Ontario shrank its deficit. But how?

Economist Mike Moffatt breaks down how the Ontario budget shakes out, and if the province’s commitment to balance in 2017-18 can stand

Share

The big questions for most Ontario budget watchers revolved around forecasted deficits. Markets wanted to see a 2015-16 deficit come in less than forecasted, a reduction in the 2016-17 deficit and a commitment to a balanced budget in 2017-18. They got their wish with all three—though there will likely be some skepticism about how they got there.

Ontario is forecasting a final 2015-16 budget deficit of $5.7 billion, $2.8 billion less than forecasted in last year’s budget. Despite this improvement, the fiscal outlook deteriorated in two areas:

– Government expenses were $400 million higher than forecast, including $300 million needed to set up the new cap-and-trade system.

– Slower-than-expected economic growth cost the government $0.6 billion in revenue.

This was offset by $3.8 billion in improvement in other areas:

– $400 million more revenue than forecasted from government business enterprises such as the LCBO.

– Budget 2016 booked $500 million for “Tax Data During 2015 and One-Time Impacts,” which includes “net adjustments to estimates of prior-year HST estimates” along with a positive adjustment to corporate tax revenue.

– Ontario’s housing boom brought in $700 million more than expected in land transfer taxes and housing completion-related HST.

– $850 million was taken out of the $1-billion contingency reserve for the year.

– $1.1 billion more than expected was booked in the government’s “Asset Optimization Strategy,” mostly through the partial privatization of Hydro One.

Put together, the improved budgetary performance was only $2 billion after taking into account the contingency reserve, which can almost entirely be explained by government asset sales and the housing boom, though credit should be given for the government hitting their targets in other areas.

The change in the budgetary outlook for 2016-17 was more modest, with a $500-million reduction in the size of the deficit, from $4.8 billion to $4.3 billion. There were four big negative changes to the budgetary outlook:

– Expected asset sales were reduced by $300 million.

– A reduction in expected GDP growth will take $400 million from government coffers.

– The contingency reserve has been increased by $600 million.

– The government will spend an additional $1 billion in 2016-17 over what was forecast in Budget 2015.

This is more than offset in the following four areas:

– Revenues will increase by $400 million from an increase in “other tax revenue”, tax measures in Budget 2016 and “Tax Data During 2015 and One-Time Impacts.”

– Sales of cap-and-trade permits will generate $500 million, which represents half of the $1 billion in new spending.

– Ontario is expecting an additional $700 million in funding from the federal government.

– Interest costs on government debts has been reduced by $700 million.

I wrote last year that the Ontario government was (likely deliberately) overestimating their debt-financing costs. They have rectified that somewhat in this budget, though they are still showing interest rates to rise at a faster rate than most forecasters would. The increased contingency reserve is almost identical to the expected new transfers from the federal government, providing a hedge should the Trudeau government change their plans.

Finally, the 2017-18 budget is still showing a perfectly balanced budget. Ignoring the expected $1.9-billion in cap-and-trade revenue allocated to a variety of projects, the big changes are an increase in expected spending of $2.3 billion, largely offset by a reduction in debt interest costs of $700 million and a $1.3-billion increase in funding from the federal government.

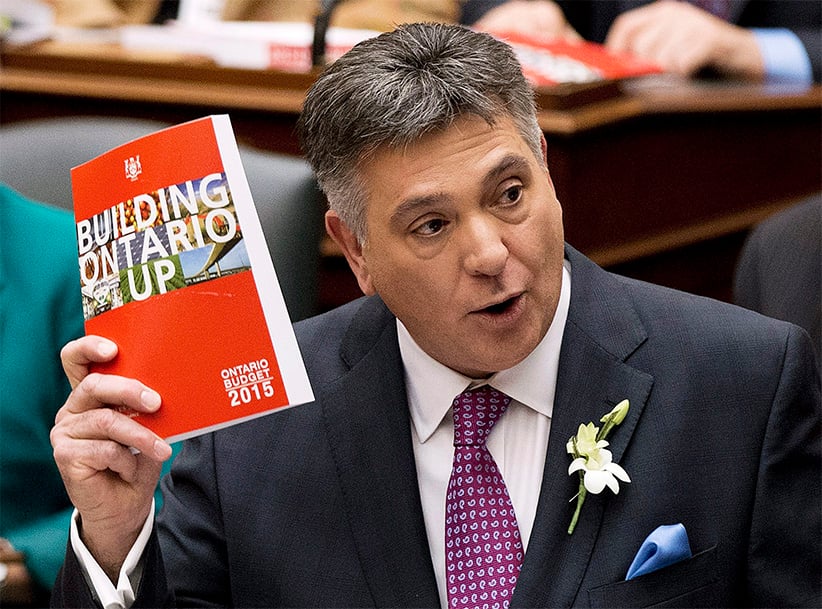

As long as the Ontario economy performs reasonably well and the Trudeau government keeps their funding commitment to the province, a balanced budget in 2017-18 looks to be in reach. Should either of those not hold true, Finance Minister Charles Sousa will have some difficult decisions to make.