Just how much is the oil price drop hurting oil sands projects?

Despite the plunge in prices, the oil sands are a lot better off than you might think

Share

Over the past few weeks the price of crude has dropped significantly, and with it we’ve seen significant discussion of the continued viability of oil sands projects. Much of this discussion was centred around the Keystone XL pipeline debate over the past week, and was informed by analysis in the State Department’s final environmental impact assessment (PDF) for the pipeline. In particular, the State Department report speculated that, at West Texas Intermediate oil prices between $65 and $75 per barrel, the savings in transportation costs implied by pipelines versus rail could be material in terms of future oil sands growth.

Over the past few weeks the price of crude has dropped significantly, and with it we’ve seen significant discussion of the continued viability of oil sands projects. Much of this discussion was centred around the Keystone XL pipeline debate over the past week, and was informed by analysis in the State Department’s final environmental impact assessment (PDF) for the pipeline. In particular, the State Department report speculated that, at West Texas Intermediate oil prices between $65 and $75 per barrel, the savings in transportation costs implied by pipelines versus rail could be material in terms of future oil sands growth.

Above approximately $75 per barrel (West Texas Intermediate [WTI]-equivalent), revenues to oil sands producers are likely to remain above the long-run supply costs of most projects responsible for expected levels of oil sands production growth. Transport penalties could reduce the returns to producers and, as with any increase in supply costs, potentially affect investment decisions about individual projects on the margins. However, at these prices, enough relatively low-cost in situ projects are under development that baseline production projections would likely be met even with constraints on new pipeline capacity. Oil sands production is expected to be most sensitive to increased transport costs in a range of prices around $65 to 75 per barrel. Assuming prices fell in this range, higher transportation costs could have a substantial impact on oil sands production levels—possibly in excess of the capacity of the proposed project—because many in situ projects are estimated to break even around these levels. Prices below this range would challenge the supply costs of many projects, regardless of pipeline constraints, but higher transport costs could further curtail production.

-State Department, final environmental impact statement, Keystone XL pipeline, market analysis, Page 1.4-8

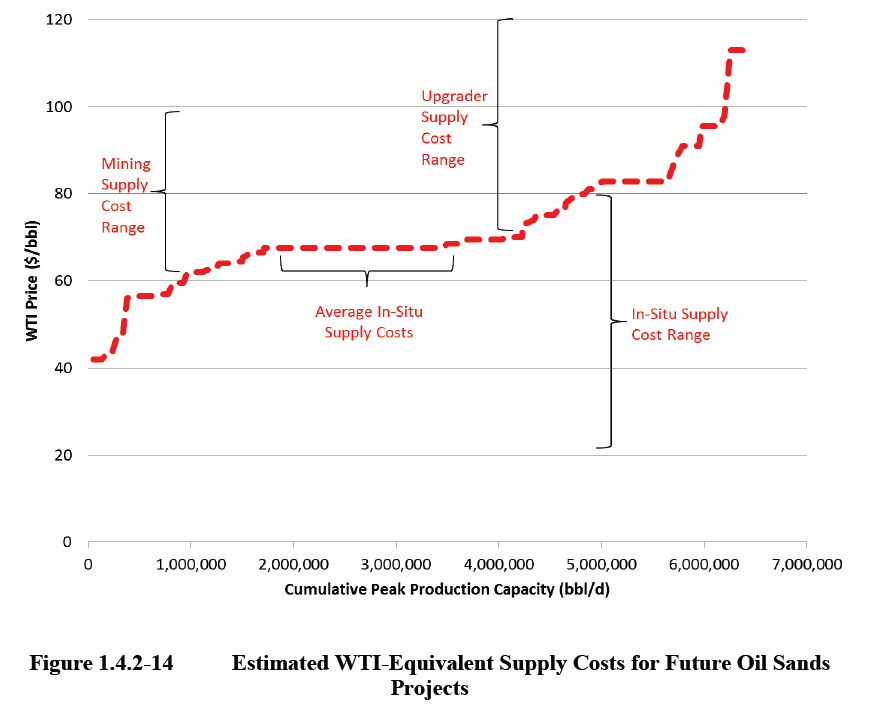

The State Department analysis is based on what are commonly referred to as supply costs, or the WTI oil price, usually reported in $US terms, at which a new project would expect to achieve a minimum, acceptable rate of return on capital deployed. Usually, the rate of return chosen for this is in the range of 10 to 12 per cent, after-tax. The State Department used a series of references to construct a project supply curve — basically a view of how much oil sands development is likely to occur as a function of expected oil prices — which is shown below. If you looked only at this figure and the recent slide in WTI prices, you’d conclude that we’ve moved from a situation in which more than six million barrels per day of oil sands production is well in-the-money to a new outlook where a lot of that forecast new production is only marginally profitable. The slide in oil prices has hurt, but to really understand the impact of recent price changes on oil sands, you need to look a little deeper.

For an oil sands project, there are four key factors that determine supply costs: the costs of building and operating the project, the discount between light oil and diluted bitumen, the costs of diluent, and the Canadian dollar exchange rate. While oil prices have dropped significantly, and have commanded much of the news coverage, the other factors in this calculation have changed significantly as well.

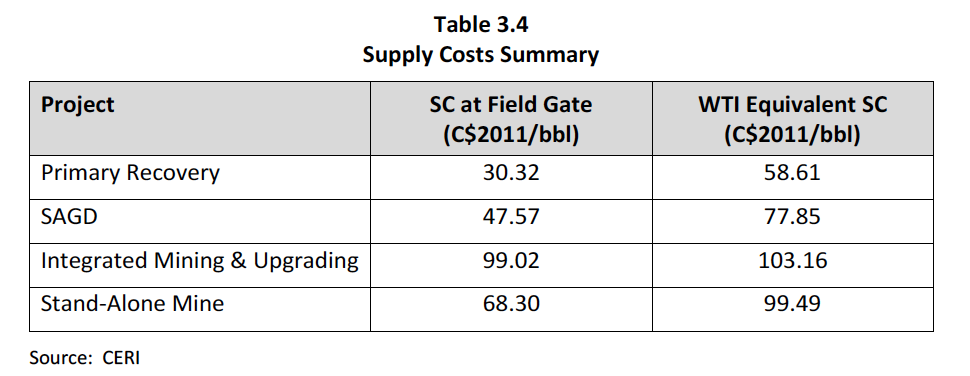

To give you some context, one of the studies cited by the State Department in developing their supply cost estimates is the May 2013 Canadian Oil Sands Supply Costs and Development Projects (2012-2046). This study assumes that oil sands projects will not be built if they yield less than a 10 per cent real (12 per cent nominal) rate of return, and shows (see the figure below) that the linos share of new oil sands projects would require a WTI-equivalent price, in Canadian dollars of between $78 and $100 per barrel to earn a that level of return.

The CERI study assumed, to get these figures, that natural gas prices would increase above inflation, from $3.50/GJ initially and rising to $6/GJ in real dollar terms by 2040. The study also assumed that heavy crudes trade at a discount of US$15 to light crude, and a five per cent premium over the value of light oil for diluents. Most important, they assumed that the Canadian dollar would trade at parity with the U.S. dollar over the study period, so supply costs in Canadian dollar terms convert directly to U.S. dollar WTI prices.

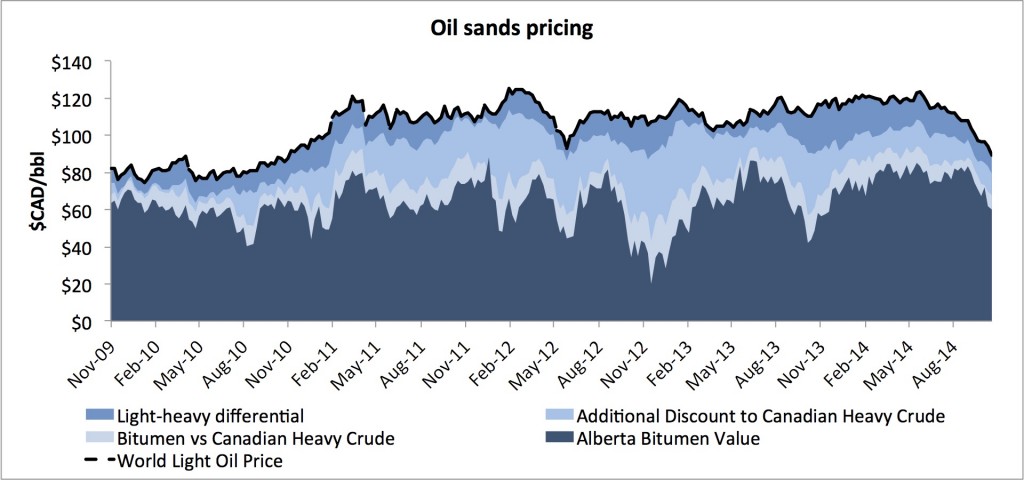

Now, consider what has happened since this report was released: yes, oil prices have dropped significantly, with WTI front-month contracts closing Wednesday at US$4.53, but the Canadian dollar has followed and closed at US88.14 cents per Canadian dollar, meaning that WTI in Canadian dollar terms was worth $84.55. In terms of heavy oil, Western Canada Select, the Canadian benchmark heavy crude, was posted Wednesday at C$71.67 (US$ 63.36), a differential to WTI of only a little more than $11, while lighter condensates traded Wednesday at C$83.62 (US$73.93), a slight discount to WTI. Combine all of these factors together, and the differences are stark.

Taking today’s WTI price of US$74.53, using the assumptions in the CERI (2013) study, you’d have heavy oil trading at C$58.53, but containing 30 per cent of a barrel of condensate worth C$23.48, leading to an implied bitumen value of approximately $50 per barrel in Canadian dollar terms. Take the same WTI price, with today’s exchange rates and other oil prices, and you’ve got a barrel of bitumen which is worth significantly more: about C$66.55 per barrel.

If you compare C$66.50 bitumen prices to the plant gate supply costs in the left-hand column of the table above, you can see why there’s less panic than you might expect from the oil sands sector based solely on older estimates of WTI-equivalent supply costs such as those reported by the State Department. Even a more expensive new mine such as Suncor’s Fort Hills currently under development, would expect to earn a reasonable rate of return on invested capital if the effective bitumen price remains at today’s levels of C$66 – not quite 12 per cent if you used CERI’s numbers, but still well above traditional mining hurdle rates of nine to 10 per cent. In fact, when Suncor approved the project, they stated that returns would exceed their cost of capital with bitumen prices in the $50-$60 per barrel range. New in-situ facilities, such as those from Cenovus, claim supply costs in lower still: in the $35-$60 WTI range given adjustments for these new market realities.

If you are looking at a Canadian bitumen project, your pricing outlook has no doubt taken a hit over the past six weeks, just as all other oil projects have, but it’s by no means clear that the relative position of oil sands projects has suffered that much, nor is this the most difficult period for oil sands pricing in recent history. If you consider the graph below, in which all the factors relevant to oil sands production are agglomerated, you’ll see that in Canadian dollar terms, implied bitumen prices have fallen significantly in recent weeks, but have also been significantly below their current levels 78 weeks out of the previous five years—30 per cent of the time—in Canadian dollar terms.

So, don’t assume that just because WTI prices have decreased that you can apply these so-called break-even costs assuming all else is equal. It isn’t. While oil prices have certainly moved against oil sands production, other factors that are just as important have moved favourably. There’s still a point where oil sands projects would be sensitive to increased transportation costs, and there will always be a marginal project, but it’s hard to see how, at this point, you’re likely to see oil sands production constrained in such a way as to leave Keystone XL underutilized were it to be constructed.