Why the Reinhart-Rogoff glitch doesn’t matter for Canada

Not right now, anyways, say Stephen Gordon

Minister of Finance Jim Flaherty shakes hands with Prime Minister Stephen Harper after delivering the Budget in the House of Commons on Parliament Hill in Ottawa on Thursday, March 29, 2012. THE CANADIAN PRESS/Sean Kilpatrick

Share

If you’ve heard about Carmen Reinhart and Kenneth Rogoff’s much-cited conclusion that economic growth rates deteriorate once debt-GDP ratios go beyond 90 per cent, you’ll have heard by now that this result appears to have been produced by a coding error (as Econowatch explains here). My initial reaction was the same as that of any other economist who does applied work: an empathetic sinking feeling. This is the sort of mistake that could happen to anyone.

But my second reaction was to shrug. The Reinhart-Rogoff (R-R) result is was most pertinent in the debates about fiscal austerity being conducted in the U.S., the U.K. and Europe, where people are making the case for fiscal contraction before the recession is over. To the extent that there’s a debate about fiscal austerity in Canada, that’s not the one we’re having.

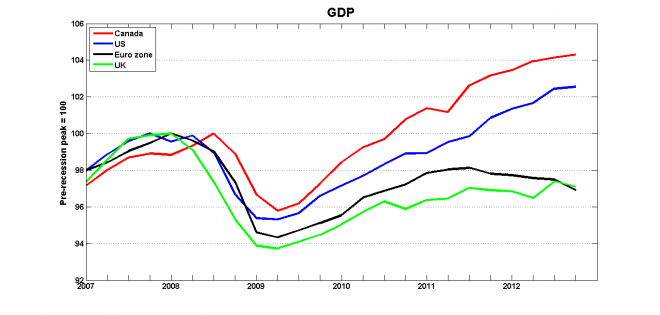

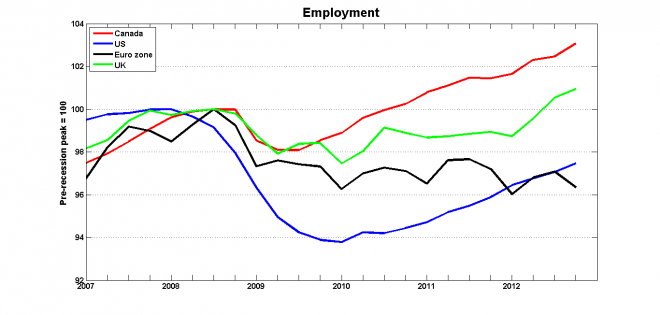

Firstly, Canada has recovered from the recession, as the following two charts clearly show:

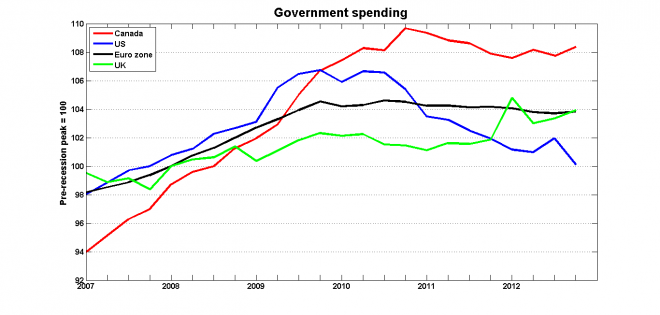

Secondly, the “contractionary stimulus” theory — the idea that fiscal austerity will help an economy to climb out of recession — wasn’t applied in Canada. Government spending increased dramatically during the recession:

The Canadian recession was shorter and milder than those in the U.S., the U.K. and the eurozone, and Canadian fiscal policy was more aggressively expansionary. Government spending leveled off only after output and employment recovered their pre-recession levels.

Even though the other three economies in those charts have yet to completely recover their pre-recession peaks, government spending there has either decreased (as in the U.S.) or held steady even as levels of output and employment continued to stagnate. The R-R result was used by many as argument for restricting government spending in the U.S., the U.K. and the eurozone, but it didn’t really play a role here in Canada. The decision to stop increasing government spending once the economy had exited the recession is a straightforward application of textbook economics: increase government spending during a recession, cut back when the recession is over. Even the most strident opponents of the “contractionary stimulus” theory — Paul Krugman in particular — agree that a fiscal contraction is in order once the economy is out of recession.