Energy East pipeline: Fact and fiction

Lower oil prices? Nope.

Enbridge Norman Wells Pipeline. Right of way between Norman Wells and Fort Simpson

Share

It’s been a week since TransCanada announced that it had secured sufficient commercial commitments and would be proceeding with the Energy East project. Their announcement included a few surprises — a larger-than-expected capacity of 1.1 million barrels per day, and a $300 million marine terminal in Saint John, N.B. What follows is a Q&A addressing some of the fact and fiction that’s been tossed around this week.

Is this pipeline a done deal?

Not even close. Securing commercial commitments is an important step, but there remains a long process ahead. The project will still face at least National Energy Board approval, but more likely a federal joint review panel including both the Canadian Environmental Assessment Agency and the National Energy Board, similar to the proceedings currently underway for the Northern Gateway Pipeline. There will also be consultations with First Nations, negotiations with landowners with respect to the new sections of pipeline, as well as dealings with the six provincial governments affected by this project among other requirements. Provinces do not have to approve energy pipelines in order for them to be granted a Certificate of Public Convenience and Necessity by the National Energy Board, but the process will be much smoother for the proponent if the respective provinces are on side.

Will Energy East lead to lower gas prices?

The answer to this comes in two parts. First you need to ask how Energy East will impact crude costs for refineries across Canada, and then you need to ask whether such a change will alter gasoline prices at the pump.

Energy East will serve as a link between Eastern Canadian refineries and the western crude oil market, where crude oil had been discounted significantly since mid-2010 until these price differentials converged rapidly over the last couple of months. By providing this link, the pipeline will alter future differentials from what they would otherwise be. If we assume that the marginal barrel out of Western Canada is still moving by rail, then you would expect western Canadian oil to be priced at approximately $12-15 below prevailing prices at the coast, reflecting the cost of rail transport. In such a scenario, a refiner who owned firm shipping capacity on Energy East could purchase oil at Edmonton and deliver it to Montreal, Quebec, or Saint John at a lower cost than that at which they would otherwise be able to obtain oil. Refiners without their own firm shipping capacity on Energy East (or Enbridge’s Line 9) will continue to pay world prices for oil, regardless of whether that oil is Canadian or imported. If the marginal barrel is moving by pipeline, the difference between oil in Alberta and oil on the east coast is likely to be comparable to the shipping tolls on Energy East, and so running Canadian oil would not save refiners any money at all relative to running imported crude.

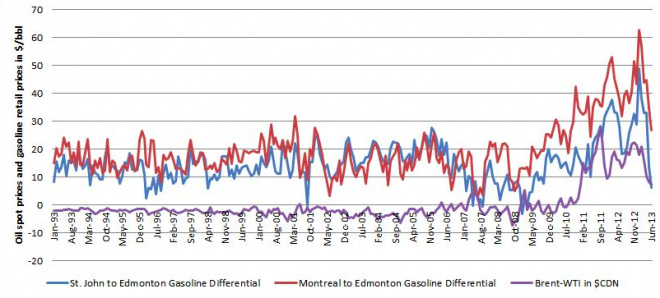

There is some evidence that recent crude oil discounts in Western Canada have been partially passed through to consumers through lower gas prices. Statistics Canada reported in The Daily in November that, “gasoline prices have increased at a slightly faster pace in the central and eastern provinces than in the west, resulting in a spread between some provincial gasoline indices…associated with the dual crude oil market in Canada and the recent price differential between crude oil benchmarks.” The image below shows that this pattern has continued for the last six months since the Statistics Canada report.

However, you need to keep in mind that we are not talking about a systematic lowering of crude oil costs in eastern North America—we are talking about an increase in crude costs in Western Canada, combined with a potential small decrease in costs for some eastern refineries. As a result, you may see a small increase in refining margins for those refiners with firm shipping capacity on Energy East, along with a decrease in refining margins for in-land refineries in Alberta. If you’re going to see a change at the pump as a result of this project, I’d expect to see an increase in Western Canada rather than a decrease in Eastern Canada.

Will Energy East increase oil sands development?

As with the question above, this question should really be followed with an alternative scenario. If you evaluate Energy East against an alternative scenario where no other pipelines out of Alberta are ever built and no existing pipes are expanded, you could expect a marginal impact on future oil sands development. I say marginal because you simply can’t look at it as enabling 1.1 million barrels per day of new production which would otherwise not occur—you have to look at the impact on profitability between the two scenarios and ask whether that impact is sufficient to have an influence on the pace of development. For a bitumen project, the difference between pipeline and rail is small, once diluent transport is factored in. In order to ship a barrel of bitumen by pipeline, you’d need to ship 1.4 barrels of diluted bitumen, so if your pipeline heavy oil toll is $7/bbl, it is going to cost you $9.80 to get a barrel of bitumen from Alberta to Saint John. You can ship bitumen by rail with little or no diluent added, so the rail vs. pipe trade-off is likely to be only $3-5 lower netback per barrel. That type of decrease in expected profit certainly matters, but it’s not likely to reduce oil sands production by 1.1 million barrels per day.

You might argue that the rail system will, at some point, reach a capacity constraint. That’s possible, but unlikely. Despite all the attention to oil-by-rail increases, crude and fuel oil still only accounted for less than 5% of Canadian rail car loadings in May, 2013. Nickel, iron-ore, coal, and potash each accounted for more rail car loadings than crude oil. Access to pipelines matters, but given the alternative of oil-by-rail, the profitability impact is not as large as some have made it out to be and that’s what will drive development.

Should we have built this pipeline a long time ago?

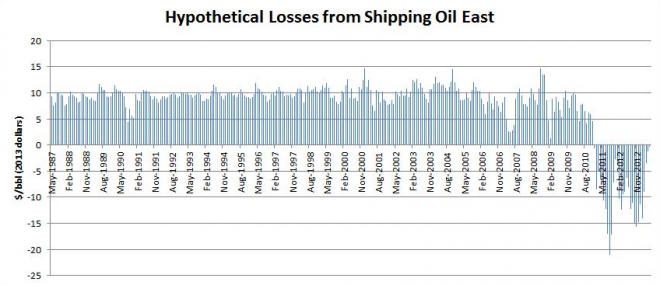

There’s a strong nationalist element which seems to think we’d be somehow better off had we not been importing oil on the east coast while exporting oil from western Canada to the U.S. Midwest. That sentiment ignores the market reality for much of the last 25 years. Here’s an admittedly simple simulation using crude oil prices since 1987. Assume you could have built a pipeline and put it in service from Alberta to an eastern refinery center, with a pipeline toll of $7/bbl in today’s dollars, adjusted for inflation (the toll would have been $3.89/bbl in 1987). Assume that your alternative project would have been the Keystone Pipeline to Cushing, OK, with tolls equivalent to today’s tolls on that line to Cushing, again adjusted for inflation. Now, here’s your choice—you can either ship your oil to Cushing, and sell it there and use the revenues to buy oil on the east coast, or you can ship your oil all the way to the east coast, and sell it (assumed price of Brent +$1.50). (The simple part of this simulation is that I’ve assumed that prices in Cushing and in eastern Canada are not affected by your choice). The Figure below shows how much you would have lost on every barrel if you chose the Canadian option.

From 1987 to 2010, you’d have been better off in every single month making the trade we have been making—exporting to the U.S. Midwest and importing on the east coast. In fact, the from May 1987 to May 2013, the average loss from shipping 1 million barrels per day of oil east rather than south would have been about $250 million per month in today’s dollars. If you assume you could have moved it east for free, you’d have still lost money, although not much of it.

The oil market in North America has certainly changed, and the expectation is that the marginal barrel will be moving to the coasts, so oil in the mid-continent will no longer trade at a premium as it has. As a result, the economics of Energy East are likely better today than they would have been at almost any point in the last couple of decades. It’s certainly the case that perfect foresight would have led to more pipelines being built to the coasts instead of to the Midwest in the late 2000s, but not before that.

Have more questions about this project? Post them in the Comments section and I’ll take some of them on next time.