over five per cent in the previous five years, the report says.

2. Canadians are getting better jobs (hence they can supposedly better afford their mortgages): In 2011, the CMHC writes, the unemployment rate fell from eight to 7.5 per cent and full-time employment rose by 1.5 per cent, while part-time work declined 0.3 per cent. “The compositional change in full-time positions will support Canada’s housing sector,” the agency concludes.

3. Canadians also keep getting richer: Reads the report: “Incomes grew in 2011 because of the economic recovery and the resulting improvements in the labour market. Income will continue to grow at a moderate pace in 2012 and be supportive of housing.”

4. Interest rates are going to stay low for the foreseeable future (so that the swelling ranks of people living in Canada with better jobs won’t have to worry about being able to continue to afford their mortgages): “The Bank of Canada has kept its target for the overnight interest rate at 1.0% since September 2010 and has indicated that it is likely to remain at 1.0%,” reads the report.

All four points seem questionable. For starters, Canada’s population seems to have been growing at a fairly steady rate since well before the housing boom of the last ten years (data come from Statistics Canada):

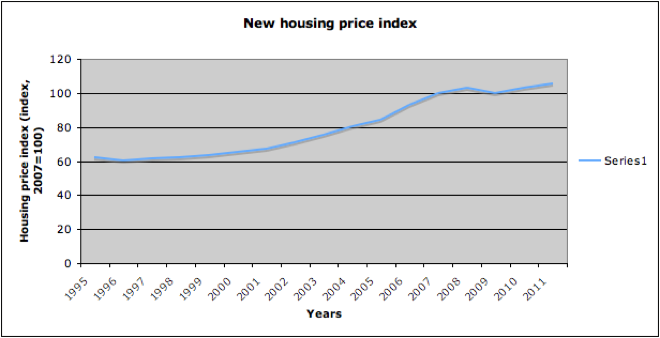

Compare that to the increase in housing prices over the same period (data come from the CMHC via StatsCan):

Though Canada’s population grew at roughly the same rate between 1995 and 2001 as it did for the next decade, the price of new houses throughout Canada remained virtually flat between 1995 and 2000 but rose considerably between 2001 and 2011.

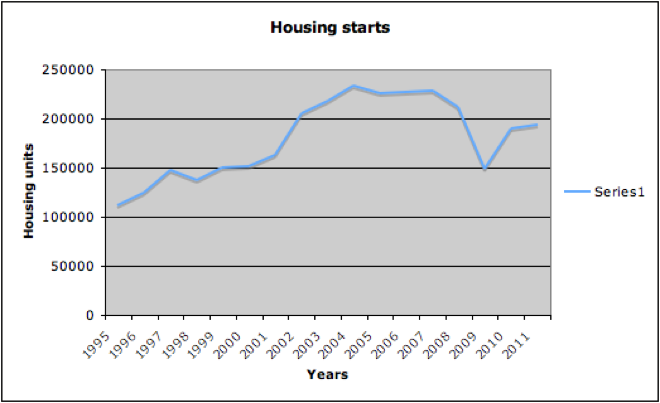

The disparity between the growth rate in population and housing prices is even more striking if one considers that the supply of houses also increased much more rapidly in the last decade than it did in the previous five years:

In an abstract world without monetary policy, household debt and wealthy Chinese investors, such a spike in the housing supply would have led to lower–not higher–housing prices, given that the demand for houses seems to have kept growing at a steady pace.

Let’s turn now to the claim that Canadians are getting increasingly better jobs. How does the CMHC explain why housing prices barely dipped between 2007 and 2009 even as Canada’s unemployment rate shot up from six to over eight per cent during that period? And even though it’s true that the share of full-time jobs increased in 2011, some analysts are warning that in 2012 the wind is turning. A CIBC report issued this week notes that “the changing composition of employment is likely to work to lower the quality of employment in the country along with the bargaining power of workers–limiting gains in labour income.” Not much to prop up the housing market there, it seems.

Also, incomes have hardly kept pace with housing prices. As Canadian Business noted in January: “Median home prices are currently at 4.6 times our gross median household income, but Demographia, an urban planning research firm and consultancy in the U.S., argues that prices become unaffordable when they exceed three times income.”

Finally, the third claim–that BOC “indicated” it’s going to keep interest rates at one per cent through 2012 is simply not true. Governor Mark Carney never explicitly said he’s going to leave the key rate unchanged. The CMHC later acknowledged as much, though it noted that almost everyone expects interest rates to stay where they are until at least 2013. Even that is questionable–some investors forecast a rate hike later this year–but, regardless, why overstate the case?

As Gordon Isfled wrote in the National Post, “it’s not often a Crown corporation bangs its drum loudly, appears to question market sentiment and misrepresents the central bank’s monetary policy — all in the same day.” And yet, “Canada’s housing agency did just that.”