A report released by the research company Capital Economics sees a real possibility of deflation coming to Canada. They caution that “a mild bout of deflation is now a real possibility,” though Sean Silcoff of the Globe and Mail notes that the company is not worried about a “sustained period of falling prices.” A mild bout of deflation would be associated with a weakened Canadian economy and is worth our concern, but is it truly a “real possibility”?

There is no official definition of a “mild bout of deflation”, so I will define it as three or more consecutive months of falling prices. Using that definitions, based on what markets are telling us, I don’t see this as being terribly likely, but it is not impossible.

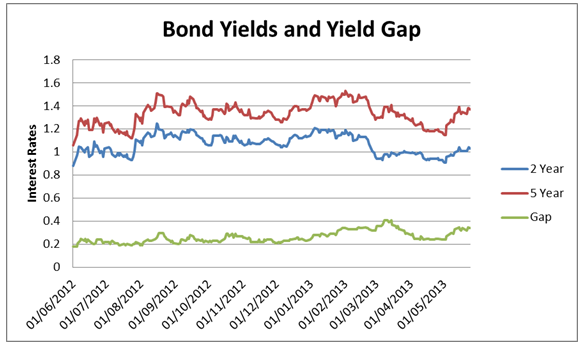

I have always found two economic indicators are helpful in predicting the future path of inflation—the yields on government bonds of two-year and five-year maturity lengths. If the economy were to slow down and the rate of deflation were to decline, I would expect two things to happen to those indicators:

- A reduction in both two-year and five-year bond yields, as reduced expected inflation makes these bonds relatively more attractive to investors. The increased demand for bonds pushes up their prices, which lowers their yields.

- The difference between the yields on the five-year bond and the two-year bond (which I will call the “yield gap”) should shrink. A substantial body of research has shown that an increase in the size of the yield gap indicates the market expects inflation to rise, whereas a shrinking yield gap indicates that the market believes the rate of inflation will fall.

If markets believe deflation is coming, we should see falling bond yields and a falling yield gap. Over the past month, however, we have seen just the opposite. Below are bond yields and the yield gap for the last 12 months:

From May 2 to May 24, the five-year bond yield has increased from 1.15 per cent to 1.37 per cent. This rise has been slightly higher than the rise in the 2-year bond yield, causing a small increase in the yield gap.

This data suggests that the most likely scenario for Canadian inflation is more of the same, with a greater chance of seeing inflation rise rather than fall. We should not make too much of this latest increase in rates; after all, the sharp increase in rates 10 months ago that was not sustained. However, nothing in this data suggests that future deflation is more likely now than it was two months ago.

It would not take too much for Canada to experience negative price growth, given our current rate of inflation at 0.4 percent (the core rate of inflation is at 1.1 percent). If I were a betting man, however, I would bet against a bout of deflation of three months or more.

This article first appeared in CanadianBusiness.com