Labour’s share of income: why are trends in the U.S. and Canada so different?

Stephen Gordon ponders the great, unsolved puzzle

Share

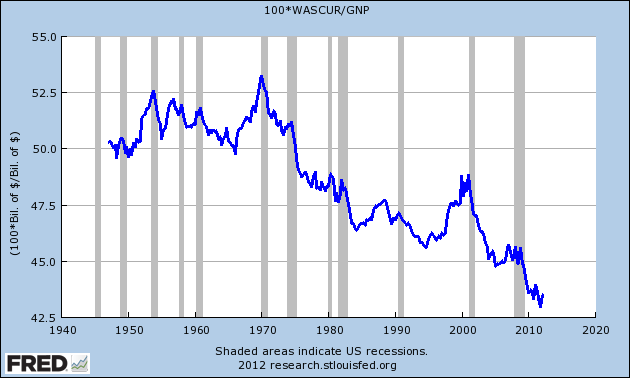

The Federal Reserve Bank of Cleveland has a commentary discussing how the share of total U.S. income coming from wages (known as labour’s share, as opposed to other sources of income, like investment) has been shrinking over the past decades:

Labour’s share of income is generally counter-cyclical, rising in recessions. This is not because wages grow strongly during recessions: labour’s share increases because profits—which are much more volatile—fall. But the trend seen in the U.S. since the oil price shock of the 1970s is one in which labour’s share is drifting steadily downward. The share of GNP going to workers is almost 10 percentage points lower than what it was 40 years ago.

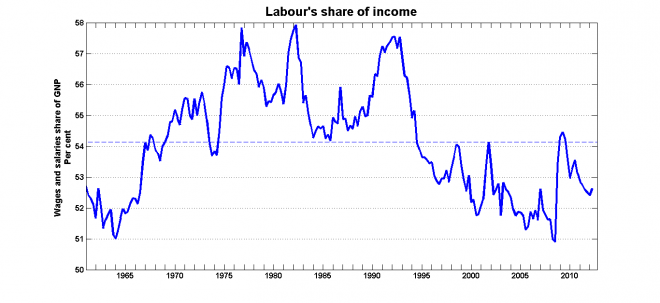

What about Canada?

As noted earlier, the spikes in the labour share are more a function of low profits than of high wages: the peaks you see in the chart above are associated with recessions. Still, there doesn’t seem to be the same sort of downward trend that you see in the U.S. data: the labour share is roughly where it was back in the 1960s.

As noted earlier, the spikes in the labour share are more a function of low profits than of high wages: the peaks you see in the chart above are associated with recessions. Still, there doesn’t seem to be the same sort of downward trend that you see in the U.S. data: the labour share is roughly where it was back in the 1960s.

This brings us to the question: why is there such a difference? It’s very likely that much of the loss in labour’s share of U.S. income can be attributed to phenomena such as increased competition from low-wage countries and offshoring, but why didn’t it have the same effect on Canada?

One conjecture might be the importance of natural resources in Canada: those jobs cannot be outsourced the way that manufacturing jobs can. But it’s only a conjecture; I don’t have a good answer.