Let the great family tax battle begin

With the release of the Liberal’s family tax package, the aim is to reverse almost all the family tax policies implemented by the Conservatives since 2006

Share

The federal election this fall looks to be shaping up, in part, as a battle between different visions of how the federal government should help families. The NDP has proposed a $15-a-day national child-care strategy. The Conservatives released their big family tax package in October. On Monday, the Liberals released their family tax package—and I see it as a big deal. With one announcement, the Liberals aim to reverse almost all the Conservatives’ family tax policy implemented since 2006, leaving only the crumbs of boutique tax credits to remain.

The new Liberal plan has two main components. First, the Liberals propose a new tax bracket on top earners to fund a tax cut for middle earners. Second, the Liberals would institute a big and bold $22-billion child benefit package that bundles together and replaces four existing family tax measures. Below I explain how each of these components works.

Before I dig in, I need to disclose my involvement with this policy package. I was asked a few weeks ago to provide some technical advice on elements of the Liberal package. I also had a chance to work through the costing of the program last week. As I make clear on my disclosure, I don’t like to isolate myself in a scholarly ivory tower; when someone from Ottawa calls with a request for policy advice, I try to take the call.

Middle-class tax cut

The current top tax bracket starts at income over $138,586 with a rate of 29 per cent. The Liberals propose to add a new tax bracket starting at $200,000, with a rate of 33 per cent. They figure this will raise about $3 billion, which they propose to recycle into a cut in the middle tax-bracket rate from 22 per cent to 20.5 per cent, affecting income in the range from $44,701 to $89,401.

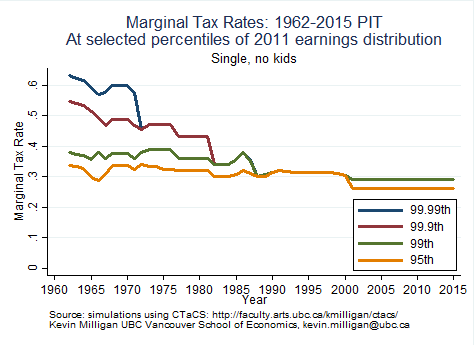

As can be seen in the chart, federal tax rates for those at the top of the income distribution have come down a lot over the last 40 years, from over 60 per cent to under 30 per cent. I’ve shown only those in the top five per cent in this graph, meaning people at or above the 95th percentile. Moving the top rate from 29 per cent to 33 per cent is a small step toward reversing some of the downward trend in tax rates for high earners.

I’ve written often on the prospect of raising taxes on high earners. A link-filled post from 2013 on the Maclean’s website argues that if you are going to try to raise rates on high earners, you need to be careful about revenue projections, because high earners tend to have access to tax advice that helps them shift some income out of the tax collector’s grips. A relevant point is made in a just-released paper by economist Alan Manning in the context of the U.K. election: Taxing high earners is easier to justify if combined with measures that tighten up the administration of the tax system so that high earners have a harder time avoiding the new higher rates. The federal government has influence through the Canada Revenue Agency, which could be given more resources, and also through tax law, which could cut back on tax preferences used by high earners. But the Liberals need to be asked tough questions here: How can we be sure the revenue raised will really be sufficient to fund the middle-class tax cut, and what will the Liberals do if revenue falls short?

Other commentators might be worried about the efficiency consequences of raising taxes on high earners. Alan Manning’s summary of the research on the response of high earners to higher taxes is in line with my view: There is little evidence that highly compensated employees will work fewer hours when faced with higher tax rates. We do need to keep a sense of proportion here; we are talking about a tax change of around $3 billion in an economy that is close to $2 trillion in size. This is not a massive or particularly radical change to the tax system. It is more a signal about priorities and values.

Signals are important, though. I have long argued that voters who don’t feel the impact of economic growth on their paycheques may stop supporting policies that drive economic growth. Shifting some of the tax burden away from the middle toward those at the top may help to change perceptions about how economic growth and the tax burden are felt by high- and lower-earning Canadians.

Canada Child Benefit

The biggest thrust of Monday’s announcement by the Liberals is a new $22-billion transfer—the Canada Child Benefit—aimed at lower- and middle-income families with children.

Before discussing the details, a first question to be answered is how the Liberals will find $22 billion to fund their initiative. The answer? The Liberals would fold three existing child benefit programs into their new benefit: the National Child Benefit Supplement, the Canada Child Tax Benefit (CCTB) and the Universal Child Care Benefit. As you can see for yourself in the 2015 budget from a few weeks ago, the existing child benefits total $18 billion per year, so that is a good start. Add the $2 billion from cancelling the income-splitting Family Tax Cut and $2 billion of new money, and you have your $22 billion.

I had a chance last week to look through the costing model the Liberal policy team used to come up with the cost estimate for their new benefit. I found their modelling assumptions cautious, and the results compared well to approaches using the Parliamentary Budget Office’s Ready Reckoner tool and the Statistics Canada simulator favoured by policy analysts. I hope other analysts will dig into the numbers, too; this is a big package and it is important to have it accurately costed.

What does the Canada Child Benefit do? The base benefit is $5,400 per year for each child, with a bonus of $1,000 for children under age six. Like the existing Canada Child Tax Benefit and National Child Benefit Supplement (NCBS), the Liberals’ benefit is slowly phased out after a certain income threshold is reached. From $30,000, the phase-out rate is 6.8 per cent for one child and 13 per cent for two children. (The existing NCBS phase-out rates are 12.2 per cent and 23 per cent over a comparable range of income.) After family income hits $65,000, the phase-out rates are dropped down to 3.1 per cent and 5.5 per cent (compared to two per cent and four per cent in the existing CCTB).

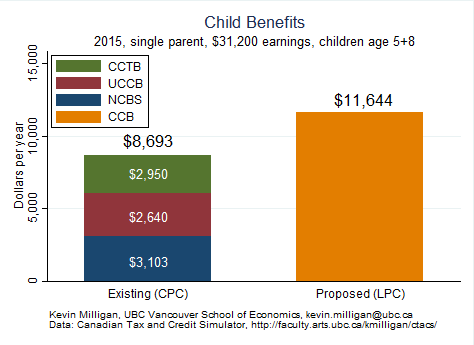

The net result is a benefit that is far larger than the existing package for most people under $150,000 of income. To take one example, imagine a single parent working full-time for the whole year at $15 per hour. The annual earnings in this case would be $31,200. The figure shows the benefit package and total under the existing (CPC) and proposed (LPC) benefit package. The total for this case rises from $8,693 per year to $11,644—an increase of about $3,000 per year, or $250 per month. Of course, other circumstances will yield other benefit totals—but the Liberals appear to have tried to engineer their benefit to deliver more for everyone with income less than $150,000.

Four features of the proposed Liberal benefit grabbed my attention as a tax-policy aficionado.

First, this is a big benefit that will be noticed by most lower- and middle-income families. The child advocates at Campaign 2000 set a target in their 2014 Report Card for child benefits of $5,600 per year. This Liberal plan exceeds that target for kids aged zero to five, and falls just short for the older kids. Advocacy groups often set high aspirational targets in the hope of focusing attention on their issue of concern. The Liberals have (more or less) met this target.

These extra dollars can have a big effect on children’s lives. In recent research with Mark Stabile and Lauren Jones, we showed that previous child-benefit expansions in Canada resulted in higher spending on food, rent and other necessities. Our new finding is in line with the research mentioned in my Maclean’s post last year on the effect of transfers to families with kids.

Second, the Canada Child Benefit would smooth out the impact of the child-benefit system on the pattern of marginal tax rates faced by parents. Economists such as Munir Sheikh have argued that the high phase-out rates embedded in the existing National Child Benefit Supplement may inhibit parents from taking on more work. The new benefit would smooth these out, lowering the phase-out rate for parents with one kid from 12.2 per cent to 6.8 per cent, and for two kids from 23 per cent to 13 per cent. For those worried about high marginal tax rates, this is a win.

Third, the new benefit simplifies our tax system and focuses attention on the children. By replacing four separate tax measures aimed at families with one simple transfer, it will be much easier for parents to understand what they will get and why. This kind of transparency is important. In my view, it is also a good move to focus attention directly on the children, rather than on how many parents the children may have, or how income might be split between the parents.

Fourth, the Liberals’ proposal removes the universal recognition of children from our tax system. By reviving the Child Tax Credit and instituting the Universal Child Care Benefit in 2006, the Conservative government restored recognition of all children in the tax system. I thought that reintroducing some degree of universal recognition was a positive element of the Conservative tax package. I’ve argued before that we give all Canadians the basic personal amount, whether rich or poor, to recognize a basic level of consumption that should not be taxed. In my view, children should receive this same recognition by allowing all parents some way to reflect the fact that they have children on their tax forms. The Liberals, however, have decided that this universal recognition is outweighed by the value of giving more funds to lower-earning families instead of to all children.

The Liberals emphasized that Monday’s policy announcement was only one part of their platform and more will be coming. That’s good, because there are certainly some holes in their tax policy so far. For one, those who are struggling economically but don’t have kids are really left out of this tax package. If the Liberals want to help those Canadians, the Working Income Tax Benefit could use some enhancements. There is also more work to be done on encouraging innovation and corporate investment that generates economic growth, and Lindsay Tedds has sharply pointed out the weakness of their approach so far.

Still, the “middle-class” announcement stakes out some important ground: The tax system under a Trudeau government would be more progressive. I suspect the Conservatives will not try to match Trudeau on that front. For the NDP, Mulcair has ruled out higher tax rates—comparing higher taxation to “confiscation.” So, I’m eager to see if and how the NDP will try to match the Liberals on bending the progressivity of the tax system. Looking at the very distinct tax positions of the three main parties, I know one thing for sure: We have the makings of a great debate.

(My disclosure statement is here.)