New family wealth data aren’t worthy of tears or cheers

We shouldn’t expect perfect equality in wealth, and real estate gains are not a sustainable source of middle class prosperity

THE CANADIAN PRESS/Nathan Denette

Share

The release of some numbers from a new Statistics Canada wealth survey created a stir this week, as commentators battled to place the findings in context. The release of results from the 2012 Survey of Financial Security are a follow-up to previous rounds of the same survey from 1999 and 2005. The 2012 SHS asked about 20,000 Canadian families detailed questions about their asset holdings and their debts.

On one side of the debate, David Macdonald of the Canadian Centre for Policy Alternatives and the Broadbent Institute focused on the meagre extent of some families’ wealth holdings compared to the big wealth holders at the top. For example, the top 20 percent of families hold 67 percent of total net wealth. On the other side of the debate, commentators such as Margaret Wente argued that the 44.5% growth in median wealth since 2005 was great news for the middle class. In my view, neither side of this argument got things quite right.

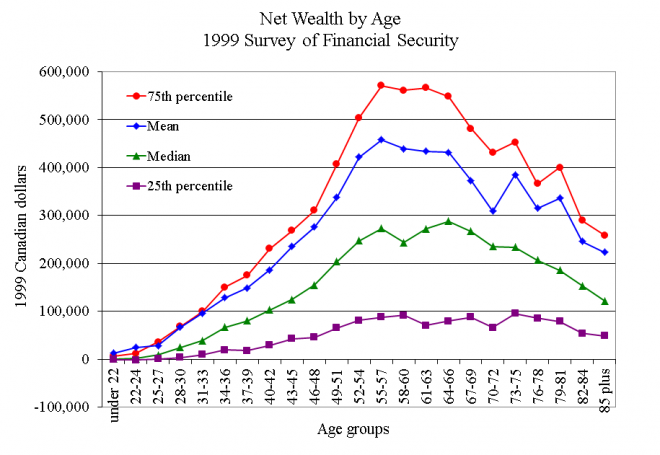

For those concerned about the inequality of wealth, I wonder what kind of equality they were looking to see. Wealth has a strong age pattern. Young people start to save and accumulate wealth. When they get older, they have more wealth. (You can see these life-cycle patterns in a paper of mine here.) In an economy where everyone had the exact same incomes, but people saved according to this kind of life-cycle pattern, there would be strong differences in wealth holdings if you put people of all ages into the same pile, as the CCPA and Broadbent Institute do.

Moreover, it is not even clear that we should expect people at the same ages to have similar observed wealth levels. One of the primary reasons for saving is to fund retirement. A large number of Canadians receive enough through our public pension system that they have no need to save–in fact many receive more income in retirement than they did while working. Why should such households save when the government is doing their saving for them?

In the graph, I show this lifecycle pattern with data from an older paper of mine that used the 1999 edition of the SFS. (I can’t use the 2012 SFS because the individual-level data have not yet been released.) There is a clear hump at middle ages. Also, the dispersion across families at a given age can be seen by comparing the 25th to the 75th percentiles.

For these reasons, I don’t find the fact that younger and lower income Canadian households have little savings surprising or particularly concerning.

The other side of the argument upon release of the SFS numbers was celebrating the large increases in median net worth. While this growth in wealth is not a bad thing, it is a matter for debate how much this growth affects anyone’s wellbeing. The reason is that the growth was mostly driven by real estate holdings.

Among economists, there is a long tradition of questioning the extent to which housing wealth should be treated as equivalent to cash in hand. Harvard economist David Wise wrote a series of papers with Steven Venti arguing that housing wealth was not fungible, since people simply didn’t want to use up housing equity and prefered to keep living where they were. My own research with Courtney Coile suggests people don’t typically sell their house until there is a major negative health event for one member of the couple. Other economists have challenged these arguments, and it’s also true that today’s homeowners may be more willing to draw on housing equity through home-equity lines of credit compared to those of earlier generations. Still, if people typically don’t sell their house when prices rise, paper gains won’t matter much.

Another argument comes from Willem Buiter, channeling former Bank of England Governor Mervyn King, in claiming that “Housing Wealth is not Wealth.” Buiter argues that changes in house prices just transfer resources between those who currently have houses and the coming generation who will soon buy houses. Every seller needs a buyer. However pleasant it may be for the present middle class to be enjoying sizable real estate gains, the future middle class will suffer if they have to buy in at exaggerated prices. In this way, wealth accumulation through real estate benefits one generation’s middle class over the middle class of the next.

Taken together, I find myself staked to a position outside either of the two camps described above. I don’t find it odd that young people have fewer assets than older people, but I also don’t think wealth gains driven by real estate price growth is worthy of much celebration.