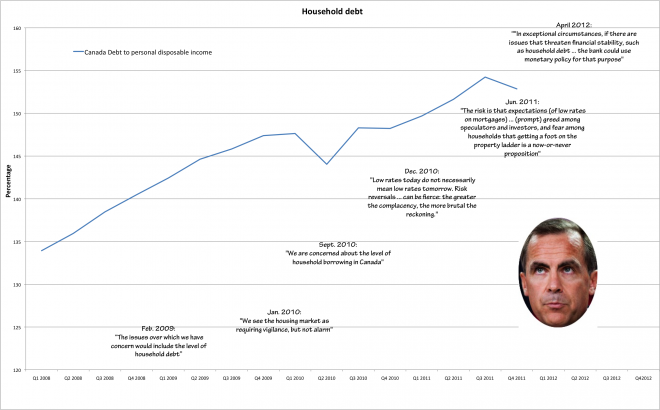

Household debt and the Bank of Canada’s anxiety levels—in a graph

Canadians’ debt-to-income ratios, with Mark Carney commentary

Share

It’s been years since Bank of Canada governor Mark Carney first started warning about Canadians piling on too much personal debt. Rising household debt, after all, has been the most dangerous byproduct of his low interest rate policy, which was initially designed to help Canada sprint out of the Great Recession––and, later on, partly dictated by the need to help sputtering Canuck exports. Right from the get-go, though, Canadians haven’t been listening. As the situation became more dire, so did the Bank’s warnings. Today Canada’s ratio of household debt compared to disposable income is inching toward 160 per cent, the peak seen in the U.S. and the U.K. just before their respective housing busts. (In the last three months of 2011, the debt-to-income ratio declined somewhat–not because Canadians stopped taking on debt, but because income levels also rose during the same period.) Carney is still at it. Last week, he finally raised the prospect of raising interest rates, cutting people off from all that cheap money, even as the Fed down south sticks to near-zero rates.

In the graph below, we’ve charted debt-to-income ratios, alongside some increasingly alarmed quotes from BOC governor Mark Carney or other Bank officials.

Click on the chart to open a full-size version of the graph in a new window.