The Bank of Canada’s muddled message on house prices

Stephen Poloz refuses to say whether Canada’s housing market is in a bubble. But he does have one message: don’t blame him for soaring prices

A real estate sold sign hangs in front of a west-end Toronto property Friday, Nov. 4, 2016. THE CANADIAN PRESS/Graeme Roy

Share

Ultra low interest rates, which have been at or below 1.25 per cent for 96 months, are not to blame for any speculation that may be driving the country’s hottest housing markets, according to Canada’s central bank chief.

In an exclusive interview with Maclean’s this week, Bank of Canada Governor Stephen Poloz shot down any suggestion the Bank’s easy money policy is responsible for home prices in cities like Toronto and Vancouver rising at double-digit annual rates. “No, when you’re borrowing money to buy a house and you think you’re going to make 20 per cent over the next year, I don’t think it’s going to make a difference if the interest rate you’re paying is 2 per cent, 4 per cent or 6 per cent,” he said. “It’s still an important capital gain. I would pretty well reject that. It’s not low interest rates that are fuelling speculation.”

READ MORE: Our full Q&A with Stephen Poloz

That was one of several stark comments Poloz made regarding the housing market in a wide ranging interview that addressed the threat Canada faces from rising protectionism as well as the quality of the current economic recovery.

The question of whether Canada’s housing market is in a bubble has dogged the Bank of Canada for several years. In December 2014 the Bank warned house prices could be overvalued by as much as 30 per cent. That warning came in the Bank’s twice-yearly review of risks facing Canada’s financial system, and was based on the work of one of its legion of economic analysts. “While it is difficult to know for certain,” the financial review stated, “the wide range of estimates, including new research done at the Bank of Canada, suggests that there is some risk that housing markets are overvalued” by between 10 and 30 per cent.

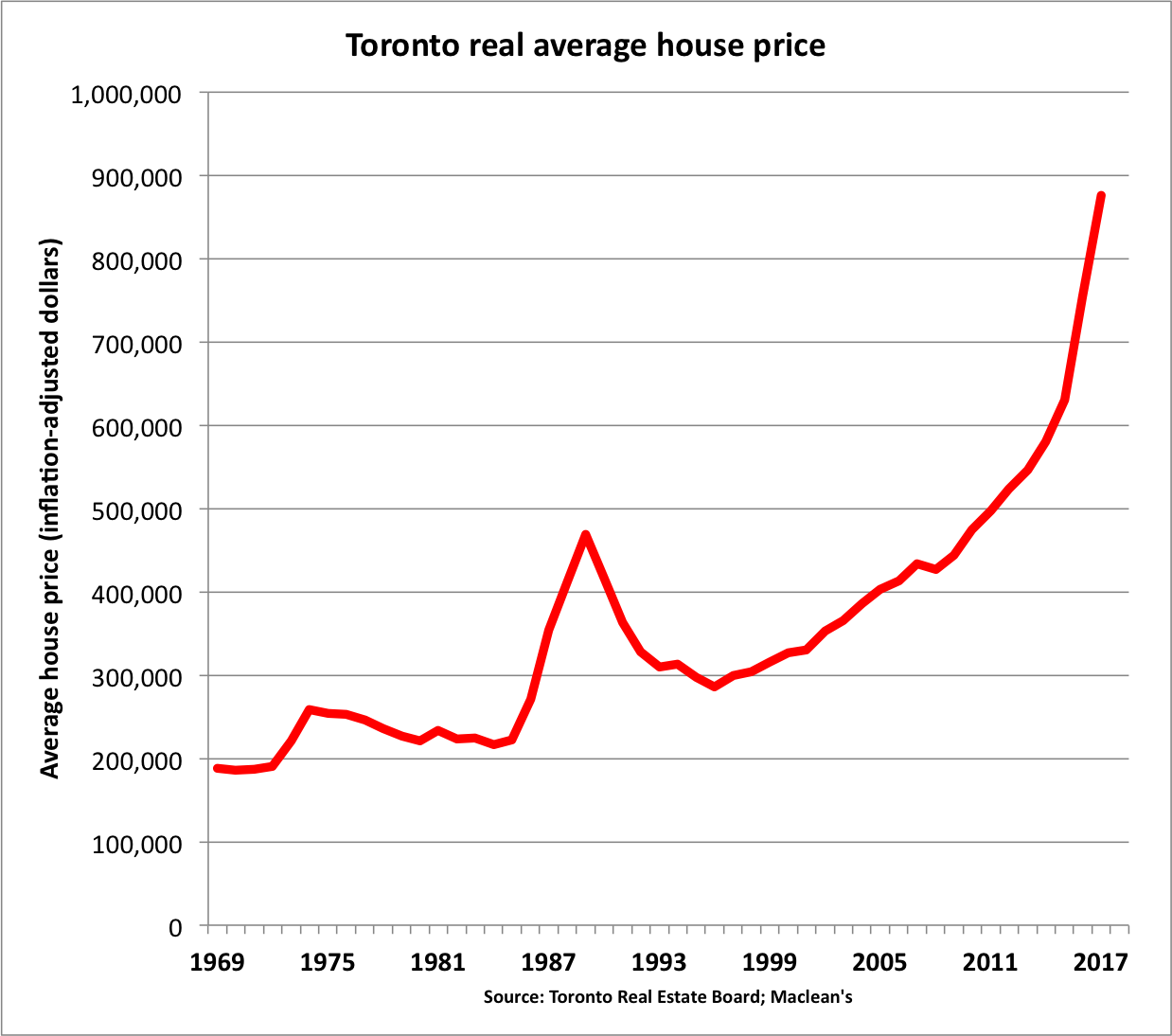

Since then, of course, house prices in several parts of the country have kept on rising, by 25 per cent nationally and 35 per cent in Toronto and Vancouver. So does that mean house prices might now be 50 or 60 per cent overvalued in parts of Canada?

When asked that question Poloz refused to be pinned down, going so far as to question the original findings of the report. “I’m certainly not going to hang my hat on that number or even whether there is overvaluation,” Poloz said, noting the report was based on a theoretical model of the housing market. “That’s the magic word, it’s a model, so you know enough now to lower your trust factor.”

It was an unusual comment, coming from the head of an institution that depends heavily on models to carry out its work. Just this past January, in a speech about the “art and science” of models for monetary policy, he called them “indispensable.” Yet it’s also just the latest confusing twist in the Bank’s narrative about Canada’s great obsession: real estate.

At times Poloz has used un-central banker like language to warn people that their expectations about the housing market in Toronto and Vancouver are unrealistic, be they buyers, sellers—domestic and foreign—or lenders. The Bank recently released an explainer video that described, in simple terms, how fast-rising prices and bloated household debt loads could combine to seriously damage the economy.

RELATED: The Bank of Canada just laid out how the economy could tank

At other times, though—especially when faced with questions about the possibility of an outright housing crash—Poloz has been more sanguine.

In speaking to Maclean’s, Poloz muddied the Bank’s position further. While house prices are high in Toronto, he said, the underlying fundamentals in recent years might support that. “The greater Toronto economy is creating five per cent per year more jobs,” he said. “Population growth is continuing to be strong. The same thing with Vancouver. That automatically generates more demand for housing at a time when there are constraints around supply.”

Yet at the same time, he pointed to the pace of double-digit house price appreciation and said the fundamentals in the city don’t support such a torrid rate. “The way prices are rising in Vancouver and certainly in Toronto, it would be really hard for me to construct a fundamental story to justify,” Poloz said. “You’re kind of left with [the idea that] some of that must be driven by extrapolated expectations.”

“Every time you hear a story about somebody who bought a house, not living in it, just to sell it eight months or a year later, pay capital gains tax and still make out all right, that’s speculative—and in a way artificial—demand.”

It’s been impossible to pin down exactly what Poloz thinks about Canada’s housing market for several years now. That is arguably by design. It was certainly the approach the U.S. Federal Reserve took as the American housing bubble grew to its dangerous heights before the crash, as the Fed’s own minutes reveal.

In 2004 Ben Bernanke, the former Fed chairman who was then still a governor, told his fellow governors that they must walk a tightrope when asked about the potential of a bubble in America’s housing market. “One’s inclination is to answer by painting a benign picture so as not to cause unnecessary public concern,” he said during one March meeting. “On the other hand, financial conditions do change, and it’s our collective responsibility both to monitor those changes and to communicate truthfully to the public what we see.”

Poloz appears to be pursuing that same strategy, preferring to focus instead on federal measures that seek to improve the quality of household debt by tightening credit conditions for buyers.

“Financial stability is the thing we’re tackling, and whether prices go up or down after you’ve changed the rules around mortgages is not relevant for that policy,” he said. “That policy is not designed to somehow control the housing market.”

More from our Q&A with Stephen Poloz:

- On money: The 200-year old story behind Stephen Poloz’s signature on your bills

- On the economy: ‘It’s not time to call out the band’