Income stagnation and inequality: It’s not about the middle class

It’s about the poor, says Stephen Gordon

Share

Kevin Milligan’s response to my posts (here and here) in which I expressed skepticism about the emphasis that the Liberals are putting on the middle class makes two important points: Earnings growth has been slow over the past few decades and inequality is higher than it was thirty years ago. These are crucial issues for policymakers, and there’s no point in trying to to downplay them. My concern is how these problems are being translated into a policy agenda focused on the middle class.

Economist Aaron Director is credited with an observation that has come to be known as Director’s Law:

Public expenditures are made for the primary benefit of the middle classes, and financed with taxes which are borne in considerable part by the poor and rich.

Turning the discussion about income stagnation and inequality into one about the problems of the middle class risks making things even worse for lower income households. After all, it’s not just the middle income group that has seen stagnant incomes:

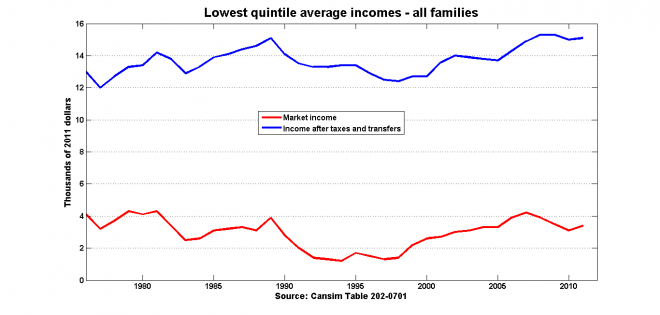

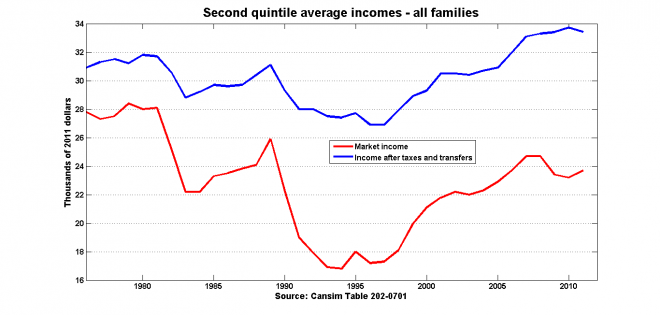

I think it’s pretty clear that trends in incomes after taxes and transfers are more important than trends in income earned from the market. (If market incomes were all that mattered, I like to think we’d all be much more concerned with those low-income families trying to get by on $3,000 a year in market income and not on the rate of growth of median market incomes.) The difference between market and after-tax-and-transfer income is where redistribution policy shows up.

I think it’s pretty clear that trends in incomes after taxes and transfers are more important than trends in income earned from the market. (If market incomes were all that mattered, I like to think we’d all be much more concerned with those low-income families trying to get by on $3,000 a year in market income and not on the rate of growth of median market incomes.) The difference between market and after-tax-and-transfer income is where redistribution policy shows up.

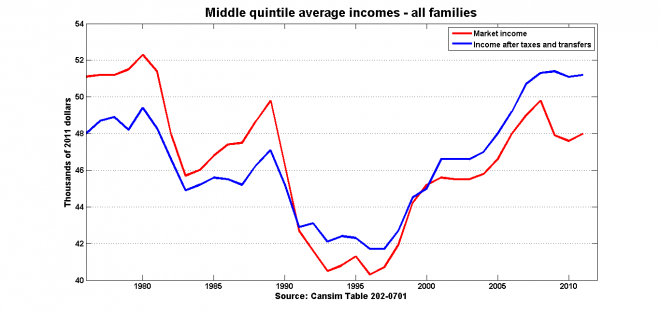

Here again is the trajectory of average incomes in the middle quintile, which I highlighted in an earlier post:

Governments — provincial and federal, and across all parties — have not stood idly by as median market incomes fell. In 1976, the net effect of government policy was to take away $3,000 a year (in 2011 terms) from middle-class families. By 2011, the government was supplementing incomes by a $3,000 per year. Market incomes may have fallen, but middle class families’ actual buying power has increased.

Governments — provincial and federal, and across all parties — have not stood idly by as median market incomes fell. In 1976, the net effect of government policy was to take away $3,000 a year (in 2011 terms) from middle-class families. By 2011, the government was supplementing incomes by a $3,000 per year. Market incomes may have fallen, but middle class families’ actual buying power has increased.

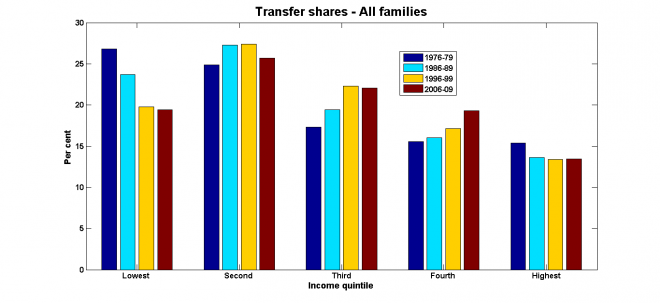

This benefit to the middle class has come at a cost: the Canadian tax-and-transfer system has become less progressive since the mid-1990s. Look at how the shares of government transfers have evolved:

Families at the bottom of the income distribution have seen their share of the transfers pie shrink considerably. People with median incomes — the third quintile — have seen theirs grow. It seems to me that the last thing we need is another government determined to put the middle class first. Why not focus on lower-income households?

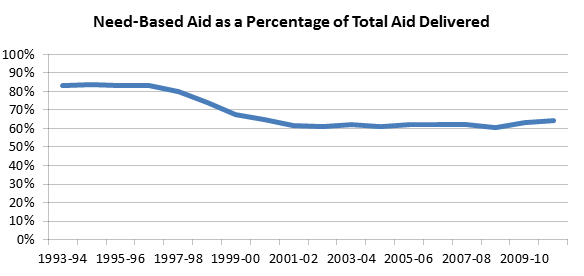

And while I’m on the point, let’s look at post-secondary education. Providing children from low-income households with access to higher education is one of the most effective ways to ensure a healthy level of social mobility in a society. But the trend in post-secondary student aid in Canada is an unhappy one:

(The above chart is courtesy of Alex Usher.)

(The above chart is courtesy of Alex Usher.)

So far, Canada has done well by international standards in promoting social mobility, and maintaining this good performance should be an overriding goal for policymakers. If it’s important to give middle-class kids a chance at a university education, it’s even more important to give that chance to kids from low-income households. That, though, as the chart shows, doesn’t seem to be the priority right now.

Inequality and income stagnation are real issues. Representing them as only — or even primarily — problems of the middle class is likely to make the problems of the most vulnerable families worse.