Stephen Gordon: Liberals’ deficit claim doesn’t add up

It will be easier for the Liberals to run on their plan of deficits if they can credibly claim they inherited one from the Conservatives. They can’t.

Share

The forms must be obeyed: after a couple of weeks in power, newly-elected governments are obliged to proclaim that they are shocked! shocked! to discover that their predecessors were even more devious and incompetent than we thought. The nation’s finances, our new masters regret to inform us, are in worse straits than had been anticipated. And such is the message in the updated Economic and Fiscal Projections (EFP) released today by the new Liberal government.

There’s not much point in discussing whether or not these new projections will be borne out by future data: they’re based on the assumption that the new Liberal government would simply continue on the path laid out by the previous Conservative budget. That’s not going to happen.

But what about the current fiscal year? The 2015-16 exercise began on April 1, and we’re now in mid-November. The Conservatives were in power for the first seven months of fiscal 2015-16, and it will still be a while before the Liberals can implement the measures required to change the course of revenues and expenditures set out by the Conservatives. I expected that there would be relatively minor changes to the outlook for the current year, along the lines of the updated projections that PBO released a couple of weeks ago. The main differences between the PBO’s outlook and the one tabled by the Conservative government last April occur farther out in the forecast horizon; the PBO’s outlook for fiscal 2015-16 is not far from what was in Joe Oliver’s budget.

So I was surprised to read this:

Economic developments have led to a downward adjustment to the fiscal outlook, leading to projected deficits of $3.0 billion in 2015–16

September’s Fiscal Monitor was also released today, and it shows a surplus of $1.6 billion through the first half of fiscal 2015-16— more than the $1.4 billion surplus that last April’s budget projected for the entire year. (The PBO’s estimate was a surplus of $1.2 billion.) How did the Liberals manage to get from an actual $1.6 billion surplus over the first six months to a projected deficit of $3.0 billion over the entire year?

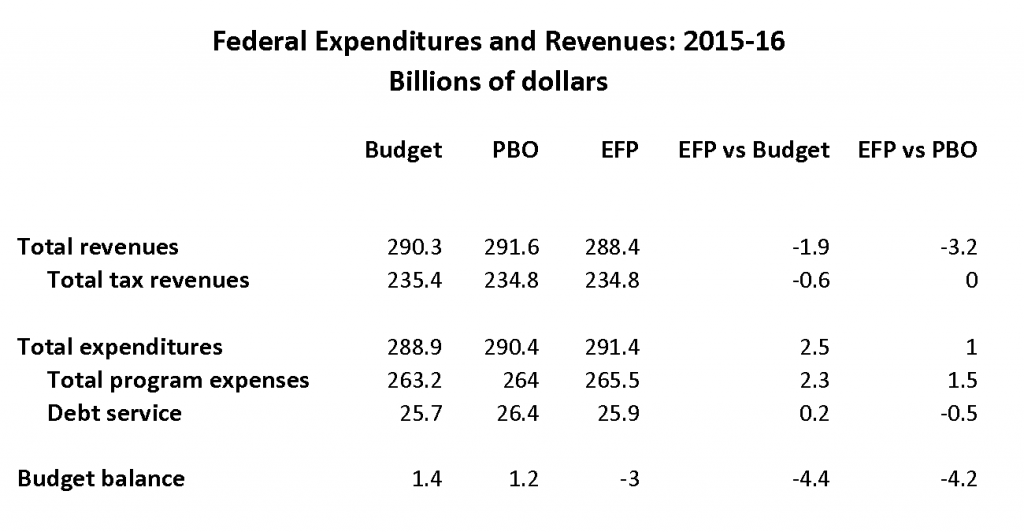

You’d expect the answer to be weaker-than expected revenues, driven by a weakened economy and oil prices that have come in lower than what was projected in April. But that’s not it. Here is a comparison of April’s budget, the PBO’s update and the EFP released today:

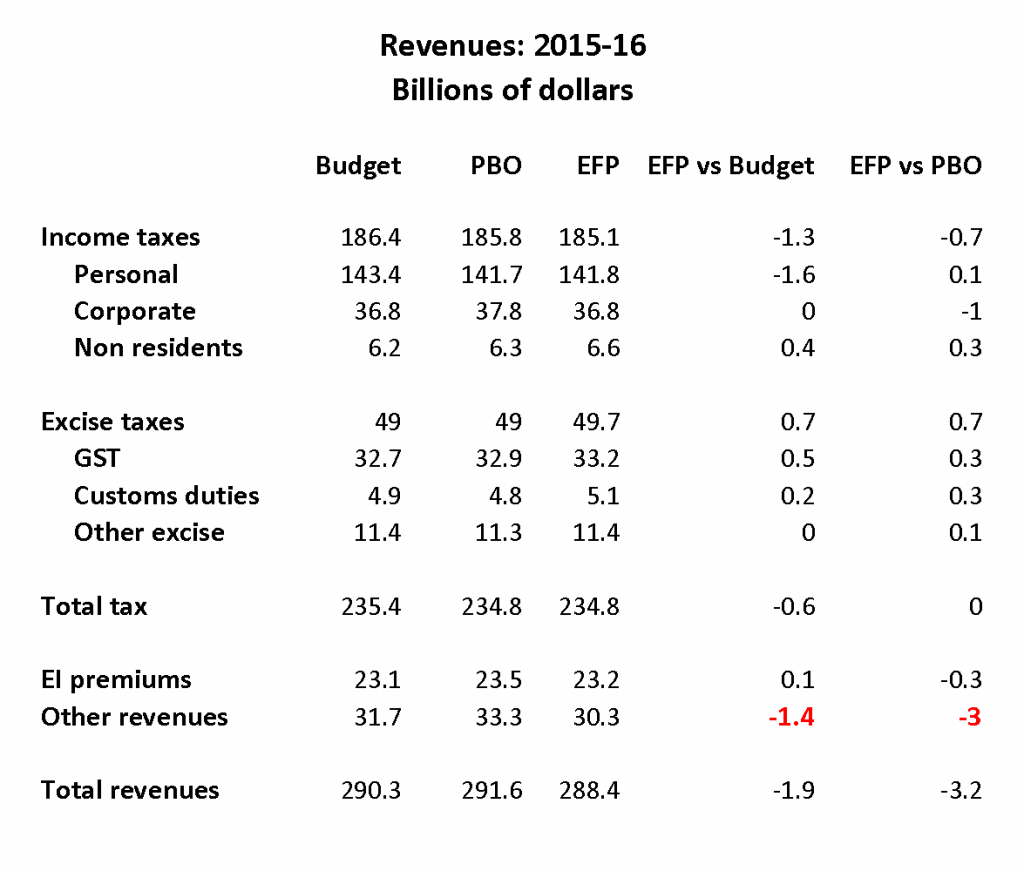

Most of the $4.4 billion swing from a $1.4 billion surplus to a $3 billion deficit is from higher projected spending, not reduced revenues. If you look at tax revenues, the EFP is only $600 million below what the budget projected for 2015-16, and has the same estimate of the PBO. So if it’s not tax revenue, what is it? Let’s unpack those revenue projections:

There’s a mixed message on the tax side: lower projected personal income tax revenues are largely offset by increases elsewhere, notably the GST. The item driving the downward revision for revenues is that $1.4 billion downward revision for “Other revenues”. Here is how the EFP explains it:

For 2015–16, other revenues are projected to decline by 2.8 per cent, primarily due to lower enterprise Crown corporation revenues and lower interest rates.

I would have expected rather more detail for a revenue item that accounts for three-quarters of the downward revision in projected revenues.

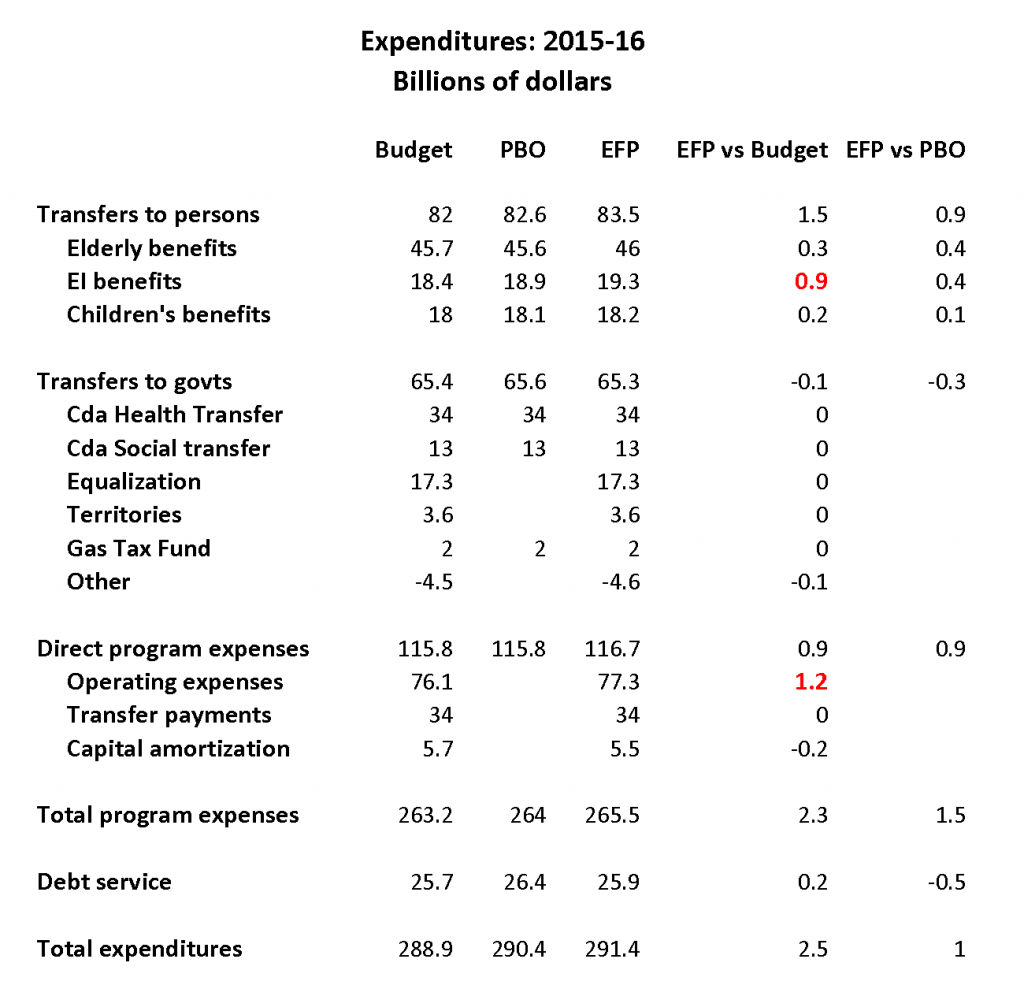

On to expenditures, which account for most of the projected swing into deficit:

One of the two most important items here is the $900 million increase in projected Employment Insurance benefits. This is above the PBO estimate, but given the state of the Alberta labour market, I don’t see much point in quibbling about this item.

But what is that $1.2 billion increase in operating expenses? Here’s the EFP explanation:

Direct program expenses are expected to be higher than projected in Budget 2015, largely as a result of higher projected public service pension and benefit expenses. Long-term interest rates are used in the valuations of the Government’s liabilities for employee pensions and other future benefits. While the total pension and benefit obligation of the Government has not changed, lower projected interest rates result in relatively more of these costs being recognized in the near term rather than the future.

I think this means that using a lower interest rate to discount future pension obligations increases their present value, and this increase is being booked as a current cost. If so, then it looks like the GM sale in reverse. But again, this one item accounts for almost half of the increase in expenditures, and the government should be clearer about what is going on here, and why it’s happening now.

It seems pretty clear that the goal of the EFP is to prepare the ground for the deficits the Liberals plans to run; it will be easier for the government to do so if it can credibly claim that it inherited a deficit situation in the current fiscal year.

Based on the information made available so far, I don’t think that claim would be credible. I don’t doubt that the government will produce a deficit for 2015-16 if it wants one, but it would be the Liberals’ deficit. They should take ownership of it.