Why Petronas cancelled its plans for an LNG project on B.C.’s coast

Market forces played a far bigger role in the decision to scrap the LNG project than many seem willing to acknowledge

Share

This week, Petronas finally announced that it would not proceed with its Pacific Northwest LNG project—part of a proposed $36 billion investment in B.C. natural gas production, processing and shipping. While the project had significant potential when first announced, and Petronas signalled continued commitment to it as recently as last year—after the Trudeau government finally approved the project—the market has been weakening since and it wasn’t a huge surprise that they announced a cancellation. In addition to market headwinds, the project faced significant opposition, it was seen as a potentially large source of GHG emissions, and the previous B.C. Liberal government had over-promised beyond what the project and others like it would have ever been able to deliver. After five years of regulatory process, with global gas prices having collapsed, Petronas decided it could better spend about $18 billion it had previously proposed to spend on the combined pipeline and LNG project. The fate of some of the remaining $18 billion—spending plans to further develop gas resources in B.C.—remains to be seen.

Before we get into the details of this project, a quick step back: what is LNG and why was it felt to be so important for Canada? LNG is liquefied natural gas (the same gas that you’d use in your home heating system) chilled to -161°C, which reduces its volume to 1/600th of the volume of gas, making it economically feasible to transport over long distances by ship. The LNG, which has lower energy density than oil-derived fuels, but much higher energy density than gas, is shipped across the ocean in its chilled state, and then delivered to re-gasification facilities via which the gas is introduced into the receiving country’s pipeline network for delivery to homes and businesses.

Processing and shipping natural gas via liquefaction is expensive. Analysis from the Canadian Association of Petroleum Producers put the combined costs of pipelining B.C. gas from the Montney and Horn River formations to the coast, liquefaction, and shipping to Asia at between $8 and $10 per GJ of gas shipped, and that’s before you’ve paid anything for the gas. For comparison, shipping costs for a barrel of oil by pipeline and tanker from Edmonton to China were estimated at less than $8/barrel in the TransMountain Pipeline Expansion application —equivalent to $1.36/GJ. LNG involves, literally, spending more to process and ship the gas than the gas is worth here at home.

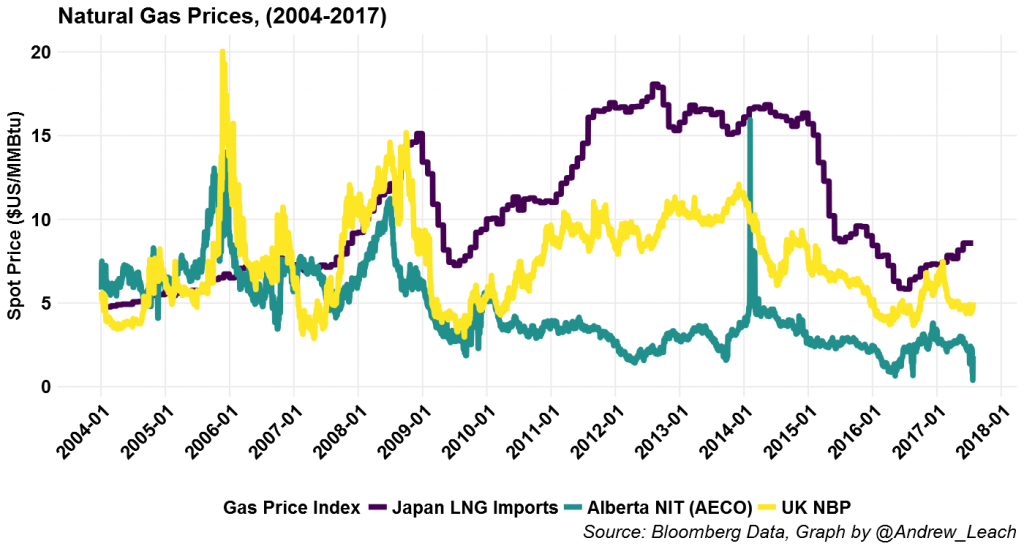

So, why was this ever attractive? Because gas is not evenly distributed around the world, and when regions such as China and Korea look to import gas to heat their homes, these high transportation costs mean that large regional price differences can occur. And that’s just what we saw occur over the past decade. If you look at the graph below, you can see why, for a period of time, the prospect of spending $8-10/GJ to ship gas to Asian markets looked attractive.

At some points during 2012 and 2013, the spread between the value of a gigajoule of gas in Alberta and Japan was over $15—more than enough to pay for liquefaction and shipping. In fact, it was this differential that led governments and industry to push hard for LNG terminals—when prices in Asia were that high, the demand induced by new LNG facilities would allow high prices to flow all the way back to the well-head value of gas in Western Canada, which would increase Canadian resource wealth.

However, all did not stay as it was in 2011-2015, nor had it always been that way. If we shift the graph to look at a wider time period, we see two important elements often omitted from the stories of this past week.

First, look to the left end of the graph. Unbeknownst to many, for a long time, both Canada and the U.S. were looking at becoming LNG importers. Yes, importers. The U.S. built and operated significant numbers of re-gasification plants (more on that later), and as late as 2007, Canada was permitting import facilities on the B.C. coast to bring gas in! During that time, gas prices in Alberta where actually higher than prevailing LNG prices, and so developers thought they could earn a return re-gasifying LNG on the B.C. coast to ship inland to supply our homes and businesses.

Next, look to the right of the graph, and what’s happened since 2015—global prices have come into much closer balance, with Japanese import prices recovering a bit recently but still sitting about $7/GJ above Alberta and B.C. gas prices, which are at near-historic lows. Now you see what people are talking about when they say that the LNG window has closed, at least for now. At today’s prices, you would certainly not make a reasonable rate of return on an LNG asset in BC. Simply put, if the interest in LNG is to drive higher values for Alberta and B.C. gas than we are currently seeing, the market isn’t there globally to allow that to happen today. The difference in price between B.C. gas and global LNG wouldn’t be high enough to pay for the operating and capital costs of pipeline and liquefaction assets.

It’s worth taking a step back, with costs in hand, to consider the three most frequently-raised issues we’ve seen in the past week—the role of government policies (including GHG policies and regulatory timelines), the reasons the U.S. and Australia seemed to get ahead of us in this market, and then get back to the future for the industry in B.C.

Regulatory hurdles

Beginning with the regulatory timelines, Petronas has not had an easy time in Canada. Their initial purchase of Progress Energy in 2012 was initially rejected by the federal government, then eventually approved at the eleventh hour. The B.C. government of then-Premier Christy Clark introduced special royalty and tax provisions for LNG, as well as specific greenhouse gas policies. Furthermore, the Christy Clark government reviewed GHG policies in 2015, during which potential LNG emissions were a primary focus. Finally, the recent election of the NDP government, while not a signal that the project would be derailed, was certainly a source of further regulatory uncertainty and likely increases in production cost. The most direct question, to which we may never have an answer, is whether Petronas would have committed to build the project and begun construction had they received immediate approval in 2012. Even then the project was huge and risky—an $11 billion terminal and a $7 billion pipeline to a still-developing gas play banking on the hope that the extraction, shipping, and liquefaction costs would combine to be less than global LNG prices and allow a return on investment.

The LNG project’s impact on emissions

What about GHGs? How much would the project have emitted? Through the various environmental assessments the project was required to pass, many estimates of the emissions from the project are available. The most comprehensive, from the federal government’s environmental assessment, puts the emissions from the facility itself, and associate operations, at 5.2 million tonnes per year. Further analysis found that the emissions associated with the natural gas production to feed the project would add a further five to nine million tonnes per year to Canada’s emissions inventory.

Whatever your preferred final number is, the emissions impact of a facility this size will not be small and GHG policies could be material to the overall costs of the project, but that’s not likely the case for current policies. At the high end of the range above, with total GHG intensities in Canada of a little over 0.21 tonnes of carbon dioxide equivalent per tonne of LNG shipped, carbon costs would not materially alter processing costs. A $30 per tonne carbon price, as is currently in place in B.C., applied on emissions, would increase processing costs by about 12 cents per gigajoule. B.C.’s previous government had enacted provisions to shelter the average costs of production from GHG costs, but there was no guarantee this would continue and the new government has indicated that GHG policies will become more stringent. While I don’t believe the project was cancelled because of risks from proposed changes to GHG policies in B.C., it’s certainly possible that any change in GHG policy would have a material impact on the expected costs of liquefaction. It’s out of the money now, so it’s not likely driving the decision, but that’s not to say it wouldn’t ever matter. LNG is all about margins, and costs here will decrease potential margins.

The American experience

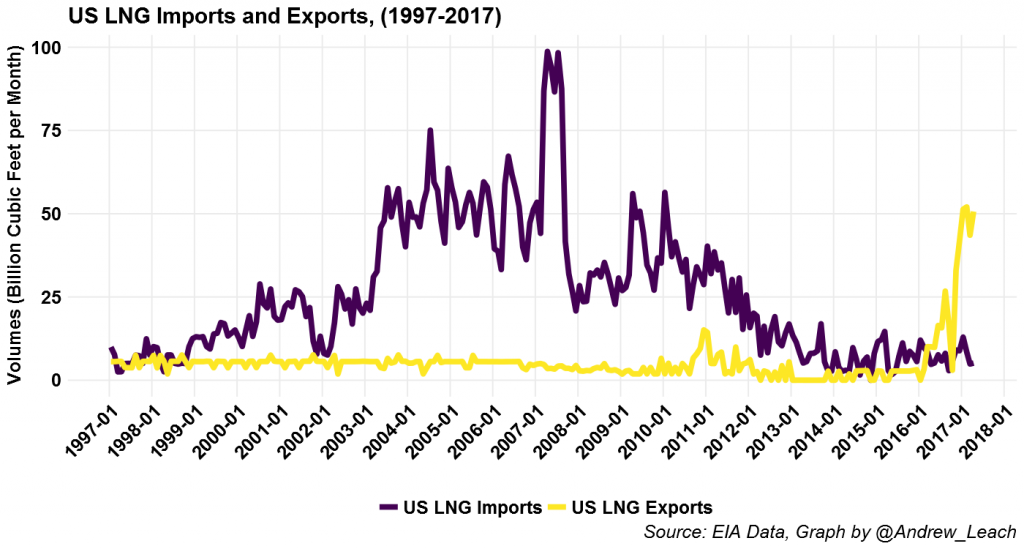

Next, the question I’ve most often heard this week is: if this is purely a market story, why is it not happening in the U.S.? The U.S. has built and is still building LNG export facilities and, these facilities are challenged by current market conditions. So, why did the U.S. build while we didn’t? In effect, the U.S. had an advantage from being far behind—in the mid-2000s, the U.S. was very short natural gas, and built a lot of import capacity, as shown in the graph below. Many of those import sites, with pipeline infrastructure, docks, storage, and such were converted to export facilities as the U.S. gas market swung from short to long after 2013.

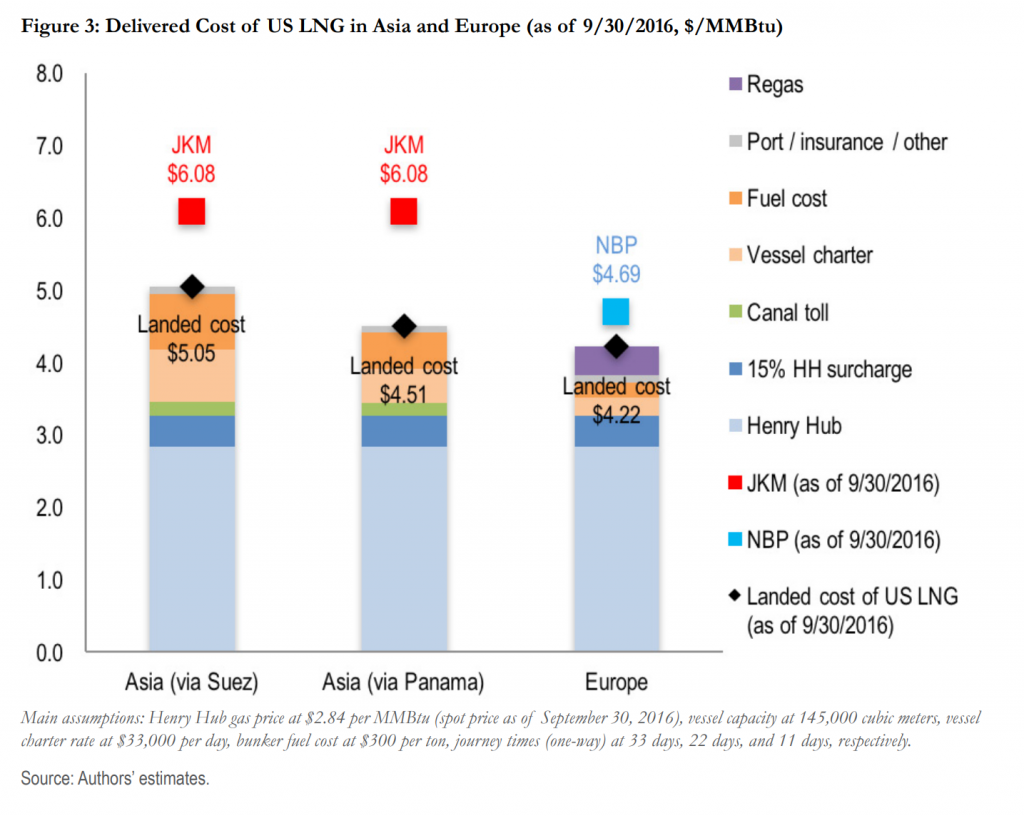

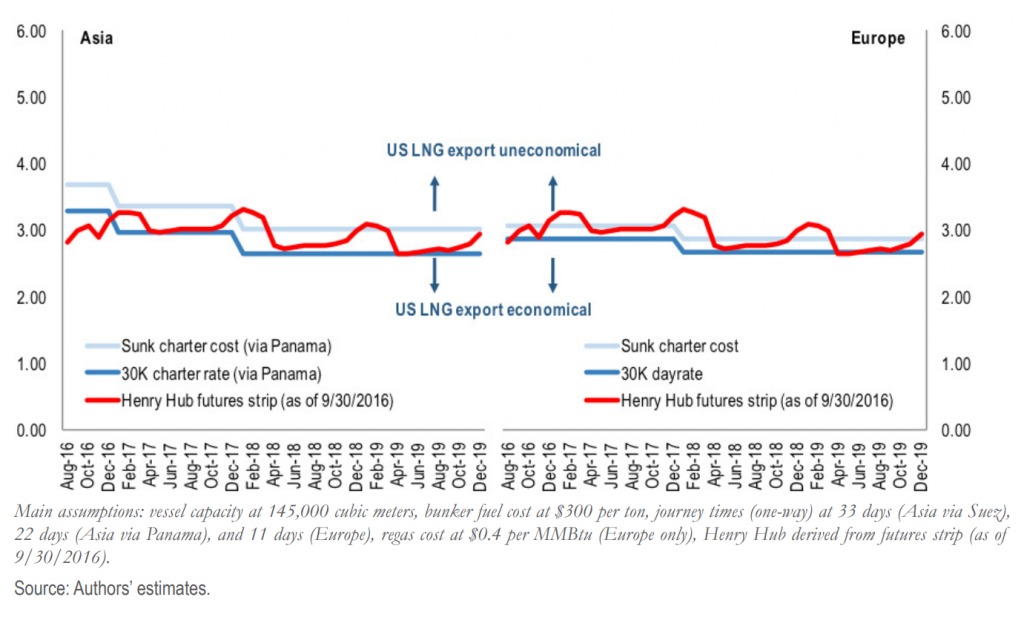

These facilities are facing the same cost pressures I described above. Recent analysis from Jason Bordoff and Akos Losz (2016) discusses just how tight US LNG margins have become and, as you can see from their graphic below, facilities faces challenges to even meet their variable costs, let alone recover the costs of sunk capital.

Bordoff and Losz also look ahead, asking whether there will be significant future upside to existing U.S. facilities, and they find very weak support. As you can see in the graphic below, they find that prototypical U.S. facilities are marginal at best (in terms covering their variable costs) let alone recovering capital costs.

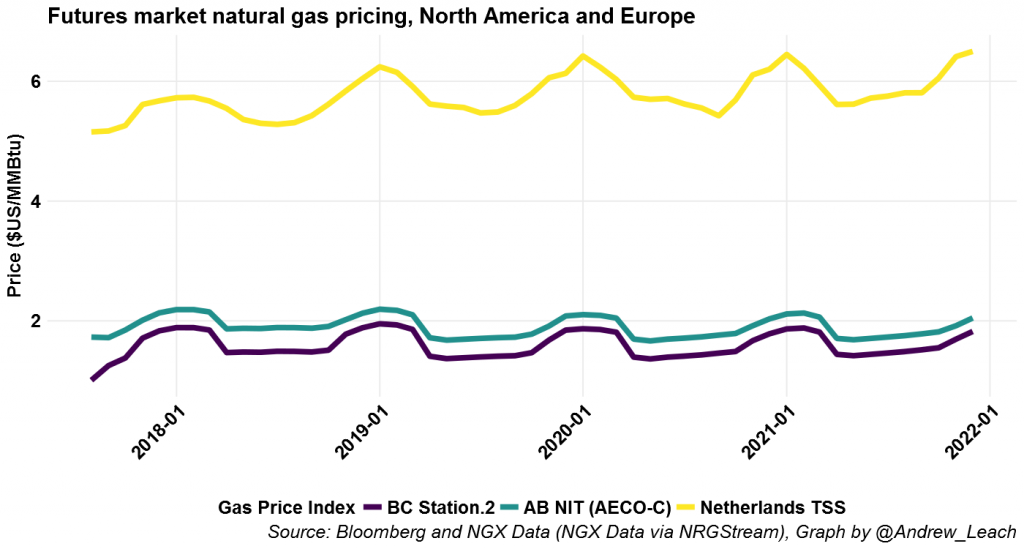

If we perform a similar analysis to see the gap between current Canadian forward market pricing and global hub pricing from Europe (I am using Dutch forwards, but German, French or U.K. forwards give the same results), you’ll see the results are similar. On the graph below, the average spread between the next five years’ forward curves for gas delivered to Europe versus gas delivered to Station 2 in B.C. is about $5 CAD/GJ—perhaps enough to cover the operating expenses for a pipeline to the B.C. coast and a liquefaction plant, but nowhere near large enough to recover the costs of capital for the liquefaction plant or to provide any uplift to BC and Alberta gas prices. Asian gas prices likely provide another dollar or two of lift, getting projects closer to economic viability at current low gas prices. Of course, insofar as you believe that LNG would raise prices in Alberta and B.C. (wasn’t that the point?), the margins get even thinner and the projects even less economic!

That’s a lot of words on LNG. What’s the bottom line? Without a doubt, government policies (Conservative, Liberal, B.C. Liberal, and B.C. NDP) have impacted the timelines, risks and potential future returns from LNG facilities on the B.C. coast. However, to be viable, these plants would have required market conditions which have only existed for four or five years in the relatively short history of global gas trade to prevail for most of the next 30 years. Furthermore, don’t believe the comparisons which suggest that LNG growth in the U.S. shows that Canadian project delays are all about government. Building LNG in B.C. is expensive—more expensive than on the U.S. Gulf Coast—because of a lack of existing facilities to retrofit, a need to construct infrastructure across the mountains to the coast, and due to building in smaller communities with smaller labour markets than we see on the U.S. Gulf Coast. Yes, gas is cheaper in Alberta and B.C. than it is on the Gulf, and we’re closer to Asia, but once you factor in the hurdles of greenfield construction and the need to add pipelines, that advantage disappears.

Will the remaining projects on the B.C. Coast get built? It’s hard to say. If global oil prices recover, and pull gas prices up with them, the LNG window may open again. But, in a world awash in gas, and with other competing sources of energy getting cheaper by the month, the window may remain closed for good.