The economy’s potential may be a little lower than we thought

Stephen Gordon spots a quiet revision

A pedestrian holding an umbrella walks past the Bank of Canada building during a snow fall in Ottawa January 17, 2012. REUTERS/Chris Wattie (CANADA – Tags: BUSINESS ENVIRONMENT)

Share

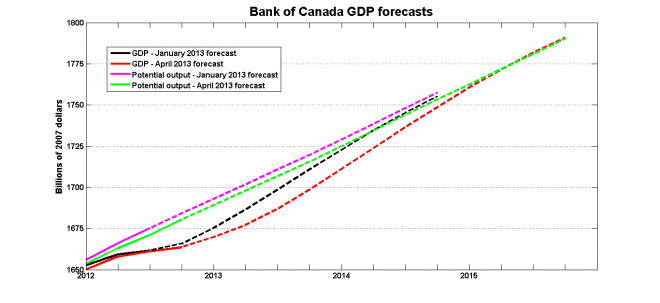

The Bank of Canada’s forecasting model (or rather models — Bank staffers use more than one when putting their projections together) has a built-in stability property: projections for GDP eventually return to potential, that is, a level consistent with no inflationary or disinflationary pressures. That was the case in the projections in the January Monetary Policy Report and again in the April MPR. It means that when short-term growth projections are revised down — as they were in January and in again in April — forecasts for growth rates a year or two out are simultaneously revised up so that the economy still reaches potential in the medium term.

But there was an interesting feature of the April MPR that I haven’t seen anyone mention: one of the Bank’s better-known estimates for capacity output was revised down in April, reflecting historical revisions. Current estimates for potential output for the third quarter of 2012 are 0.25 per cent lower than they were in January. So even though the new set of projections still shows convergence to potential in the medium term, this convergence occurs at a lower potential output trend:

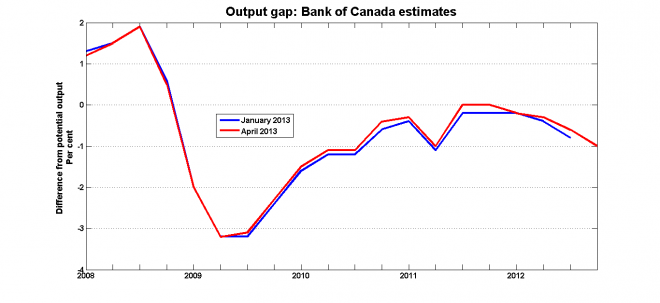

Another way of saying the same thing is that historical estimates of the output gap — the difference between actual and potential output — have been narrowed (that is, they have become less negative):

The historical revisions reflect changes to the data used to construct estimates for the output gap, including the recent changes in the way Statistics Canada measures GDP.

If and when GDP reaches its potential (or capacity), inflationary pressures will get stronger, and the Bank of Canada will tighten monetary policy by increasing interest rates. Although the output gap as measured using StatsCan data widened in the last quarter, the downward revisions to estimates for potential output means that this gap is still smaller than it would have been otherwise.

I don’t think the changes are significant enough to affect the Bank’s monetary policy stance: the output gap is only one of a set of measures the Bank uses to judge how far the economy is from capacity output. The Bank’s policy rate has been steady at one per cent for nearly three years, and it has long been warning the next move will be a hike. This stance was reiterated on Wednesday, albeit with the caveat that an interest hike won’t happen for a “period of time”. But I have to wonder: what if the revisions to potential output had gone in the other direction, and suggesting that the output gap turned out to be larger than the Bank of Canada had thought?