How the BoC revised its growth forecast down—and up

Stephen Gordon puts the January Monetary Policy Report under the lens

Bank of Canada Governor Mark Carney speaks during a news conference upon the release of the Monetary Policy Report in Ottawa January 23, 2013. REUTERS/Chris Wattie (CANADA – Tags: POLITICS BUSINESS)

Share

They key elements of the Bank of Canada’s Monetary Policy Report (MPR) that was released yesterday are by now well-known: growth in the second half of 2012 was weaker than expected, and the growth of consumer and mortgage debt has slowed. Put together, the two developments mean that whatever date the Bank might have had in mind to start increasing interest rates, it’s been put off. Again.

But there are another couple of points that don’t seem to have received much attention:

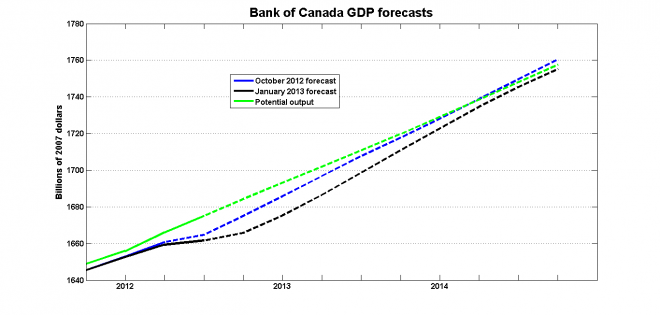

- Estimates for GDP in the first two quarters of 2012 were revised downwards. The data available to the BoC when it was preparing its October 2012 MPR showed an annualised growth rate of 1.9 per cent in the first half of 2012. These estimates were then revised downward in the November national accounts release: the most recent data now suggest that GDP grew at an annualised rate of 1.7 per cent.

- The Bank’s projection for the next two years tell remain fundamentally the same. Yes, the GDP estimate for the fourth quarter of 2012 (in the jargon of forecasting, this is a backcast — events that have already occurred, but for which definitive data are not yet available) has been sharply reduced, but the growth projections for the first two quarters of 2013 have been revised up. The Bank’s position is that much of the recent economic weakness is due to to transitory factors and that GDP growth will catch up to to the path the Bank was originally expecting for 2013.

The graph below charts the projections for GDP growth from the last two MPRs. The solid lines are the data that were available when the projections were made, while the dashed lines represent projections.

Given the lags with which monetary policy operates, current decisions about monetary policy are being made with an eye to projections for the latter half of 2014. Both the October and January MPRs have GDP reaching the Bank’s estimate for potential GDP by the end of 2014, so the essential strategy is the same: the next interest rate change will be an increase, although the timing of that increase has been deferred.

Given the lags with which monetary policy operates, current decisions about monetary policy are being made with an eye to projections for the latter half of 2014. Both the October and January MPRs have GDP reaching the Bank’s estimate for potential GDP by the end of 2014, so the essential strategy is the same: the next interest rate change will be an increase, although the timing of that increase has been deferred.