Why the new EI tax credit could do more harm than good

Reducing payroll taxes, like EI premiums, is good policy. Too bad that’s not what the Harper government chose to do.

Share

There was a lot of talk about job creation leading up to the federal government’s announcement of a reduction in employer contributions to Employment Insurance (EI), and there’s plenty of reason to believe that lower EI premiums have the potential to increase employment and wages. But the Conservatives have yet again eschewed a straightforward and effective measure and adopted one that is complicated and most likely to have little effect on employment or wages.

Reducing EI contributions is not in itself a bad idea. The EI balance is usually in surplus to cover the costs of running the program, but the surplus is currently running about $2 billion above what it was before the crisis. Perhaps not coincidentally, the PBO’s estimate for the “break-even” EI balance is about $2 billion lower than what it is now.

EI premiums are generally structured to make sure that the program breaks even, so the government had two choices: make EI more generous or reduce premiums. To the surprise of absolutely no one, the CPC has chosen the latter option. But once again, instead of simply reducing EI contribution rates, the Conservatives have created yet another boutique tax credit. To understand the implications of this move, it’s worth taking some time looking at what we might have seen if the government had simply reduced the premiums paid by employers.

In a standard analysis of payroll taxes (EI and CPP contributions are effectively payroll taxes) it turns out that even though the taxes are paid by the employers, the actual tax burden is mainly borne by the workers: wages are driven down by the reduction in labour demand. This is the distinction between the statutory incidence of a tax (who sends the money to the government) and its economic incidence (who is ultimately out of pocket). (See here for a primer on the economics of tax incidence and see here for an application to payroll taxes.)

If the government had simply reduced EI premiums paid by firms, workers would have been—after a certain transition period—the main beneficiaries. But instead of doing this, the government has set up a tax credit that can only be claimed by small businesses whose EI contributions are less than $15,000 a year (see this explainer for how it works). As Kevin Milligan noted on Twitter, this sets up yet another “kink” in the tax schedule: small businesses will lose this tax credit if they grow too large.

Special treatment for small businesses is another one of those things that makes lots of sense to politicians and much less so to economists. Here’s how Duanjie Chen and Jack Mintz put it in a 2011 paper for the School of Public Policy:

In contradiction to the widely held view that small business tax concessions encourage growth, such small business tax relief could actually be antithetical to growth by creating a “taxation wall.” First, it could result in the breakup of companies into smaller, less efficient-sized units in order to take advantage of tax benefits even if there are economic gains to growing in size. Second, it could encourage individuals to create small corporations in order to reduce their personal tax liabilities rather than grow companies. And third, it could lead to a “threshold effect” that holds back small business from growing beyond the official definition of “smallness,” regardless of the criteria for measuring size (e.g., the size of revenue or assets, or the number of employees).

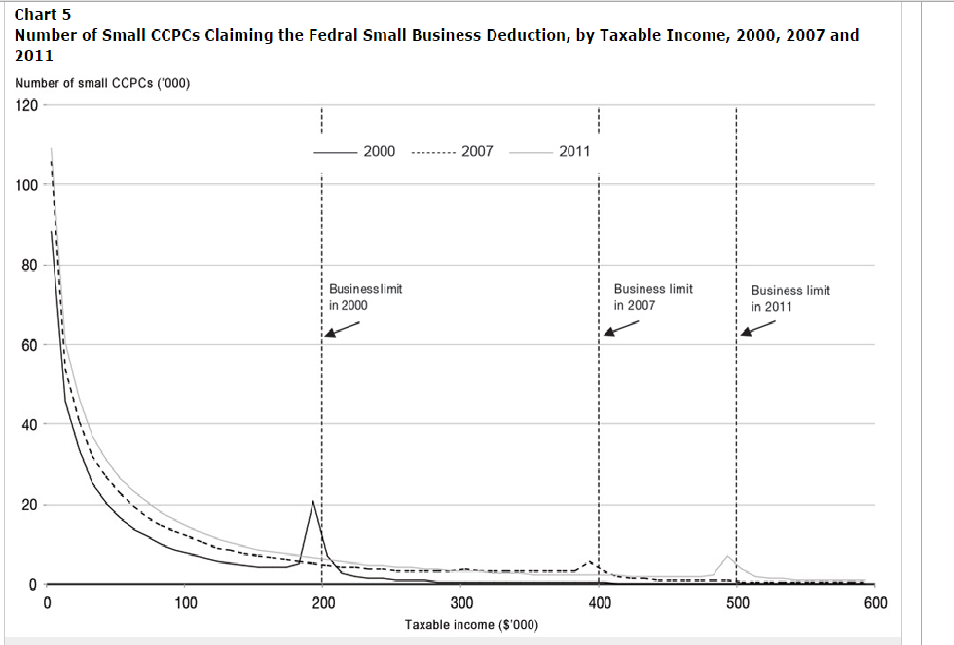

This chart from a Department of Finance study shows the “tax wall” at work:

There are clear spikes in the number of firms just under the income threshold that makes them eligible for the Small Business Deduction. For many of them, the tax system is a clear disincentive for growth.

The tax credit announced today will have a similar effect. For firms that are just under the $15,000 threshold, hiring a new worker would mean crossing the line and losing the tax credit entirely. For firms that are just over the threshold, the incentives are even more perverse: firms may choose to actually reduce employment in order to be eligible for the tax credit. To be sure, not all small businesses are in this position and many will be able to hire and take advantage of the tax credit. But it’s by no means clear at this point that the positive incentives to hire more workers will outweigh the negative ones.

Nor is it clear that the usual incidence result—i.e, that workers benefit most from payroll tax cuts—will apply with this new tax credit. Competitive pressures are a crucial feature of the standard framework: wages get bid up because all employers are paying lower taxes. In this case, the only upward wage pressure there might be would come from small businesses who are well below the $15,000 EI contribution threshold.

Reducing payroll taxes is usually a clear win-win situation, resulting in increased employment and higher wages. The Conservatives have passed up this opportunity by creating yet another targeted boutique tax credit.