The latest GDP numbers, released yesterday by Statistics Canada, caught everyone off guard. The Canadian economy dipped 0.2 per cent in February, surprising most economists, who’d been predicting GDP would inch forward by roughly the same magnitude. Most surprised of all must have been Bank of Canada governor Mark Carney, who had projected 2.5-per-cent annual growth rate for the first quarter. “It looks like the Bank of Canada jumped the gun,” quipped CIBC in a note to clients, adding that “the report suggests that the Canadian economy isn’t out of the woods just yet.”

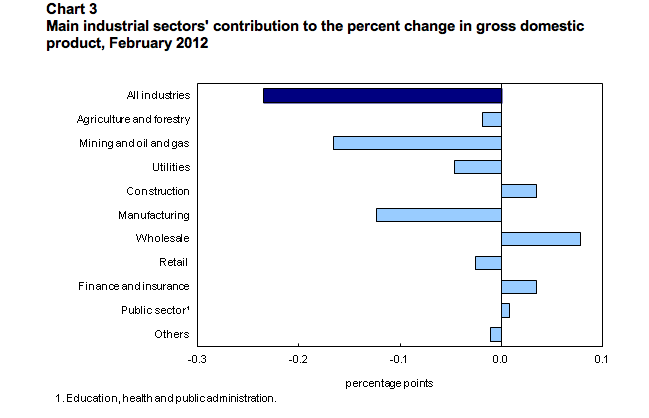

The disappointing numbers seemed to be tied in large part to sluggish performance in the mining and oil industry, which, as Maclean’s wrote last week, just can’t seem to be able to get their due from the commodities boom. Luckily, there were a couple of sectors that defied the general downward trend and softened the February drop. One of them was—you guessed it—housing. Take a look at this chart from the StatsCan release:

The boost to GDP from the housing sector is coming both from the construction industry, and, in part, from the “finance and insurance” category, which includes things like management of residential mortgages.

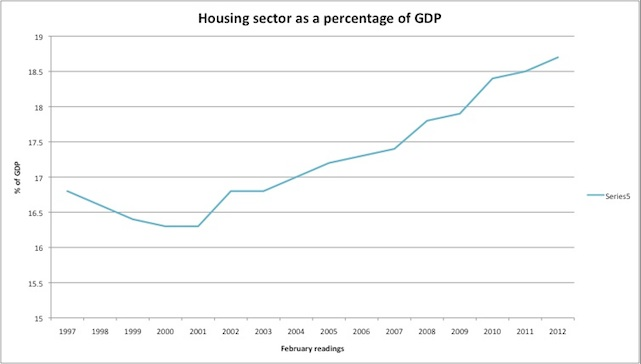

Does this mean housing is becoming a larger and larger share of our economy? Indeed, it does. Take a look at this graph we put together using StatsCan data, which shows how construction and real estate-related financial services have been growing over the past decade as a share of GDP:

Between 1997 and 2003 the housing market’s share of the economy was 17 per cent or less. Today, it accounts for nearly 19 per cent. Now, a two per cent rise isn’t peanuts when you’re talking about a trillion-dollar economy.

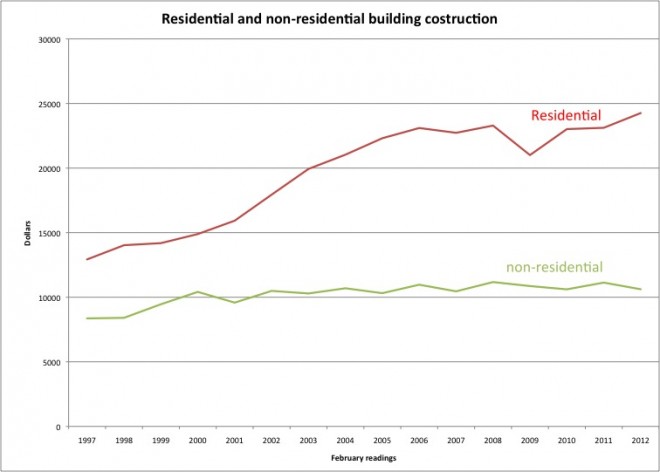

Admittedly, the graph above doesn’t distinguish between residential and non-residential real estate activity. Just to make sure it is actually condos and family homes, as opposed to office building and factories, that’ve been driving this decade-long climb, we looked at how the two main components of the construction industry have been performing over the years… and we got this jaw-dropping chart:

Non residential construction has been virtually flat for the last 10+ years. Residential construction has exploded (and, yes, those on the Y axis are millions of dollars).

Without the housing market, it seems, the Canadian economy would be deeper in the woods than it is now. The “good” news is that, with sluggish GDP figures forcing the Bank of Canada keep interest rates at rock-bottom, things aren’t likely to change anytime soon.