For Canada’s economy it seems the worst of the oil crash is over

We can’t read too much into a single quarter, but the period of weak growth and declining incomes appears to be over

Pumpjacks at work pumping crude oil near Halkirk, Alta., June 20, 2007. With Canada’s premiers poised to meet next week in Quebec City to discuss energy strategy and climate change, forces are girding for battle – with Alberta’s oilsands the figurative no-man’s land that lies between the warring world views. THE CANADIAN PRESS/Larry MacDougal

Share

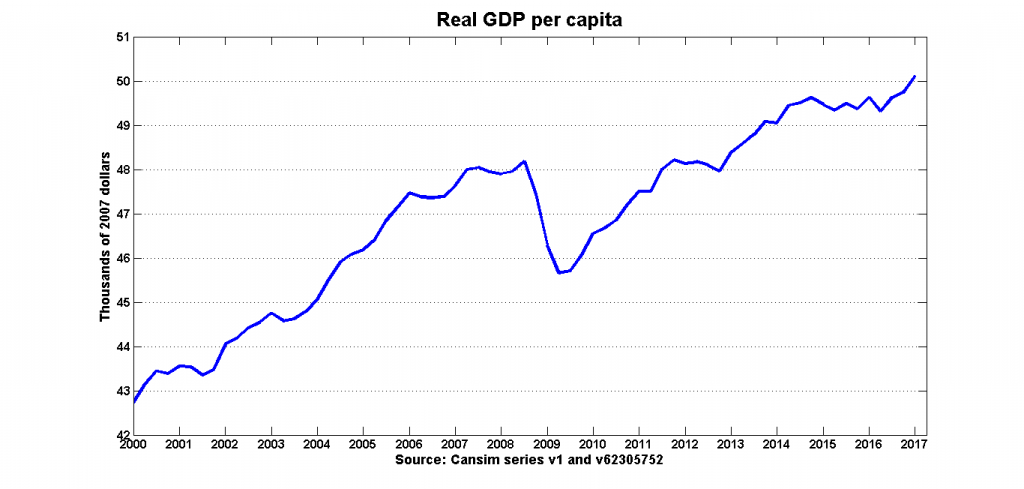

It’s usually a mistake to read too much into a single economic data release, but the national accounts estimates for the first quarter of 2017 seem to confirm an inflection point in the Canadian economy. After a two-year pause induced by the decline in oil prices in 2014, the pace of economic activity appeared to quicken sometime in mid-2016—coinciding with the recovery in oil prices and renewed activity in the oil and gas sector.

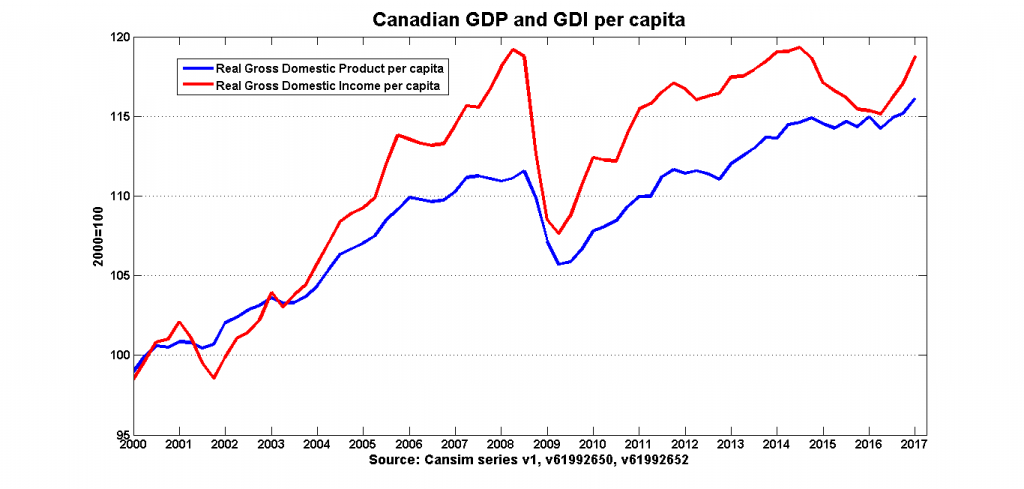

But the more encouraging news is what’s happening to incomes with the improvement in Canada’s terms of trade (the ratio of export prices to import prices). As I explained here, the principal downside of a fall in oil prices wasn’t the effect on GDP, but on incomes (see here as well). As oil prices fell, Canadian exports would be traded for fewer imported goods, and this reduction in our terms of trade would be reflected in a decline of Canadians’ purchasing power. And that’s what happened: Canadian Gross Domestic Income (GDI) fell sharply after mid-2014.

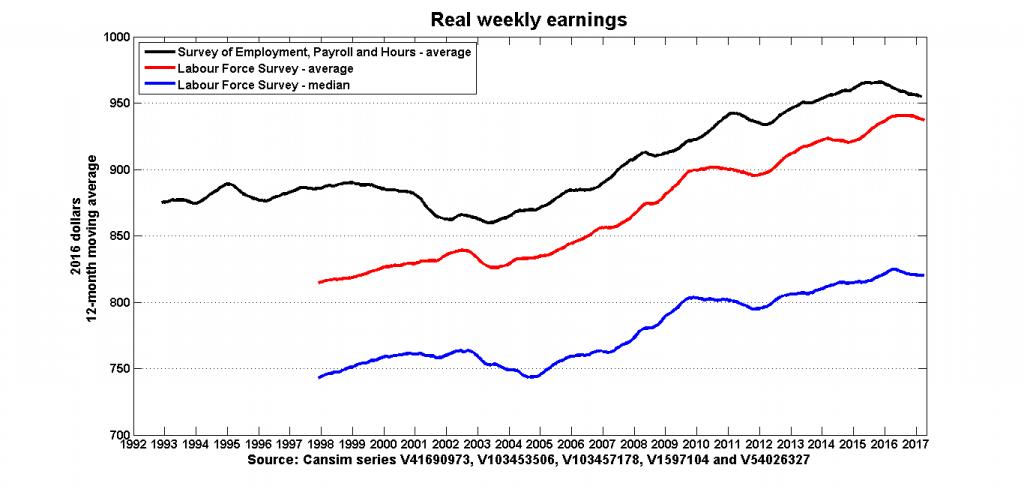

The decline in GDI manifested itself as a softening in real wages. After a decade of steady increases, real earnings started to decline in 2016:

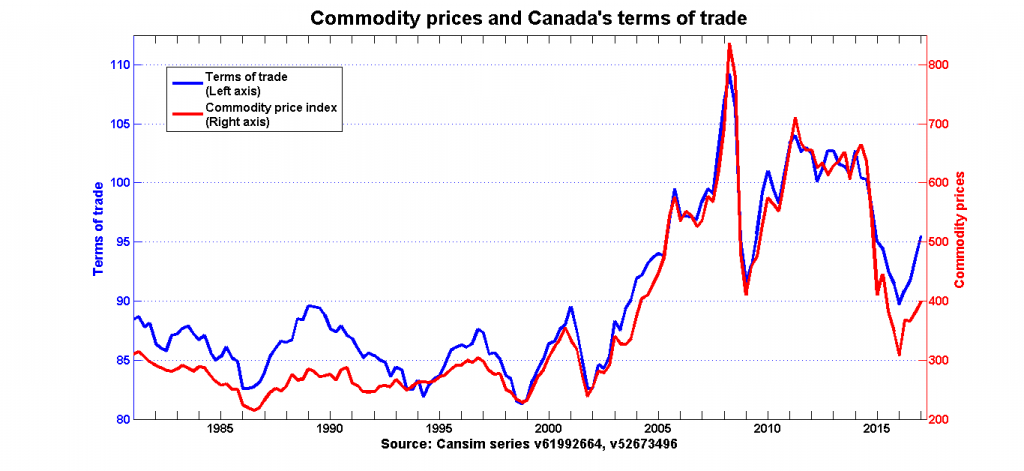

The good news is of course that GDI has rebounded in the last few quarters, thanks to the improvement in Canada’s terms of trade – which in turn was driven by a rebound in the prices of oil and other commodities:

As I said, it’s a mistake to read too much into any single data point. But the national accounts release from the first quarter of 2017 seems to confirm that the 2014-2016 episode of weak growth and declining incomes is behind us.

For now, at least.