Why Bitcoin is the banking industry’s newest, biggest threat

The cold, hard cash of the Internet has seen dramatic growth recently, and shows no signs of slowing down

Share

Late last year, a radical banking experiment hit a major milestone in Europe, a continent with no shortage of financial drama. It had nothing to do with the euro, however, and everything to do with the “currency of the future”: Bitcoin.

Late last year, a radical banking experiment hit a major milestone in Europe, a continent with no shortage of financial drama. It had nothing to do with the euro, however, and everything to do with the “currency of the future”: Bitcoin.

The digital currency, still widely dismissed by many as Internet play money, gained an unprecedented foothold in the traditional banking world. In December, a Bitcoin currency exchange in France became the first to officially operate within the European financial system. Bitcoin-Central, and its parent company, Paymium, will offer their Bitcoin customers a legitimate French payment account through a partnership with the French financial firm Aqoba. Users will be able to buy euro-priced goods with a debit card attached to that account, and even have their salary paid into it. The account can then be used to buy Bitcoin-priced products online through Bitcoin-Central and, alternatively, trade in Bitcoins for euros. (One Bitcoin is currently worth around $13.) “Ever since we started Paymium, what we’re trying to do is explain the benefits of the technology to the banking industry,” says Paymium co-founder and CEO Pierre Noizat.

Banks and governments may be slow in listening, but there has been a dramatic growth in the number of Bitcoin users and retailers. WordPress, the ubiquitous blogging website, now accepts payment in Bitcoin. Bitcoin transactions in 2012 expanded to almost five million through September, more than double the number of transactions for all of 2011 and up from just 219 in 2009. It is now used to buy everything from cupcakes in San Francisco to limo rides in New York.

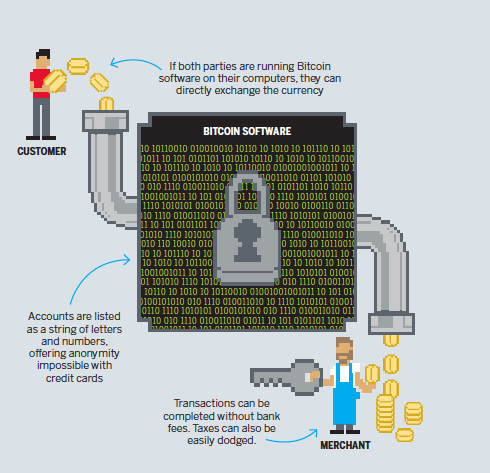

Bitcoin’s big advantage is that it is essentially the cold, hard cash of the Internet. Instead of bills, Bitcoin’s software keeps a public ledger of every transaction among users. If a buyer and seller are running the software on their computers, they can directly exchange Bitcoins, anonymously and with no taxes or bank fees. Others can pay a company to process the payment. Bitcoin accounts are listed simply as a string of letters and numbers with no names attached, giving a level of anonymity impossible with debit and credit cards or even PayPal accounts.

Launched in 2008—the same year the financial crisis struck—Bitcoin is often described as an antithesis to fiat currencies, set apart for what it does not have: a central bank or any regulating authority. What it does have, however, is a PR problem. Bitcoin is known as a choice currency for illegal drug websites, money laundering and tax evasion. And that’s among the minority of people who are even aware it exists. “The big challenge right now is people haven’t heard about Bitcoin,” says Joseph David, the CEO and founder of

VirtEx, a Calgary-based currency exchange that trades Canadian dollars and Bitcoins. He is working to convince Alberta lawmakers of Bitcoin’s benefits, hoping for government recognition. “This is the revolutionary currency of the future,” he says, “decentralized, not controlled by any government, and no one can shut it down or freeze accounts.”

But the struggle to go mainstream exposes a dilemma at the heart of the Bitcoin movement: the thing that enthusiasts love most about Bitcoin—its lawlessness—is the same thing that keeps it on the fringes.

David and other owners of Bitcoin currency exchanges—of which there are thousands—now look to France with envy. Noizat says Bitcoin-Central’s deal with Aqoba “can help people to adopt Bitcoin as a payment network, and make them more comfortable about using our application.” Tony Gallippi, co-founder of BitPay, the company hired by WordPress to process Bitcoin payments, agrees. “This is the Netscape moment,” he says, referencing the Internet company often credited with popularizing the Internet.

The Aqoba deal formalizes a relationship that already exists. Bitcoin exchanges hold bank accounts in various currencies, with various financial institutions. The largest exchange, Tokyo-based Mt.Gox, trades US$3 million worth of Bitcoins every day and has an 88 per cent share of the market. It deals in euros, British pounds, U.S., Canadian and Australian dollars, Japanese yen and Polish zloty. Bitcoin buyers make deposits into Mt.Gox’s accounts, and are credited with Bitcoins in their digital “wallets.” But Mt.Gox and others suffer from unpredictable relationships with banks. On Sept. 25, Mt.Gox announced its account with U.K.-based Barclays had been frozen, with no word from the bank as to why. It later told customers Barclays had shut down the account.

Through its new partnership, Bitcoin-Central will be able to offer clients a regulated account, in euros, directly linked to the Bitcoin network and the client’s Bitcoin wallet. Because balances held in euros will be protected with the same insurance as regular French bank accounts, the move answers at least one of Bitcoin’s ongoing issues: security. Its reputation has suffered from reports of fraud and a string of hacker attacks that saw Bitcoin wallets emptied.

“For a while, all of the news stories have been quite negative—Ponzi schemes, scams, hacking attacks—and it’s always spun in a negative way,” says Michael Bliss, owner of a massage therapy company in Vancouver that accepts Bitcoins. “It needs to be tested and made stronger from serious attacks,” he says, but adds that it also needs time to develop. “It took the euro years to get in the disastrous state it is right now. We’re in year four of Bitcoin.”

For financial blogger Jon Matonis, that is exactly why he’s against Bitcoin companies seeking ties to the banking world. “It’s premature going toward regulation when Bitcoin is still in beta,” he says. “It’s play money still.” Matonis, author of a blog called The Monetary Future, also sits on the board of the Bitcoin Foundation, a group created this year to fund improvements to the Bitcoin software. Regulation and oversight mean less anonymity for Bitcoin’s users, he warns—which is particularly a concern when the majority of payments online are tracked. Besides, he argues, “It doesn’t need legitimacy, it’s already working.”

Which is perhaps why the European Central Bank has even bothered to give Bitcoin the once-over. The ECB produced a report in 2012 that suggested policy-makers keep an eye on Bitcoin, in part because of its ideological departure from the kind of economic policy at the heart of all central banks.

If using Bitcoins becomes as easy as using a debit card, the ECB may have reason to worry. The Internet could house, independent of financial regulation and policy-making, its own sprawling economy. “They can ignore it, and they can fight it,” says Paymium’s Pierre Noizat of the banking establishment, “but it will keep going.”