The Harper agenda prevails, whether he wins or loses

By putting shrewd politics ahead of sound economics, the Prime Minister has guaranteed Canada will have austerity for years to come

Share

This is taken from page five of Paul Wells’s 2006 book Right Side Up; the context is a speech that Stephen Harper gave to a Canadian Alliance (remember them?) policy conference in 2001. He would soon go on to announce his candidacy for the CA leadership, and the rest is, well, history:

This is taken from page five of Paul Wells’s 2006 book Right Side Up; the context is a speech that Stephen Harper gave to a Canadian Alliance (remember them?) policy conference in 2001. He would soon go on to announce his candidacy for the CA leadership, and the rest is, well, history:

And what was the policy end to which Harper was urging conservatives? He offered only hints. He cited research suggesting that a nation’s government is simply wasting money if it spends more than 30 per cent of a nation’s gross domestic product. “Canada is 50 cents on the dollar above that level.” That is, Canada’s various levels of governments were spending closer to 45 per cent of GDP.

This is the kind of statement that news reporters never write about. It’s full of numbers; it’s abstract; it’s theoretical. But if Harper’s words had any meaning, the implication of what he was saying was breathtaking. Total federal spending in 2001 was about $120 billion. So Harper was calling, at least in theory, for $40 billion in cuts to government spending.

This passage is key to understanding a significant part of what Harper’s agenda has been, what it will be, and what he hopes will be the baseline with which future governments will be obliged to work.

There are a lot of things to disagree with in Harper’s assessment. For one thing, the 30 per cent threshold isn’t based on much in the way of research. I noted here that share of GDP is not a useful indicator for government size: heavy-handed regulations are cheap to implement. The tax mix is usually more important than amount of tax revenues generated. (See here for how a large tax take can be consistent with strong economic growth.) The goal of a smaller government-spending-to-GDP ratio is one driven by politics, not economics.

Politics, not economics, has also determined the strategy for achieving this goal. If you asked an economist for the best way of reducing revenues, she’d probably prepare a list with the taxes that are the most harmful to the economy at the top, and the taxes that are the least harmful at the bottom. The GST would rank at or near the bottom of that list. (Here is a representative reaction to the Conservatives’ 2005 campaign promise to reduce the GST; here is an explanation for why economists think the GST is a good idea.) In economic terms, reducing the GST was probably the worst possible option available to the Conservatives.

But as far as politics goes, it was an inspired choice. It helped win the election, and—perhaps even more importantly—reducing the GST has made it that much harder for any future government to reverse the trend to lower spending. If the Liberals and the NDP were to ask an economist to provide a list of ways of generating the most revenues at the least economic cost, increasing the GST would be at or near the top of the list. But those two GST points are not going to come back to fill federal coffers in the foreseeable future. Both the Liberals and the NDP have campaigned at some point on anti-GST platforms, and history has not been kind to provincial governments that have raised the HST without an electoral mandate to do so. (The NDP’s proposal to increase corporate tax rates is the doppelgänger of the Conservatives’ GST cut. In economic terms, an increase in corporate taxes is probably the worst possible choice for generating revenues, but it’s a potential vote-winner. Maybe it will work for them as well as it did for the CPC.)

Then there’s the Conservatives’ predilection for boutique tax credits. Here’s how UBC’s (and Macleans.ca’s) Kevin Milligan put it recently:

Since 2006, so-called “boutique” tax credits have proliferated, allowing tax recognition of activities ranging from children’s fitness to volunteer firefighting. These credits are inefficient, and they are biased toward higher earners who are more tax-savvy.

Normally, when we raise revenue using high marginal tax rates, there is a tradeoff: We distort economic activity but we get tax revenue that can be spent on productive public projects. With boutique tax credits, we end up with the worst of both worlds; we distort decisions with higher tax rates, but the issuance of credits means that we don’t raise as much revenue.

But on the political front, the Conservatives probably view boutique tax credits as a win-win-win proposition: They win votes, they reduce revenues, and they are politically difficult to eliminate once in place.

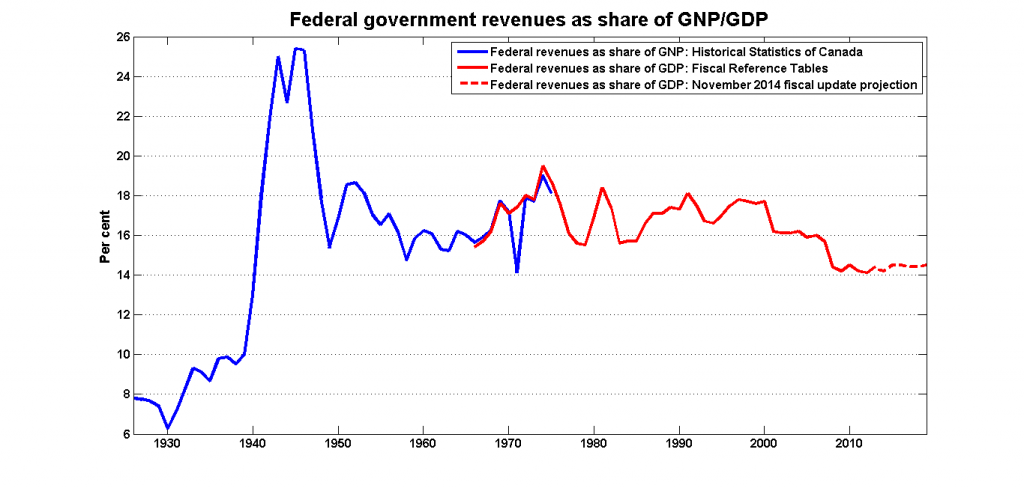

This doesn’t sound like much and, indeed, it’s not supposed to sound like much. But the net result is that federal revenues as a share of total economic activity are now at levels not seen since before the Second World War:

This brings us to the “starve the beast strategy” described in detail here: the reduction in revenues is now a justification for reducing expenditures. But, once again, the strategy is driven by politics, not economics. The elements are as follows (see also here and, most recently, here):

- Let transfer payments to individuals grow at the rate of GDP.

- Let transfer payments to provinces grow at the rate of GDP.

- Hold nominal direct program spending constant.

These elements have been in place in every budget since 2010. The economics of this approach are very dodgy: the economically efficient way to approach the problem of reducing spending is to perform a cost-benefit analysis and eliminate the programs that don’t pass the test. But the politics are something else. Cuts in transfer payments directly affect peoples’ personal finances, and could be reversed at no political cost. The same is true for cuts in transfer payments to the provinces; much of the Jean Chrétien-era cuts to the provinces were rescinded a few year later. The path of least political resistance is through direct program spending: the cost of paying federal public servants’ wages.

I’ve noted that holding nominal spending constant means continued austerity: the costs of delivering a given set of public services increases more or less in line with GDP. The only way to reconcile rising costs with constant spending is to make cuts. Once again, even if you’ve accepted this point, the economically efficient strategy is to eliminate the programs that deliver the least value for money, and the government is free to determine what activities it values. Across-the-board cuts are almost never the best strategy. This point was well-known during the Chrétien budget-cutting years, and the Conservative government was made aware of a similar analysis fairly recently. But since every program has its own constituency, there’s always a risk that cancelling a program outright will provide a focal point for discontent.

Indeed, Conservatives may view some of the economic disadvantages of across-the-board cuts as political advantages. For example:

“The authors found that prolonged cuts of this nature result in a loss of workforce capability, public sector productivity and innovation, and trust and confidence in public sector institutions,” states the memo.

I’m pretty sure that many Conservatives are not overly upset by this prospect. And, even the most imaginative CPC strategist wouldn’t allow herself to dream that an opposition party would campaign on a promise to raise taxes in order to increase public sector productivity and morale.

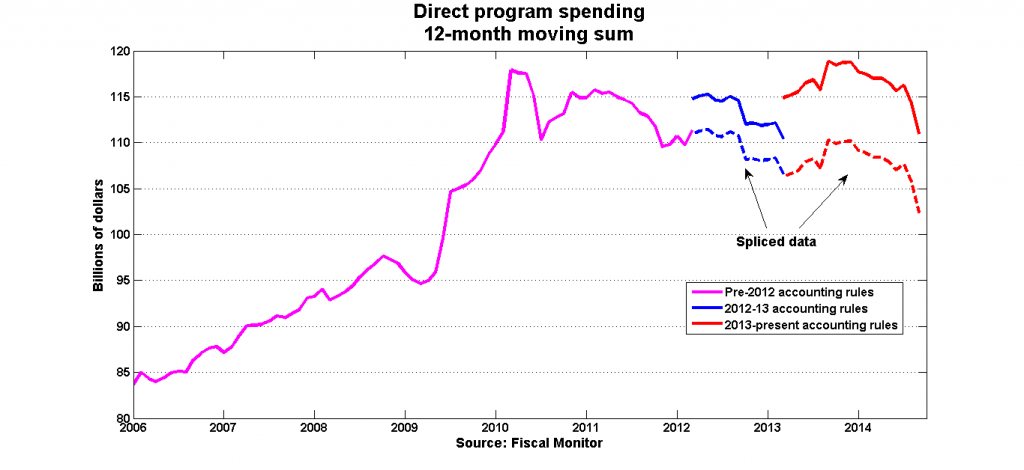

The third prong of the CPC approach—holding direct program spending constant—has gotten sharper recently. Although the government’s habit of frequently changing its accounting rules obscures the picture—again, another political winner—it seems clear that nominal spending is actually falling:

Splicing these series is almost certainly not the correct way to go about this, but it will have to do for now. If the Department of Finance is willing to provide me with a consistent series, I would be happy—thrilled! ecstatic!—to replace this chart with a better one.

This brings us to the present. Looking forward, I’ve noted that talk of a future surplus is contingent on a baseline in which the Conservatives’ three-point program remains in place over the next few years; without continued austerity, those projected surpluses are transformed into projected deficits.

It’s hard to overstate the importance of establishing this baseline scenario: Election platforms are invariably expressed in terms of deviations from the most recent Department of Finance projection. Proposals for new spending (or new tax cuts) are expected to be accompanied by offsetting measures for new revenues. From what we’ve seen so far, neither opposition party is willing to consider the sort of tax increases that would produce a significant deviation from the Conservatives’ baseline.

The ballot-box question in 2015 may well be: “Which party do you want to implement Stephen Harper’s agenda?”