Carney: This time it’s different

‘Even though all booms are finite, this one could go on for some time’

Share

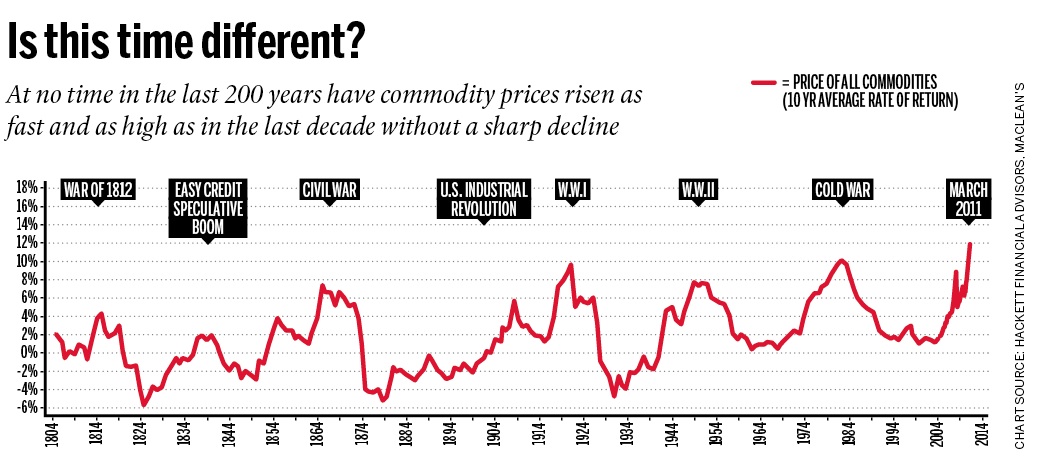

In a recent magazine story and blog post, we highlighted the tremendous benefits Canada has enjoyed thanks to the commodity boom, but warned that if you think this will go on forever, you’re basically saying “this time it’s different.” That type of thinking has coincided with every bubble we’ve ever witnessed, and was invariably followed by a loud POP!!.

Well, Bank of Canada Governor Mark Carney disagrees.

In a speech in Calgary earlier today Carney said the rise of the middle class in India and China does mean this boom is different than all the others that have come before it. “Even though history teaches that all booms are finite, this one could go on for some time,” he said. (Here’s the full text of his speech.)

If Carney is proven right, here again is a chart we put together that shows how unbelievably, astoundingly history-defying his prediction would be:

Yes, that’s 200 years of booms and busts. Whenever 10-year average rates of return climb above 10 per cent, you’re into the danger zone, and as of a few weeks ago, we’d hit 12 per cent, according to Hackett Financial Advisors.

But Carney says this is a Supercycle, so the old rules don’t apply. His analysis seems to stand in contrast to his colleague at the Bank, Deputy Governor John Murray. Last year Murray warned against expecting commodity prices to keep going up forever: “If history is any guide, continuous rapid upward movement in real prices – oil or otherwise – is unlikely, as is a large permanent increase in the real price level.”

So who’s right—Carney or Murray?

P.S. someone will undoubtedly complain again that the chart doesn’t state which currency commodities were priced in. The chart measures 10-year trailing rates of return, priced in US$ terms.