There are two big problems with the Alberta NDP tax plan

Given the size of Alberta’s deficit, the Alberta NDP’s tax changes alone won’t be enough to balance the budget by their mandate’s end

Alberta premier-elect Rachel Notley waves as she speaks the media during a press conference in Edmonton on Wednesday, May 6, 2015. THE CANADIAN PRESS/Nathan Denette

Share

Remember when Alberta had one of the highest-spending provincial governments along with the lowest tax rates in the country? Those were good times—but those times are over. Alberta faces a projected deficit of around $5 billion for 2015-16, worse than any province except for Ontario, and larger compared to the size of the economy than any province except for Newfoundland and Labrador.

Remember when Alberta had one of the highest-spending provincial governments along with the lowest tax rates in the country? Those were good times—but those times are over. Alberta faces a projected deficit of around $5 billion for 2015-16, worse than any province except for Ontario, and larger compared to the size of the economy than any province except for Newfoundland and Labrador.

The March budget presented (but not implemented) by Jim Prentice and the Progressive Conservatives proposed to close the deficit through a number of tax increases, along with modest restraint in the growth of spending. The newly elected NDP government plans to change this mix by doubling down on the revenue increases and using the extra funds to increase spending. There’s a lot of room for doubt about the NDP’s fiscal plan for the 2015-16 year, as shown below. Moreover, if they’re going to make their goal of a balanced budget by 2018-19 the Alberta NDP will have to draw deeply on the vaunted “NDP Prairie Pragmatism” to find the necessary spending restraint.

I start with a description of the personal income tax changes, then move on to corporate taxes. I then assess the tax challenges facing the new NDP government in the last section. I’ve placed in this public document all my calculations for the charts presented below.

Personal income taxes

There are two elements of personal income tax to consider: changes to the standard rates and brackets of the personal tax system, and also the new health levy proposed by the Prentice government. For a great backgrounder on how tax brackets and tax rates work, see this post by Stephen Gordon.

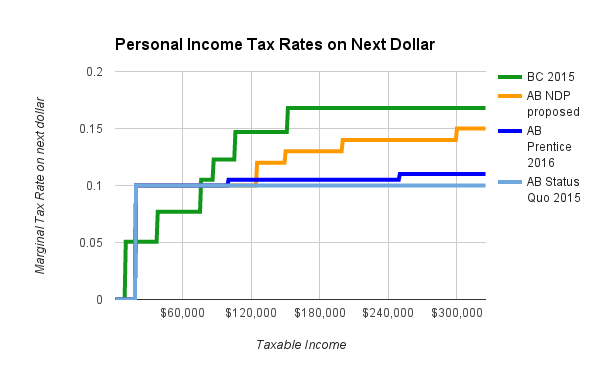

The Alberta NDP proposes a substantial increase to the progressivity of personal taxes for those at the top of the income scale. The existing provincial income tax in Alberta is pretty simple—everyone pays 10 per cent once you exceed the $18,214 basic exemption. To introduce greater progressivity, you need to implement some combination of lower rates on low earners and higher rates on high earners. The NDP proposes new rates of 12 per cent starting at $125,000; 13 per cent at $150,000; 14 per cent at $200,000, and 15 per cent at $300,000. The chart below shows the tax rate on the next dollar earned for the 2015 status quo system, the 2016 Prentice plan presented in his March budget, and the proposed NDP plan. I’ve also included the 2015 British Columbia rates for comparison, since B.C. has one of the most progressive income tax systems in the country.

The NDP plan shows a clear increase in progressivity at top income ranges compared to the status quo, reaching a difference of 15 per cent versus 10 per cent by the time taxable income reaches $300,000. However, by keeping the lowest bracket rate at 10 per cent, those earning under $76,000 face a higher marginal rate in Alberta than in B.C. The reason is that B.C., like most other provinces, starts with a low rate in the first few tax brackets before hitting higher rates for those at the top. The Alberta NDP proposal does the second part (higher rates for those at the top) but not the first (low rates on low earners).

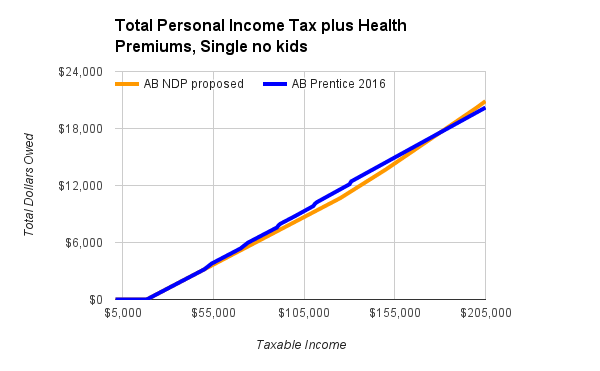

The Prentice government proposed a Health Care Contribution Levy, starting at an income level of $50,000. Earners around $50,000 would owe $200, and this increased progressively to a $1,000 maximum amount around $130,000. The Alberta NDP proposes to scrap this levy. This is a big tax shift—it gives a fairly large tax cut compared to the Prentice plan for those earning more than $50,000.

When you put all this together, you can see the overall impact on total income taxes (including the health levy) under the Prentice and the NDP plans. It turns out that those earning between $50,000 (where the health levy would have kicked in) and $180,000 (where the NDP tax rate increases overcome the Prentice health levy) are better off under the Alberta NDP plan. In other words, the Alberta NDP plan effectively raises taxes on those earning more than $180,000 and cuts taxes on those between $50,000 and $180,000.

Federally, the Liberal proposal to shift some tax burden from the middle to the top brackets has generated pointed criticism that low earners are left behind by this kind of shift. The same criticism could be aimed at this Alberta NDP tax shift from the middle to the top. The analysis underlying those criticisms is correct, but misguided. Why? Because one third of tax filers in Canada don’t pay any income taxes—their income doesn’t exceed their basic amount and other credits, so these low earners don’t pay income taxes at all. This means it is simply not possible to propose any changes in brackets or rates that will help the bottom one-third of tax filers. If you want to increase the progressivity at the bottom of the income scales, other tools (like refundable tax credits) must be employed. As far as I can see, the NDP plan leaves lower-earning Albertans paying heavier taxes than their neighbours in B.C., and little difference in tax rates between those at the bottom and the middle.

Corporate income tax

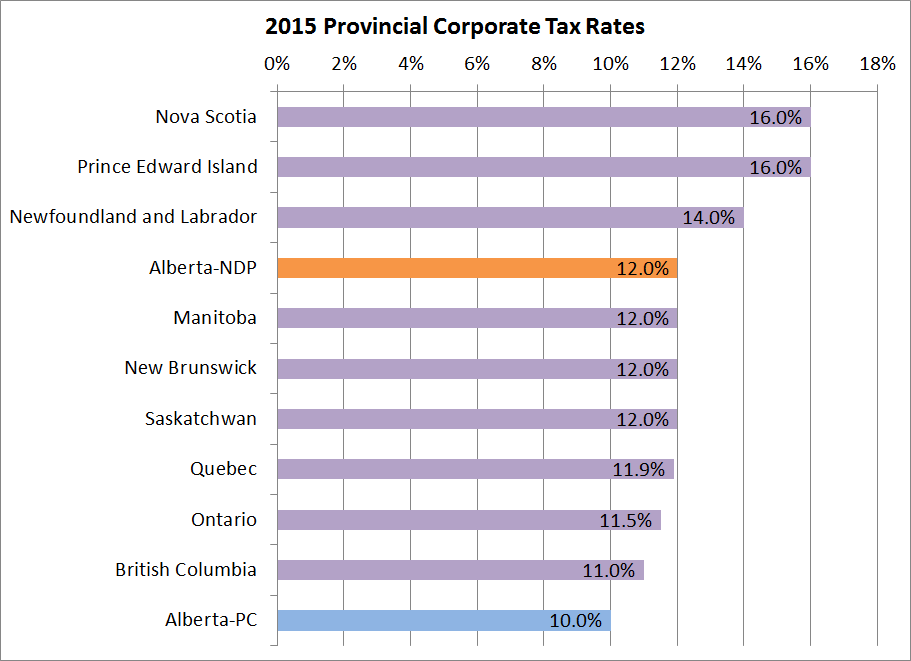

Corporations pay tax on their profit (revenue less expenses). In Canada, the federal government charges a tax rate of 15 per cent on corporate profits, but provinces have the freedom to set their own rates. The chart shows the rates chosen by each province, with two entries for Alberta showing the proposed tax rates under a PC or NDP government. The NDP proposal to move from 10 per cent to 12 per cent puts Alberta squarely in the middle of the pack.

All taxes harm the economy in some way, so the job of raising taxes involves a choice among bad options. Most economists agree that corporate taxes are the most harmful among the choices, as documented in this link-filled post on Maclean’s from Stephen Gordon. So, I don’t think that raising corporate taxes is a step in the right direction.

However, we must also maintain a sense of proportion. When deciding on a big investment, firms will consider labour costs, output prices, and other factors along with corporate tax rates. Picture a corporate VP in Calgary constructing her financial planning spreadsheet. My suspicion is that any sweat observed on her brow comes more from the “future oil price” cell in her spreadsheet than the 10 per cent versus 12 per cent corporate tax rate. Economist Jack Mintz has estimated the long-run job impact of corporate tax increases in Alberta at about 8,900 per point of tax. That represents about 0.4 per cent of the 2.3 million jobs in Alberta—not a huge impact. Again, it is better to have more corporate investment and jobs than not, but in my view the “end of the world” political rhetoric employed around this corporate tax increase during the Alberta election has been exaggerated.

Challenges

The tax proposals of the new Alberta NDP government are not particularly radical compared to other provinces. However, given the size of the budget deficit hole facing Alberta, I don’t think these tax changes alone will be enough to reach the goal of a balanced budget at the end of the mandate. Two challenges in particular will be top of the mind for the new cabinet in Edmonton over the next few weeks: timing and revenue estimates.

The biggest short-term issue facing Alberta is the timing of the tax changes. The Alberta NDP election platform plan booked a substantial amount of revenue for the 2015-16 fiscal year. To do that, the NDP would have to increase tax rates retroactively on both the personal and corporate tax sides. On the personal side, our income tax system does not distinguish between income received in January versus December, so the only way to raise rates for 2015 is to raise them for the whole year—which is now close to half done. On the corporate side, if rates are increased immediately, any company with a year end arriving in the next few months will be paying 12 per cent on their year’s profits when they had been counting on 10 per cent. This kind of corporate surprise isn’t without precedent, though—when B.C. raised its tax rate from 10 per cent to 11 per cent in 2013, only six weeks notice was given.

Even if the Alberta NDP is philosophically fine with retroactively increasing personal tax rates for 2015, they face a seemingly difficult challenge in doing so. Alberta is party to a Tax Collection Agreement with the federal government, through which the Canada Revenue Agency collects personal income tax and remits the revenue to the Alberta government. Under section 2.10(a) of the agreement, however, any tax changes have to be given to the federal government by April 15. So, unless the new NDP government finds something in the Tax Collection Agreement that I’ve missed, or is able to call in a favour with Prime Minister Harper to facilitate tax increases, the NDP will not be able to make their desired personal tax changes in 2015. If so, this leaves a $1.1-billion dollar hole in their plan.

The second issue facing the Alberta NDP government is a clear-headed assessment of the realism of their budget numbers. They expect to raise $800 million in 2015-16 in new corporate tax revenue, along with the $1.1 billion in new personal taxes. They also plan to find $100 million in “delinquent corporate tax collection.” I think these tax revenue numbers are overstated.

The issue of tax leakage—companies and high earners adjusting their financial affairs and accounting entries to shift money out of higher-tax jurisdictions—must be considered. Moreover, at the provincial level this concern is heightened, as firms or individuals operating in several provinces have greater ease to shift taxable income across provincial borders than national borders. Alberta, being a low-tax jurisdiction within the federation, has been the recipient and beneficiary of much of these interprovincial tax shifts up to now. I don’t expect Albertans to start shifting their own money out of the province, but I do expect the inflow from other provinces to slow to a trickle since the tax differential will no longer be as large.

Tax leakage is not an all-or-nothing thing; not everyone has the ability to shift income and most firms have only a limited scope for shifting. But it doesn’t take much shifting for it to matter. A quick example shows why.

Imagine there is $6 of corporate income being taxed at 10 per cent, for a tax revenue haul of 60 cents. If the tax rate goes up to 12 per cent, it only takes $1 of those $6 being shifted out of Alberta for the tax change to yield no net increase in revenue. ($5 times 12 per cent leaves you with the same 60 cents of tax revenue you started with.) The reason? When a dollar is shifted away, you lose the whole 12 per cent, and it takes a lot of dollars to stick around to pay the incremental two per cent to make up the difference. The best evidence suggests that provincial corporate taxation in Canada is quite susceptible to income shifting and tax leakage.

The bottom line

Taking all the numbers together, what is the bottom-line impact for the new Alberta NDP government? For 2015-16, the analysis presented here suggests almost no chance the Alberta government will meet its revenue targets. It will simply be too hard to make changes quickly enough. In future years, the target of $800 million to $1 billion of new revenue is aggressive, but may be possible depending on how much high income and corporate tax shifting occurs.

Left out of the analysis here is the spending side of the NDP’s fiscal proposals. In short, the spending plan appears to address Alberta’s high-spending ways with the novel approach of committing to still-higher levels of spending. In my view, for the Alberta NDP to meet its target of eliminating the deficit by 2018-19, they will need to reach deep into the “pragmatic prairie NDP” tradition and keep a tougher line on spending than is evident in their platform plan. How tough? I think that to meet their goals they will need to exhibit “unprecedented discipline” of the kind shown by Stephen Harper—which will be interesting to watch.

Of course, every word of analysis in this post is dependent on oil prices. If energy prices surge, the budget will improve; if they drop, the fiscal problems will be many times worse. But I think all readers knew that already.

(My disclosure statement is here.)