What happens to a $300,000 mortgage if interest rates go up by 1.5 per cent?

It’s scary–and it shouldn’t be

Share

The Bank of Canada announced on Tuesday it’s going to leave the key interest rate at one per cent. No big surprise there. But the Bank was sounding more optimistic than it has been recently on the state of the Canadian economy–hinting that rates may start climbing soon. Now, governor Mark Carney has sounded hawkish before and then held off. As CIBC wrote in a note to clients:

“It’s déjà vu all over again … recall that in mid-2011, Governor Carney’s team was even more convinced that the need to tighten policy was at hand … but an economic bump in the road waylaid those plans, including a […] drop in Canadian GDP and the subsequent eurozone crisis.”

The Bank may well hit a similar bump again this year, with Europe struggling with gaping budget holes again and the U.S. recovery wobbling. So if you want to shrug it all off and keep wallowing in cheap credit, you can quote the pros.

BUT whenever the Bank does kick off the tightening–and the time will come, eventually–it will have a long way to catch up. A recent report by the Conference Board of Canada estimates that, based on the pace of the Canadian economy (and ignoring factors that are constraining our maneuvering space on monetary policy, such as the situation in Europe and the Fed’s interest rate target), our key interest rate right now should be 2.5 per cent. Imagine that.

What would a $300,000 mortgage look like if interest rates climbed up by one and half percentage points? (For an overview of how the key interest rate affects mortgage rates, click here.)

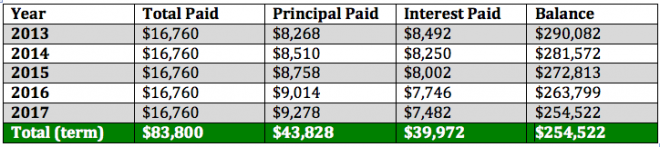

To figure it out, we use the detailed mortgage payment calculator of RateHub, a website that compares Canadian mortgage rates–these are rough, back-of-the-envelope calculations, of course, but they give us an idea of what these interest rate movements would do to Canadians’ pockets. Here’s what a five-year flexible mortgage at a 2.9 per cent rate (one of the lowest available for that term) looks like right now, with the key interest rate at one per cent:

That is, in five years, you pay just under $40,000 in interest rate and almost $44,000 in principal. That roughly boils down to $1,397 in monthly payments–$689 going toward paying down the principal, and $707 in interest.

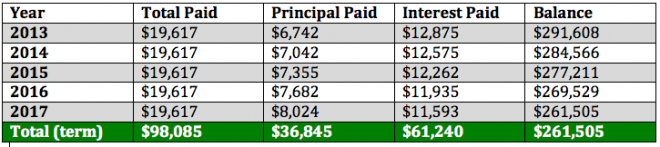

Here’s what things would look like if the key interest rate was 2.5 per cent (i.e. our calculations were based on a hypothetical 4.4 mortgage rate):

In that very same five-year time frame, you pay off less than $37,000 in principal and as much as $61,000 in interest. That translates to $1,635 a month, of which a whopping $1,073 is interest. That’s $366 more a month in interest rate charges. You could almost get yourself a new BlackBerry Bold with that much money (whether you should actually use the cash for a BlackBerry is an entirely different question…).

Sounds scary? Well, that’s what paying for a house used to be like. Worse, in fact. According to the Conference Board the “normal” interest rate (i.e. one that does not stimulate or slow down the economy) is over four per cent. Would your wallet be ready for that?