The truth about where the Canadian dollar is headed

Nobody really knows anything

Canadian one dollar coins, also known as Loonies, fall into a container at the Royal Canadian Mint in Winnipeg, Ontario, Canada, on Friday, July 5, 2013. The Canadian dollar rose from its lowest level in almost two years before a report tomorrow forecast to show the pace of home construction in June stayed above the year-to-date average for the second month in a row. Photographer: Brent Lewin/Bloomberg via Getty Images

Share

The Canadian dollar fell from 97 cents US to below 89 cents US in the weeks following the Bank of Canada’s decision to shift its monetary policy stance away from a tightening bias. (It has recently rebounded to hold steady at around 91 cents as I write.) These developments have provided additional fodder for those pundits who are in the habit of offering their views about where the dollar should go and/or where it will go (the two are separate issues). These views fill up media space, but they shouldn’t be taken too seriously. The foreign exchange market is one where the “semi-strong” form of the Efficient Market Hypothesis holds: movements in exchange rates cannot be predicted using publicly-available information.

If everyone really believed that the Canadian dollar will end up at (say) 85 US cents, then everyone would sell CAD at its current price to buy USD, wait for the price of USD to increase – which is the same thing as waiting for the CAD to depreciate – and then sell at the higher price. But if everyone does that, the CAD would be bid down to the point where it is no longer profitable: 85 cents. This is why you should take predictions about foreign exchange movements with a grain of salt: if you could actually predict them, the last thing you’d do is tell anyone.

This doesn’t mean that exchange rate movements are completely random: some of the fluctuations can be ascribed to variations in the ‘fundamentals’. But what really drives these movements are the unexpected changes in the fundamentals. And unexpected changes are, by definition, unpredictable. The most reliable forecasting model is a random walk: the exchange rate next period is the current exchange rate plus a white noise error term. The best prediction for where the exchange rate is going is where it is now.

While we’re on the subject, here are why a couple of popular theories are wrong (see also Mike Moffatt’s recent post):

Purchasing Power Parity (PPP): According to this theory, the CAD will – or should – return to its PPP value. Roughly speaking, if the CAD-USD exchange rate is equal to its PPP, then both currencies have the same purchasing power in both countries. For example, if 85 USD has the same purchasing power in the US that 100 CAD has in Canada, then the CAD-USD PPP is 0.85. The problem with this story is that it is entirely based on activity in the goods market, and that is not the only market that matters. In addition to purchasing Canadian-provided goods and services, the demand for CAD is also driven by the demand for CAD-denominated assets. If foreigners wish to increase their holdings, then there will be upward pressure on the Canadian dollar. There is no reason to think that these capital flows will or should cancel out exactly.

The current account deficit: The idea here is that the current account deficit is due to an insufficient demand for Canadian goods, and a depreciation will close the gap by making Canadian goods more competitive on world markets. But running a current account deficit is the same thing as running a capital account surplus: a positive new flow of foreign investment into Canada. An increase in foreign demand for Canadian assets will put upward pressure on the CAD and show up as a surplus in the capital account – which is the same thing as a current account deficit. It’s possible to tell a story in which a current account deficit is associated with a depreciation or an appreciation of the CAD, depending on which side of the national accounts you’re looking at.

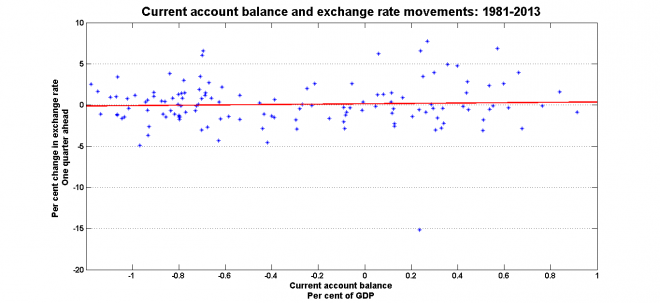

In any case, there is no significant relationship between the current account balance and future movements in the exchange rate. This shouldn’t be surprising, because if there were, it would have been arbitraged away. (You get similar-looking results regardless of the length of the forecast horizon):