Here’s what we know—and don’t know—about Alberta’s carbon tax

There’s a lot of good in Alberta’s carbon tax plan, writes economist Trevor Tombe, but also one big missed opportunity

Premier Rachel Notley, right, and Environment and Parks Minister Shannon Phillips after unveiling Alberta’s climate strategy in Edmonton, Alberta, on Sunday, November 22, 2015. THE CANADIAN PRESS/Amber Bracken

Share

Months of speculation ended Sunday when Premier Rachel Notley and Environment Minister Shannon Phillips announced a carbon tax is coming to Alberta. Pricing carbon is one of the most sensible policy prescriptions to address greenhouse gas emissions, so this is good news. But, of course the devil is in the details, so we should explore some of those.

Before doing that, though, I want to note that the process used to arrive at this point was excellent. With a review panel chaired by Andrew Leach—a top economist from the University of Alberta—the government was sure to receive sensible, evidence-based policy advice. That is precisely what the panel delivered. Regardless of one’s views of the package ultimately adopted by the government, we owe Andrew Leach and the panelists thanks. The entire process is a model for other jurisdictions.

There will be much analysis in the coming days and weeks, and the government will likely release many more details next spring in their budget. So, I want to focus on a few of the largest aspects of the plan. The good: the carbon tax is set at a reasonable level, and low to middle-income households will receive compensation. The good or bad (depending on your perspective): the package doesn’t increase renewable electricity generation as much as people might think, and provides billions in subsidies to large emitters (which is sensible in this case, I think). And the missed opportunity: no existing taxes will be lowered; it’s not revenue-neutral, despite claims to that effect. Let’s go through these one by one.

The Carbon Tax

This is a big win. Not because it is a new source of revenue for the government, but because it is a far more efficient means of lowering greenhouse gas emissions than regulatory approaches. The consensus among top economists on this point is as strong as the consensus among scientists that climate change is real and greenhouse gas emissions contribute to it. Politically, putting a price on carbon also receives broad support from the left and the right (just look at the people behind Canada’s EcoFiscal Commission, the leading advocacy group in Canada for carbon pricing, featuring Jim Dinning, Jack Mintz, Paul Martin, and Preston Manning, among many others). Of course, it is one thing to oppose lower emissions, but if you (a) want to lower emissions and (b) think price signals work in general, then a carbon tax is for you.

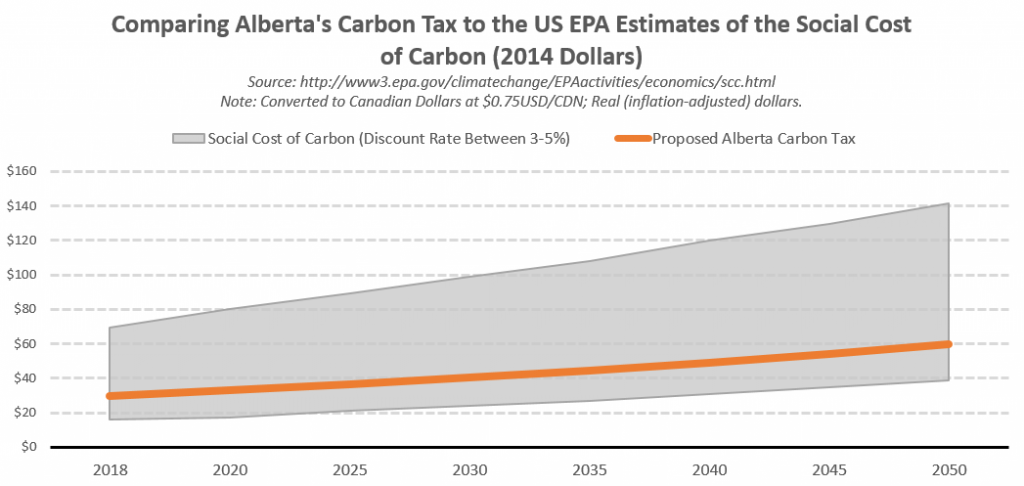

So, is the Alberta carbon tax set at a reasonable level? At an initial price of $20 per tonne in 2017, rising to $30 in 2018, and rising at inflation plus 2 per cent after that, this is a tangible price on carbon that is within the range of reasonable estimates of the true cost of carbon (that is, the estimated monetary cost of damages from emissions). Below I plot a range of estimates from the U.S. Environmental Protection Agency and Alberta’s proposed carbon tax.

These estimates are subject to a large degree of uncertainty, which is evident in the wide band illustrated in the graph. No one knows what the “right” price is, but it is certainly more than zero. At $30, Alberta’s proposed tax is not obviously too high or too low, and with the tax rising by 2 per cent plus inflation, it will stay within this “reasonable” range for many years to come.

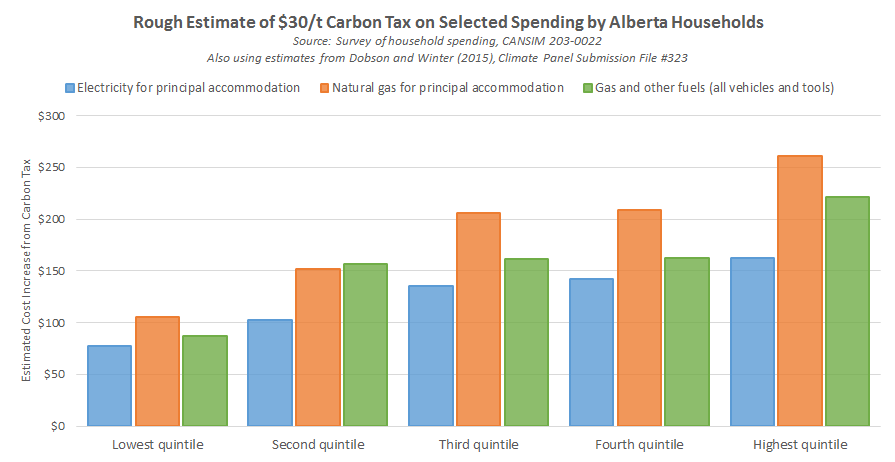

How will it affect families? Let’s look at the three most carbon-intensive purchases that households make: gasoline for vehicles, electricity, and natural gas for home heating. At $30 per tonne, gasoline prices will rise by about 6.7 cents per litre and natural gas prices will rise by about $1.50 per GJ (for a complete list, see B.C.’s carbon tax numbers here). The effect on electricity prices is more complex, and I explore this shortly, but it will likely be less than two cents per kWh. The full dollar cost of the carbon tax will depend on how much a household spends. Using Statistics Canada data on household expenditure patterns in Alberta, and analysis from Dobson and Winter (2015), I find the following:

Roughly speaking, households in the bottom 20 per cent of the income distribution face a $300 per year cost increase from the carbon tax. For a median household, the cost is $500, and for the top 20 per cent of households, the cost is about $600. To be sure, this will be a burden for many, but the government is committed to providing rebates to low and lower-middle income households. The panel recommended this rebate be given to “low and middle income households” twice a year by providing an amount “equal to the expected annual cost of the carbon price for an average Albertan.” This suggests about $500 per year to the 500,000 (or so) Alberta households in the lower half of the income distribution. So, about 5 per cent of the carbon tax revenue will be rebated as direct low income support. The spring budget will likely provide more details on this.

Coal Phase Out and Renewable Electricity

(This section has been updated. See update below.)

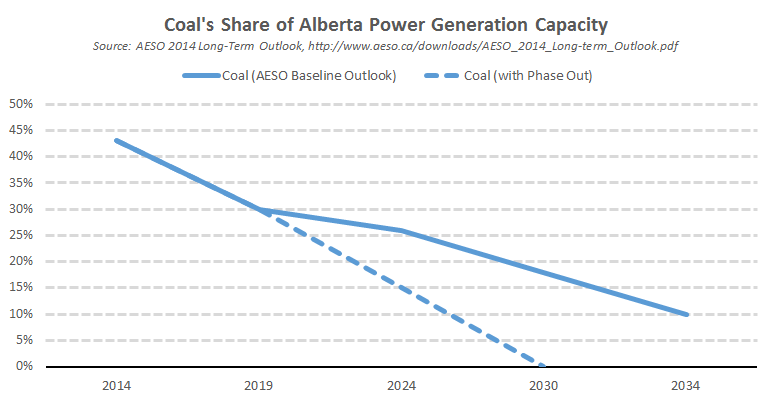

Coal was already on the way out, though the government plans will accelerate the phase-out by many years. I plot this below (though the dotted line is completely stylized, it may not be phased out in such a smooth straight line).

Given coal’s serious health and environmental consequences, this is welcome news. (As an aside: the health consequences of coal plants, and other facilities like them, are likely an order of magnitude larger than the environmental costs.) Natural gas prices are also very low, and not likely to rise substantially, making natural gas power stations an economical alternative.

On the other hand, why the focus on coal power plants? Refineries and upgraders emits just as much greenhouse gases and huge amounts of NOx and SOx, but are not singled out. (For details, explore this.) A carbon tax is efficient precisely because it sets a price and let the chips fall where they may. A tonne is a tonne is a tonne. If a coal plant can operate profitably with a price on carbon (and of course another tax to reflect the health costs) then so be it. But then again, perhaps there are other considerations beyond environmental ones—and fair enough, but policymakers should be open about it.

Back to the issue at hand: How much are renewables expected to offset lost power from decommissioned coal plants? Only a moderate amount. This may seem surprising, given the government’s emphasis on renewables. Indeed, the government announced that “by 2030, renewable sources like wind and solar will account for up to 30 percent of Alberta’s total operating generation capacity.” Currently, renewables account for about 18 per cent of capacity (counting waste heat as renewable), so we’re really talking about an extra 12 per cent share for renewables. Another calculation confirms this. Under the baseline AESO projection above, coal will have about a 17 per cent share in 2030. The government said two-thirds of the lost capacity will be from renewables. Hence, about 12 per cent.

So renewable capacity will increase by 12 percentage points, but is that a good measure of their true contribution to the grid? The key word here is “capacity”. Currently, wind generates electricity equivalent to 27 per cent of its potential capacity—the wind doesn’t blow all the time, after all. Let’s do a little thought experiment, assuming this 27 per cent share holds into the future. The lost coal capacity in 2030 is about 4000 MW, so two-thirds of that (2700 MW) will be replaced with renewables capacity. Let’s assume that’s all wind. This will generate 6,400 GWh per year—which is a lot, since wind currently only generates 3,500 GWh per year. But, the lost coal capacity would have generated over 28,000 GWh per year, since coal operates a much higher fraction of the time. This means wind will make up less than one-quarter of the lost power, even though it’s making up two-thirds of the lost capacity. This is interesting, and potentially encouraging to those who worried about Alberta repeating Ontario’s mistakes that resulted in large electricity rate increases. The panel also recommends a cap on subsidies to wind, at no more than $90 per tonne of carbon, which is another sensible component of the plan (see page 50 here).

UPDATE (Fair warning, it’s wonky): Late afternoon on Monday, the government clarified (somewhat) the language on the renewable generation goal, removing the word “capacity” from the last bullet point here. A helpful reader in the comment section below also suggests a 27 per cent capacity factor for wind is too low; let’s round that up to 30 per cent (consistent with this). Both of these change the math somewhat. What’s the plan now? They want 30 per cent of generated electricity to be renewable by 2030. They also want two-thirds of the lost coal capacity to be replaced with renewables. So, it now looks like 4200 MW of wind capacity will be built (two-thirds of the lost 6200MW of current coal capacity). This translates into about 11,000 GWh. Add this to our current renewable generation, and by 2030 we’ll have almost 19,000 GWh of renewable electricity generated per year. The AESO projects that by 2030 we’ll need over 125,500 GWh per year of power, so renewables may be only 15 per cent of the total. If the government wants 30 per cent of generation to come from renewables, where does the other 15 per cent come from? It’s unclear. There’s certainly some details of the renewable electricity plan that remain to be worked out.

The Output Subsidy to Large Emitters

This is perhaps the largest cost of the entire plan, but has only limited information available. So let me try to unpack it.

Firms will pay a carbon tax of $30 per tonne, just like everyone else. As many large emitters are in trade-exposed industries, unable to pass on the costs, there are genuine competitiveness concerns. The government will therefore rebate some of the tax revenue back to large emitters in industry. This cushions the blow, and ensures their costs do not rise too much. (For full exploration of trade exposure and carbon intensity across Canada, see a recent EcoFiscal Commission report here.)

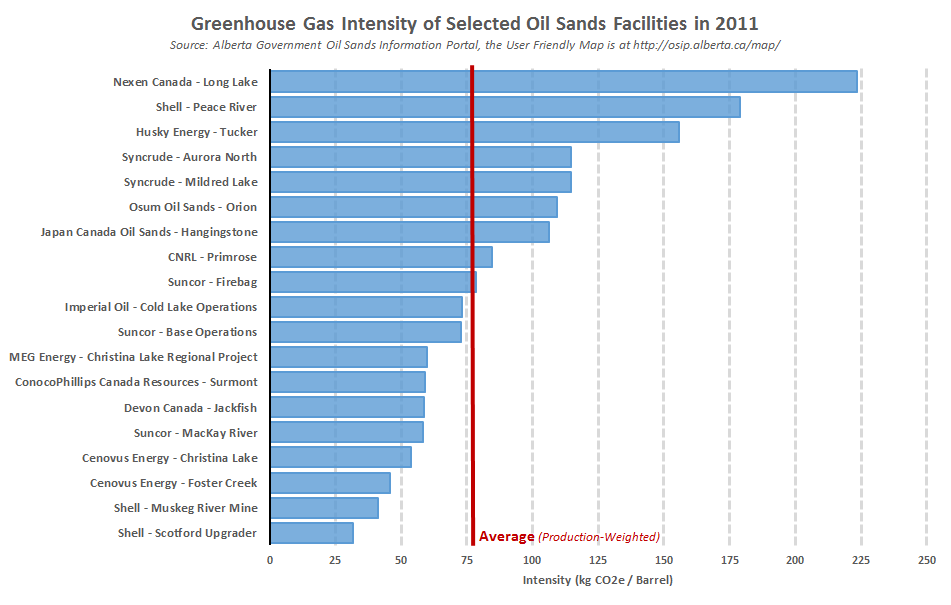

How will the rebate be structured? As a subsidy per unit of production. The government calls this a “product-based emission performance standard.” In plain English we can really just call it a subsidy. A subsidy that is the same dollar amount per unit of output for all firms in a sector. In the oil sands, for example, a facility will receive some dollar amount per barrel as a subsidy. Importantly, this doesn’t eliminate the incentive to reduce emissions—the tax is on carbon, the subsidy is on output. But it does create interesting differences between firms in how costly the carbon tax will be. Using the most recently available data, here are the carbon emissions per barrel of oil for the largest oil sands projects:

Some firms are much more emissions intensive than others. Cenovus, for example, emits roughly 50 kg of CO2 per barrel, while the average among the projects listed here is 75kg. At the high end, Nexen, emits nearly 225 kg per barrel at its Long Lake facility.

If the output subsidy returned the full amount raised by the carbon tax, it would pay each firm $2.25 per barrel (0.075 tonnes of carbon per barrel times the $30 per tonne carbon tax). Of course, the subsidy will not return the full amount; instead, the panel recommends they recognise “top quartile” performance. This means 75 per cent of firms will pay more in carbon taxes than they receive in subsidies. This suggests a subsidy of about $1.50 per barrel, which will then be declining over time. In any case, there are winners and losers among oil sands firms—Cenovus is a clear winner. (Side note: I don’t own Cenovus stock and I’m not making investment advice here.) Most firms will also see costs rise by less than $1 per barrel, although Nexen will face a net increase in costs closer to $5 per barrel. Overall, this is not a big hit to oil sands producers and potentially explains their support, along with the certainty of carbon prices and likely improved access to markets (see here and here).

This output subsidy will go to all large emitters, not just those in the oil sands. There was, unfortunately, very little detail in the announcement (understandable, given the tight time table) but a very rough back-of-the-envelope calculation suggests it’s in the range of $2.5-3 billion, with $1.5 billion going to oil and gas firms, close to $1 billion going to electricity generators, and the rest to other large emitters. (Again, I’m ball-parking, but this is gives a good sense of the numbers involved.) So, roughly half of all carbon tax revenue raised will be recycled in the form of output subsidies, making this the single largest line item in the whole package.

Does an output subsidy make economic sense? The competitiveness of trade-exposed sectors is a valid concern. The EcoFiscal Commission wisely suggests that support to these sectors should be targeted, transparent, and temporary. The panel’s proposed approach to providing subsidies is certainly targeted and transparent, but is it temporary? That’s unclear. I suspect the government will need to return to this aspect of the system in the future, though the panel does recommend the subsidies shrink over time.

There are also some small distortions associated with this form of rebating. Since it subsidizes output only in some sectors and not others, there is potential for what economists call misallocation. That is, the allocation of investment, production, and employment differs from optimal allocations given underlying fundamentals like productivity. (For an accessible discussion see a recent paper by Stanford economists Charles Jones here.) That being said, these large emitters have large discrete operations that are less likely to be responsive to such small subsidies, which limits the distortionary effect.

In any case, the largest economic cost of the overall plan is what isn’t in it: lowering other, worse forms of taxation. This bring me to my last observation.

Revenue Neutrality

Premier Rachel Notley, in her speech announcing the tax, said:

We will put every penny raised through the carbon price to work here in Alberta — building our economy, creating jobs, and doubling down on efforts to reduce pollution and promote greater efficiency. The Alberta carbon price will therefore be revenue-neutral, fully recycled back into the Alberta economy. To that end, revenue will be reinvested directly into measures to reduce pollution — including clean research and technology; green infrastructure like public transit; to help finance the transition to renewable energy; and efficiency programs to help people reduce their energy use. [Emphasis added.]

If by revenue-neutral she means they aren’t going to toss the carbon tax revenue into the ocean but are instead going to spend the money on stuff, then okay. But, the phrase “revenue neutral” rightly means total government revenue will be unchanged. (How could it mean otherwise?) That is, a carbon tax is revenue neutral if what’s levied by the government is fully offset by reductions in other taxes elsewhere. This is basically what B.C. did with their carbon tax. They report annually in their budget how much came in from the carbon tax and how much went out through lower taxes, so it’s all above-board.

The Alberta carbon tax plan is not revenue neutral—not at all. Nothing in the report today suggests any existing tax will be lowered. Of course, that’s a valid position to take, but the government shouldn’t try to mislead people by misusing the phrase “revenue neutral”—it should advocate clearly for the policies it prefers, and let people decide. To many economists, the opportunity to use carbon tax revenue to lower highly distortionary taxes like corporate income taxes or personal income taxes is an opportunity that shouldn’t be wasted. There’s an opportunity for a double-dividend (an improved environment, and an improved tax system). Now, in fairness, Alberta faces serious fiscal challenges and a large deficit (for more, see this or this), and using a carbon tax to help fill the gap between revenue and expenses may be seen as avoiding future tax increases. But that’s not how it was framed.

Overall Assessment

We must be careful to separate carbon taxes as a tool to efficiently incentivize emissions reductions, on the one hand, from what governments choose to do with the money, on the other. One may take issue with the lack of real revenue neutrality in Alberta’s carbon tax, but the response should be in calling for tax reductions elsewhere. (Given Alberta’s fiscal situation, this also means calling for spending restraint, of course.) Putting the revenue neutrality issue aside, a carbon tax is a huge win for Alberta households and businesses alike. Any other policy to lower emissions would have needless costs for our economy.