The conservative agenda in the numbers

Stephen Gordon details the ‘starve the beast strategy’ in budget 2013

Finance Minister Jim Flaherty has gone public in a deeply personal interview with The Globe and Mail to explain some recent changes to his appearance. To quell concerns that his face has grown bloated and puffy and heâs gained a significant amount of weight, Flaherty gave the interview, explaining that he has a rare skin disease, called bullous pemphigoid, that requires strong steroid treatment. Flaherty is shown responding to a question during question period in the House of Commons Monday January 28, 2013 in Ottawa. THE CANADIAN PRESS/Adrian Wyld

Share

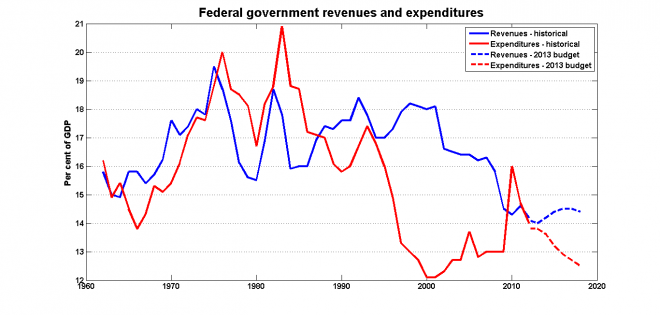

The Conservatives’ “starve the beast” strategy of reducing the size of the federal government is one of gradual erosion and not dramatic cuts, so it’s only noticeable if you revisit the process at regular intervals, like time-lapse photography. Here is the history of federal government revenues and expenditures as a share of GDP:

Federal government revenues have been at record low levels — less than 14.5 per cent of GDP — for the last four years, and they are projected to remain there. The strategy for eliminating the deficit is to keep expenditure growth below that of GDP so that its share of GDP declines over time. But this approach is not applied across the board. For example, transfers to persons (elderly benefits, children’s benefits and the like) are politically sensitive, and cuts here could provoke broad-based opposition. So the plan in this budget — and the ones that preceded it — is to limit the growth of these transfers to the rate of growth of GDP. In other words, transfers to persons as a share of GDP is projected to converge to a constant level:

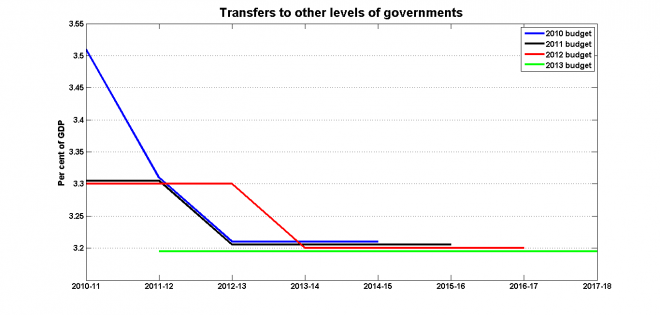

The same goes for transfers to the provinces:

If you combine this strategy with the downward revisions to the Department of Finance’s GDP projections, you get the cuts in the projected path of transfers to the provinces that are in this year’s budget.

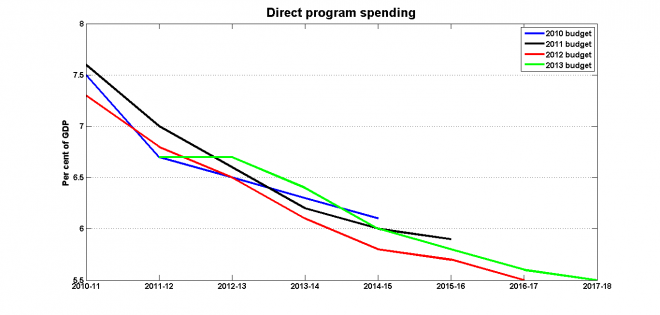

If transfers to persons and transfers to other levels of governments are schedule to rise with GDP, then direct program spending must fall as a share of GDP. The way this is done is by holding nominal spending constant: its share of GDP declines as GDP increases:

Not only do these lines slope down, they get steeper with every budget. The jump in the current budget in 2012-13 is due to an accounting change: some measures that had previously been classified as tax expenditures have been reclassified (properly, in my view) as part of regular spending. But this is simply a one-time level shift; the trend to steeper profiles continues. The 2012 budget projected a decline of one percentage point between 2013 and 2017; the decline projected in this year’s budget is 1.1 percentage points.

The Conservatives are often accused of having a secret agenda on certain policy fronts, but they certainly can’t be accused of having a secret agenda about what they have planned for the size of the federal government. Their agenda has been published in every post-recession budget, and it will be published in next year’s budget as well.