Why Quebec is closed for business

La Belle Province comes close to dead last in almost every measure of private sector investment

Quebec’s Premier elect Philippe Couillard looks on during a news conference at the National Assembly in Quebec City, April 8, 2014. REUTERS/Mathieu Belanger (CANADA – Tags: POLITICS) – RTR3KGHN

Share

It’s been a little more than a month since the Liberal government of Quebec Premier Philippe Couillard released its belt-tightening budget, and since then everyone from movie producers and doctors to teachers and mayors has griped about the cuts it promises. They shouldn’t be surprised. Couillard campaigned on a pledge to fix Quebec’s “economic fiasco.” But a new report from the C.D. Howe Institute offers a stark reminder of how difficult that task will be.

The report, authored by Philip Cross, the former chief economist at Statistics Canada, shows the extent to which the economies of Ontario, Quebec and the Maritimes now rely on public sector versus private sector investment for growth. Condensed version: a whole honking lot. Investment spending refers to money spent on structures, machinery and equipment, and since 2000, the report notes, public sector investment as a share of GDP has nearly doubled in Quebec to almost six per cent. At the same time, business investment—you know, by actual companies—has stagnated at seven per cent. That’s put Quebec near the bottom of the pack, alongside Ontario, and a notch above New Brunswick and Nova Scotia. “Business investment is the lifeblood of economic growth,” Cross wrote in an opinion piece. “It determines what the economy will look like years from now, and how competitive its workers will be.”

Of course, to have business investment, you’ve got to have businesses. And that’s where Quebec faces serious problems that run far deeper than any single austerity budget can hope to tackle. In December, Statistics Canada released a largely overlooked research paper that examined the rates at which new businesses have been joining and leaving the marketplace in each province. The creation of new firms and the destruction of old ones, through consolidation or closure, is key to a vibrant economy, bringing in new ideas and innovations and forcing existing businesses to pick up their game. You can probably guess where Quebec ranked, but I’ll tell you anyway. From 2000 to 2009, no province had lower so-called “firm entry” than Quebec. In fact, in the manufacturing, retail, transportation and finance sectors, more companies went away than were created. No other province had that level of “destruction” without the customarily accompanying “creative.”

Related:

Maybe Harper has slain the separatists

The charter may be gone, but Quebec’s identity crisis remains

Why Justin Trudeau risks alienating Quebec

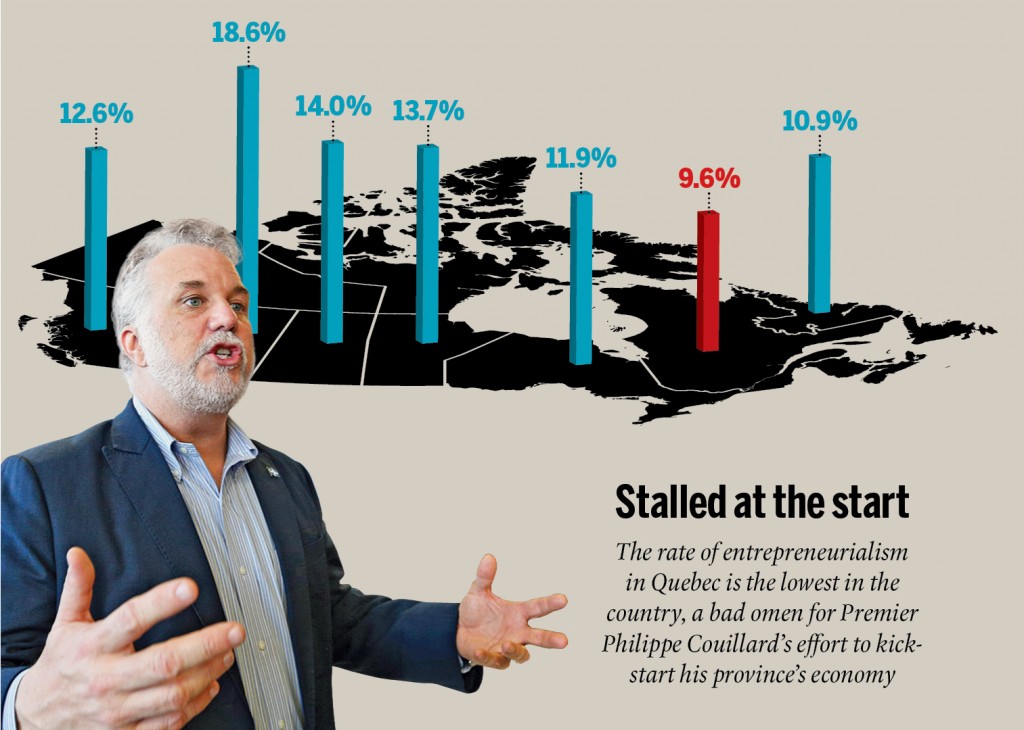

It gets worse. Another report from a few months ago, the Global Entrepreneurship Monitor, measured the levels of entrepreneurialism across Canada. It did so by looking at the percentage of working-age adults who are either engaged in setting up a business or who own a wage-paying business that’s existed for less than 42 months. On that front, too, Quebec came dead last, with an entrepreneurship rate of 9.6 per cent, compared to 11.9 per cent in Ontario and close to 19 per cent in Alberta.

Sylvain Carle, an entrepreneur in Montreal who’s started several companies, recently shared an anecdote with the Montreal Gazette that sums up Quebec’s sluggish start-up culture. While attending a conference at Stanford University, a speaker had asked how many people in the audience of 100 were starting their own companies, and 105 hands went up, since some were multi-preneurs. When Carle asked the same question to a similar-sized audience in Montreal a few weeks later, five hands went up.

It doesn’t take an advanced degree in rocketry to know why all this is the case. For decades Quebec businesses have been plagued with repeated bouts of separation anxiety and the constant irritant of the province’s language police. The province punishes businesses with some of the highest taxes in North America, yet it has rung up a $2.4-billion deficit and a debt load equal to half its GDP, the highest in the country. When not arbitrarily overriding the rights of shareholders to protect underperforming Quebec companies, the government has flip-flopped on its attitude toward resource development. In short, it’s an economic environment layered with uncertainty, instability and state interference.

For the longest time, the solution from the Quebec government to its stagnant business environment was more Quebec government, in the form of state-sponsored funds doling out cheques to those it deems to be worthy entrepreneurs. Just this past March, the Caisse de dépôt et placement du Québec pension fund, that bastion of economic nationalism, joined with Desjardins Group to create a fund to pump $230 million into small and medium-sized enterprises, having already distributed $190 million to 186 other companies through an earlier fund. And yet the level of business creation is stuck in neutral.

This is what Couillard faces. He’s said all the right things about tackling Quebec’s fiscal crisis: “The time for cosmetic changes is gone,” he said in his throne speech in May. “We must act firmly and decisively. And we will.” His far bigger challenge remains to make Quebec a place where entrepreneurs would want to set up shop. The best way he can do that is to get his government out of the way.