Don’t blame Canada’s productivity woes on the commodity boom

An Econowatch special report on productivity (part four)

Etienne de Malglaive/REA/Redux

Share

If you spend any time reading about the Canadian economy, you have inevitably come across the Great Canadian Productivity Puzzle. Canada’s productivity is much lower than that of other countries, and we don’t really know why. Neither do we seem to be able to fix the problem. Policymakers have used every trick in the book to try to boost productivity, but the results have disappointed. Productivity growth matters because it drives up our purchasing power: if it lags, so will our standard of living. And yet—here’s where things get interesting—Canadians are far better off than one would tell looking at our dismal productivity performance over the past 20 years. How did we do it? In this six-part special report, Maclean’s in-house economist Stephen Gordon investigates the mystery. (With a contribution from Econowatch editor Erica Alini.)

Click here to see what’s coming up next and visit past posts.

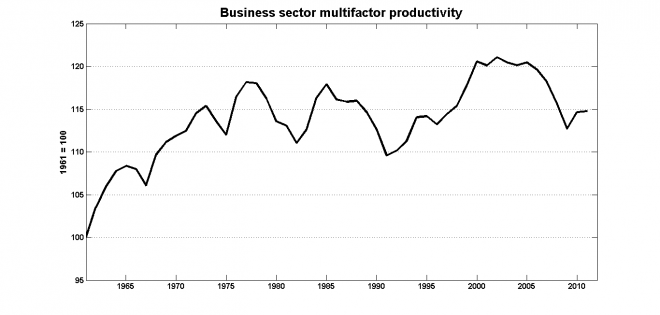

This chart from the second part of this series is probably the best illustration of the notion that Canada has an inordinately severe productivity problem:

Multifactor productivity (MFP), commonly interpreted as a measure of technical progress, is at the same level in 2011 as it was in 1971 (for an explanation of what MFP is, see part two). But if the numbers in that graph (series v41712881 in Statistics Canada’s Cansim database) are to be taken seriously, we’d be led to the conclusion that Canada’s business sector is using technologies that are about as sophisticated as the ones they were using 40 years ago. I don’t imagine anyone seriously believes this to be the case, so what’s going on with Statistics Canada’s MFP estimates? Answering that question is an ongoing research project, and I’ll get back to it in the next post.

Multifactor productivity (MFP), commonly interpreted as a measure of technical progress, is at the same level in 2011 as it was in 1971 (for an explanation of what MFP is, see part two). But if the numbers in that graph (series v41712881 in Statistics Canada’s Cansim database) are to be taken seriously, we’d be led to the conclusion that Canada’s business sector is using technologies that are about as sophisticated as the ones they were using 40 years ago. I don’t imagine anyone seriously believes this to be the case, so what’s going on with Statistics Canada’s MFP estimates? Answering that question is an ongoing research project, and I’ll get back to it in the next post.

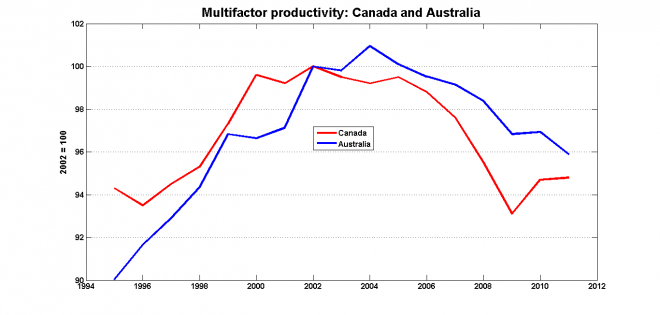

For now, I think this chart suggests that declining MFP estimates don’t invariably lead to economic stagnation:

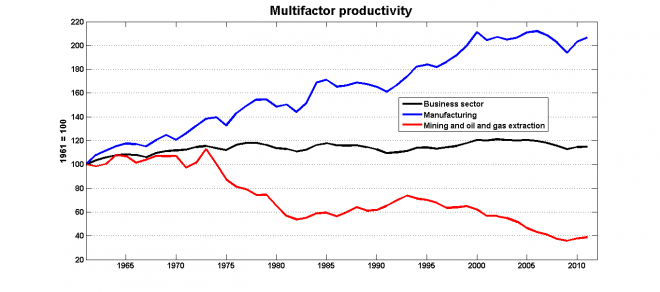

Both Canada and Australia pulled off the trick of producing significant gains in income even as MFP fell. I don’t think this is a coincidence. The next graph charts MFP growth for the Canadian business sector as a whole and two important sub-components, manufacturing and the mining and oil and gas industry.

Both Canada and Australia pulled off the trick of producing significant gains in income even as MFP fell. I don’t think this is a coincidence. The next graph charts MFP growth for the Canadian business sector as a whole and two important sub-components, manufacturing and the mining and oil and gas industry.

Statistics Canada’s estimate for MFP in the mining, oil and gas extraction sector has been on a downward trend for decades. Interpreting MFP as a measure of technical progress would lead to the conclusion that technology used in 1961 was almost three times more advanced than the technology available now—which clearly cannot be.

Statistics Canada’s estimate for MFP in the mining, oil and gas extraction sector has been on a downward trend for decades. Interpreting MFP as a measure of technical progress would lead to the conclusion that technology used in 1961 was almost three times more advanced than the technology available now—which clearly cannot be.

I can think of at least two explanations why multifactor productivity estimates for the resource-extraction sector might underestimate the actual rate of technical progress:

1) “Low-hanging fruit” bias. In the standard model of multifactor productivity, an industry that displays no technical progress and sees no changes in the amounts of capital and labour would produce a constant level of output. But this is not generally true of resource-extraction industries. There is considerable variation in both the quality of and the ease with which a resource deposit can be extracted, so the most profitable strategy is to start with the high-quality, low-cost plays and, when these are exhausted, move on to deposits that are of lower quality and are more costly (think conventional oil fields vs. the oil sands).

This strategy of picking the “low-hanging fruit” first means that the baseline scenario of fixed technology and constant inputs will not produce a constant level of output. Output will decline as firms are forced to move on to increasingly marginal deposits. Applying the MFP formula to this sector would show negative MFP growth, even though technology hasn’t changed. More generally, the low-hanging fruit bias will produce MFP estimates that systematically understate technical progress in the resource sector.

2) “Time-to-build” bias. In most industries, new investment results in an increase in output right away, as many capital goods can be installed and put to use fairly quickly. But often that’s not the case in the mining, oil and gas extraction sector. It can take several years before, say, a new oil sands installation begins production. This means that for a period of time there will be investment expenditures with no corresponding increase in output. And if output is constant while input quantities are increasing, measured MFP growth will be negative.

Commodity prices have been surging since the 2002, which, in Canada as well as Australia, has resulted in a surge of investment in the resource industry. A shift of productive resources toward a sector where technical progress is consistently underestimated (and I don’t think there’s any question that MFP underestimates technical progress in the mining and oil and gas sector) would result in slower MFP growth rates in the economy as a whole. Higher resource prices aren’t a reprieve from slow productivity growth: They’re a reason why the measure of productivity growth is so slow.

In the next post, I’ll look at some recent research that revisits the question of how we should be interpreting MFP and measuring technical progress.

****

- Part four: Don’t blame Canada’s productivity woes on the commodity boom