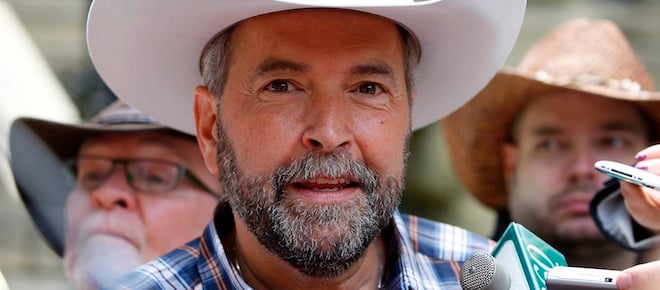

Questions for Tom Mulcair

… on oil, refining and the environment

NDP leader Tom Mulcair speaks to the media on the steps of old city hall in Calgary, Thursday, July 12, 2012. Mulcair is visiting the city and taking in the Stampede which is celebrating its 100th anniversary featuring rodeo action, chuckwagon races, a midway, agricultural exhibits and live stock competitions. THE CANADIAN PRESS/Jeff McIntosh

Share

Tom Mulcair’s recent article for the Institute for Research on Public Policy (IRPP) raises perhaps more questions than it answers about the NDP’s positions on the economics of energy and the environment. Here are a few key passages:

An NDP government would establish a comprehensive upstream cap-and trade system to meet our international commitments to fight climate change and rigorously enforce environmental laws here in Canada.

We’ve heard this before, but we still don’t know very much about what this system would look like. Does “comprehensive” mean “applicable to all GHG emissions”? What are the estimated costs to consumers? What measures will be taken to compensate low-income households for these costs?

The Conservatives’ single-minded focus on the export of raw resources — combined with their failure to internalize environmental costs — has contributed to an artificial rise in the value of the Canadian dollar that is hollowing out our other export industries — from forestry to fisheries, from manufacturing to agriculture.

When the prices of some export goods rise relative to others, the income-improving response is to sell more of the things whose (relative) price has gone up, and less of the things whose (relative) price has gone down. Why is this “artificial”? And why is an appreciating Canadian dollar – a development that increases the buying power of Canadian incomes – a bad thing?

There’s also the unsupported assertion that an effective GHG emission policy would benefit the manufacturing sector. This is far from clear: a proper carbon pricing policy would favour firms that are profitable enough to absorb the cost of GHG emissions, and penalise those who can only survive if emissions are not priced. I’m not so sure the manufacturing sector is in that first category, and I’d like to know why Mr. Mulcair thinks it is.

While the export of resources will always be an important part of our economic mix, the export of raw resources is not the obvious path to prosperity it is sometimes held up to be.

If the prices of raw resources are high and if you have them, then the obvious path to prosperity is to sell them. Or should we wait until prices are low? Or should we sell things that don’t command high prices on world markets?

The cancellation of the Voyageur upgrader project is just the most recent illustration of this short-sightedness. Conservatives sat by as an $11-billion project to process raw bitumen was cancelled with seemingly no concern for the loss of tens of thousands of value-added jobs.

What, exactly, should have been the government’s response? Provide corporate welfare? Offer to relax environmental regulations? More importantly, what is the market failure here that requires a policy response?

And what is it with the repeated reference to “value-added jobs”? All jobs add value; that’s what value-added means:

Vaue-added = capital input + labour input

The idea that resource extraction doesn’t “add value” is just silly: no one thinks that a cubic metre of bitumen buried under several hundred metres of rock has the same value as a cubic metre of bitumen that has been brought above ground. Nor does the “tens of thousands” of jobs factoid pass the smell test. There are just under 60,000 people working in the entire oil and gas extraction industry (NAICS code 211). One extra upgrader is not going to increase that number by “tens of thousands.”

Within a framework of sustainable development — including a cap-and-trade system and thorough environmental assessments — New Democrats would prioritize our own energy security and with it the creation of high-paying, value-added jobs, refining and upgrading our own natural resources right here in Canada — just as other resource-rich developed nations like Norway already have.

According to the U.S. Energy Information Administration, Norway produces 1,602,000 barrels of crude oil a day, and its refinery capacity is 319,000 bbl/day – about 20 per cent of crude oil production. The comparable figures for Canada are 3,136,000 bbl/day of crude oil production and 1,918,000 bbl/day of refinery capacity – about 61 per cent of crude oil production. Even if you take upgraders out of that ratio, Canada’s refining capacity is already much larger than Norway’s.

But that’s not to say that Norway doesn’t sell refined oil products to the rest of the world; Statoil has built a 110,000 bbl/day refinery specifically to serve the export market. On the other hand, they built it in Denmark. Is building refineries abroad the model Canada should be adopting?