The return of the federal structural deficit?

Even the Department of Finance’s own figures suggest the red ink is here to stay

Chris Wattie/Reuters

Share

Keen observers of the evolution of the federal budget balance will recall the back-and-forth a couple of years ago about whether or not the federal government was running a ‘structural deficit’. We should be able—in principle—to break down the government budget balance into two components: what it would be if the economy were running normally plus the deviation induced by the business cycle. During a recession, the business cycle contribution would be negative, and we’d expect to run deficits even if public finances were on solid footing. But if the government were running a structural deficit, then the books won’t balance even after the economy recovers.

It seems reasonably clear now that the Conservatives created a structural deficit when they cut the GST, and the federal government admitted as much in last year’s release of the Fiscal Reference Tables. (It had already done so implicitly in the 2011 budget.) The cuts in the last few budget cycles have been designed to offset the revenue losses from those two GST points, and most observers seem to agree that these measures will eventually eliminate the deficit—although perhaps not in time for the government’s self-imposed deadline of 2015-16.

But a dissenting voice has risen up to challenge that consensus, and the dissent is even more startling when you consider the source: the Department of Finance. This year’s update of the Fiscal Reference Tables provides updated estimates for the ‘cyclically-adjusted budget balance’ (CABB), which is an estimate of what the balance would look like if the economy were running at its potential. The new estimates suggest a structural deficit that has actually widened over the past two years, notwithstanding the cuts in spending.

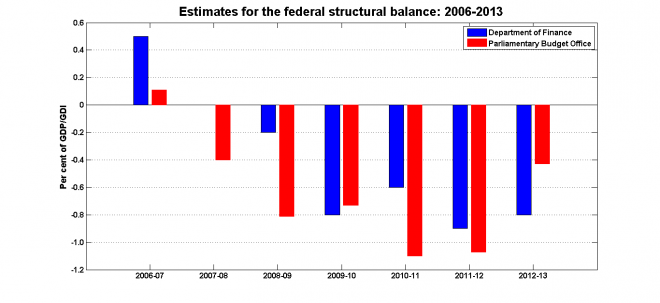

Here is a chart comparing Finance’s estimates with the most recent estimates of the CABB calculated by the Parliamentary Budget Office. Last year, the two sets of estimates lined up fairly closely, even though they were derived from very different methodologies (among other things, Finance uses GDP to scale its estimates, while the PBO uses Gross Domestic Income). But this year, they look quite different:

The PBO sees a steadily shrinking structural deficit, but Finance sees one that hasn’t changed much over the last three years.

This raises any number of questions, including:

- Why are the two sets of estimates so different? Some of the difference may be due to purely technical issues. There are a lot of data redefinitions that are going on: Statistics Canada has changed the way they calculate national accounts, and the Department of Finance has – yet again – changed its accounting rules. Both sets of estimates will likely be revised again after things settle down.

- If Finance thinks that it’s running a $15 billion/year structural deficit, how does it plan to balance its budget in the next two or three years?