What you should know about Alberta’s royalty review

With the release of the royalty review, let’s take a step back and ask: Are we getting our fair share? And more importantly: a fair share of what?

(Amber Bracken, The Canadian Press)

Share

Alberta’s royalty review is now complete. It was no small task. Over several months, there were 132 submissions, dozens of public meetings, countless hours of hard work by the panel and three “expert groups” of advisers.

So what did they accomplish? A lot–though perhaps not in a way that grabs headlines. With a 200+ page report, analysts have much to digest. Here is a quick take.

Quick Summary

There are four recommendations. All worth knowing.

- Establish guiding principles and design criteria for Alberta’s royalty framework. There will, and should be future royalty reviews. We should know how they will work and what the objectives are. This is sensible.

- Modernize Alberta’s royalty framework for crude oil, liquids, and natural gas. This is the meat of the report. Analysis by more capable experts is sure to follow. I’ll leave the details to them. It’s a set of largely technical recommendations that appears likely improve the efficiency of the system. I’ll give brief intuition behind how this might work later.

- Enhance royalty processes for the oil sands. This is the largest source of royalty revenues, and the source of almost all future growth. In a nutshell: nothing changes except some improvements in cost accounting and reporting. The rates and structure remain the same.

- Seize opportunities to enhance value-added processing. Of course, by “seize” they mean “enlist the advice of experts to examine many questions…” Examine what specifically? Subsidizing petroleum processing, refining and upgrading activities. I’ll come back to this later.

Notice the panel does not recommend increasing or decreasing the government’s share of the pie. Instead, their recommendations are likely to make this pie slightly larger, for the benefit of industry and the public alike.

This is a relief to some, and a missed opportunity to others. Let’s take a step back and ask: Are we getting our fair share? And more importantly: a fair share of what?

Our Fair Share?

What’s a royalty system supposed to do? Albertans own most of the hydrocarbon resources–and those resources have value. But how do we extract that value? The government doesn’t do the exploration, drilling, pumping, mining, or whatever else, on its own. (Nor should it.) Instead, we rely on private industry, and the royalty system is how we extract the resource’s value from private industry.

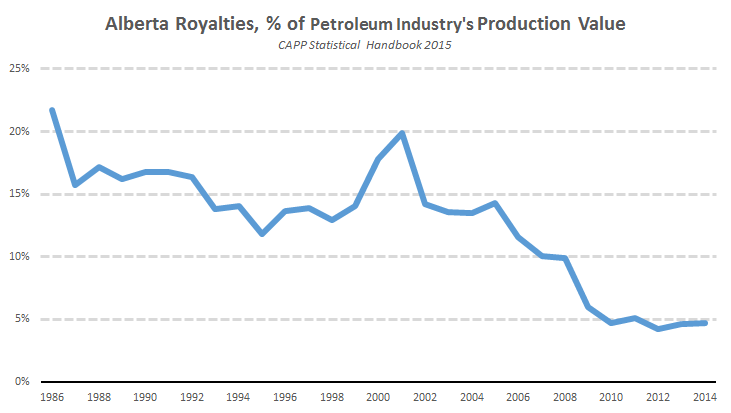

But, what is the proper measure of value? Some point to royalties as a share of industry revenue and conclude we aren’t getting our “fair share”.

They’re falling! This is unfair!

Not at all. Revenue from resource sales are very costly to generate. Wells are expensive to drill. Oil sands facilities are (ridiculously) expensive to build. And there are on-going operating costs. There are also foregone earnings that investors could have earned in alternative assets had they not sunk money into oil and gas facilities. These missed opportunities are also real economic costs.

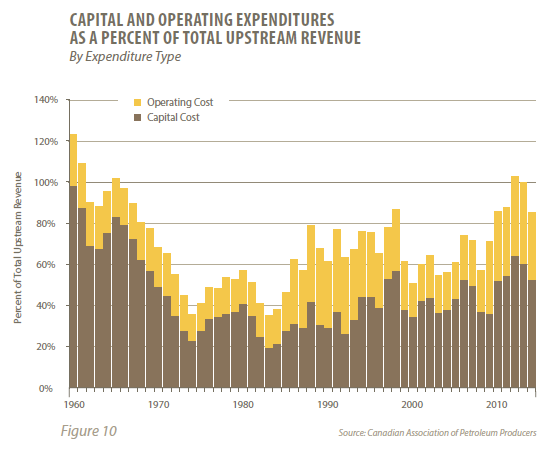

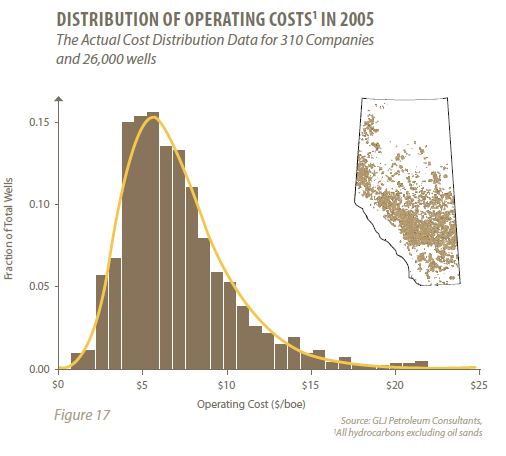

To illustrate the high and rising costs in Alberta, the panel produced the following figure:

In recent years, costs consumed almost the entire value of each barrel of oil produced!

What we want our royalty system to extract is what’s left over from revenue after subtracting all costs. This is what economists call a resource rent.

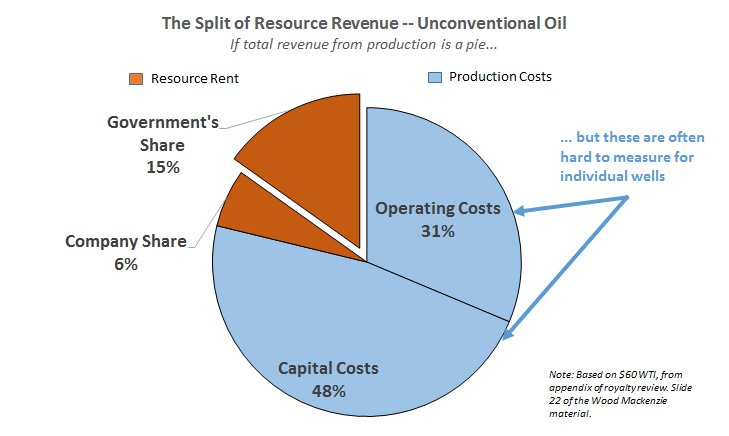

The panel report also contains an appendix that breaks down how the revenue from each barrel of oil is split among various components. This measures the split over the entire lifetime of a hypothetical future project. Operating and capital costs are huge, eating up close to 80 per cent of revenue. What’s left is the rent, and government collects about 70 per cent of that. The following pie graph is based on this appendix data.

This pie graph represents a model-based estimate. One thing is clear: costs are massive. (For individual wells, they are tricky to measure. More on this later.)

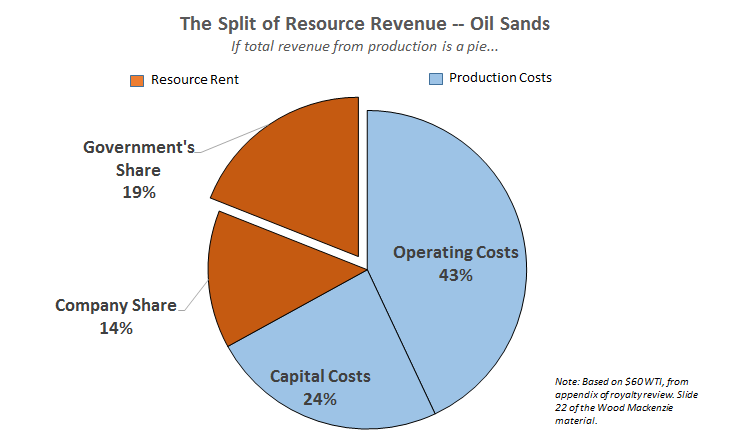

How about oil sands? Costs per barrel over the long life of an oil sands facility are lower than for a typical unconventional oil well, so the rent is larger. The government share of this is about 60 per cent.

Is a government share between 60 to 70 per cent too low, too high, or just right? It’s tough to say.

There’s a risk in extracting too much of the rent. One reason is for industry to have an incentive to lower costs, which increases the rent available. Another is to compensate for investment risk. Another may be to ensure we attract the most capable companies. There isn’t any obvious “best” share, so we must be careful.

Perhaps a comparison is helpful. Based on the same appendix to the panel report, this 60 to 70 per cent government share is roughly the same as Texas and North Dakota, though it is much higher than Saskatchewan’s take. So, Alberta’s share is not obviously too low relative to other jurisdictions.

Recommendations #2 and #3

Costs of an oil or natural gas well are important in determining the available resource rent. The tricky part in practice is to estimate operating and capital costs of each individual well. There are a lot of wells in Alberta, spread all over the province – roughly 120,000 natural gas wells, and 40,000 crude oil wells (based on this). It would be administratively difficult to get accurate costs for each one.

This isn’t to say it couldn’t be done, but the panel instead recommends providing each well an allowance based on some measure of average costs for wells with similar characteristics (like horizontal and vertical depth). In the current system, there is no explicit recognition of costs. There are only incentive programs that charge lower royalty rates for a certain amount of time or physical production. Under the new cost allowance system, wells that have lower costs will win. Those that have higher costs, lose. This provides an incentive to innovate, lower costs, and grow the overall size of the resource-rent pie. Even though the government’s share of rents will remain unchanged, total government revenue may gradually increase. This is what Recommendation #2 is all about.

For oil sands, recommendation #3 is about improving the transparency and clarity of costs. In essence, we’ll get a better handle on the blue slices of the pie graph shown above. This is sensible. Improved transparency can help improve how royalties are levied and will provide information to Albertans.

Diversification and Value Added

The final recommendation of the panel was for the government to explore processing, refining and upgrading activities in Alberta.

This recommendation is not surprising. The panel was mandated by the government to explore ways to “encourage diversification opportunities such as value-added processing, innovation or other forms of investment in Alberta.” Sounds innocuous. But “diversification” and “value-added processing” mean different things to different people–and the latter doesn’t mean what most people think it does.

It’s not just the current NDP government. The PC and Wildrose parties both have some form of “value added strategy”. Even the Alberta Party wants more support for “value added agricultural products”. They are all equally confused. In reality, all sectors add value. (Here are Statistics Canada’s measurements.) To call processing activities “value added” but not raw extraction is wrong. The phrase does sound good, though, and is frequently invoked to advocate a subsidy to some project or another.

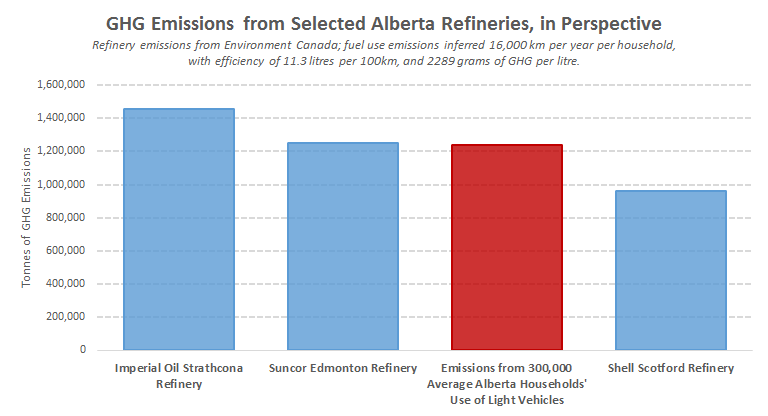

What would be the proper justification for a subsidy? A market failure of some kind. Is refining a public good or does it have some externality? If not, subsidies can damage the economy. When petroleum processing, refining, or upgrading are involved, subsidies can even damage the environment. Here’s a useful comparison:

An average Alberta refinery is roughly equivalent to 300,000 cars. This is a market failure, though one that calls for a tax, not a subsidy. The previously announced carbon tax is precisely the right policy. Subsidies would weaken that policy’s effectiveness. In addition, with today’s difficult fiscal situation, the government surely has more pressing priorities.

(Just for kicks, I submitted a paper to the panel on this point. Judging by how many times the phrase “value added” was abused in the report, they didn’t listen. The phrase appeared in the report 25 times, all incorrectly.)

In any case, little was actually recommended by the royalty review panel. The government will likely appoint a separate panel to explore these questions in more detail. All I can say is: for the love of god, hire an economist!

Final Thought

There was lots of fear surrounding the royalty review. One Alberta politician claimed the review had cost billions of dollars and cost thousands of jobs. Another said “I’m glad it’s over with, I wish it would have been over with before it started.”

Was it so bad?

Periodic review of policy should be nothing to fear. We re-evaluate tax and spending policies annually through the government budget process. Markets and technologies change rapidly and policy must keep up. Consider that horizontal drilling and shale gas production are all on the rise. Is our royalty system still structured in a way that makes sense given today’s conditions? There’s nothing wrong with asking the question. And that is precisely what a royalty review is for. The panel did a great job and Albertans owe them, and their staff, many thanks. The next review – and there will be a next one – will hopefully be greeted with less alarm. I look forward to it.

P.S. This is a very complex policy area. I’ve benefited a lot of discussions with very knowledgeable colleagues. In particular, Blake Shaffer and Jennifer Winter.

Trevor Tombe is an assistant professor in the department of economics at the University of Calgary. Follow him on Twitter: @trevortombe