Why the Trans-Pacific Partnership will help the auto sector

Calls to maintain import barriers reflect an old way of thinking about trade, and will actually harm the very sector they are meant to protect

REUTERS/Fred Thornhill

Share

The Trans-Pacific Partnership (TPP)—perhaps the largest trade deal in a generation—looks set to finally conclude. Rumours suggest a deal may be completed this week. With many (many) years of on-again, off-again negotiations, this is welcome news. Trade in goods and in services between 12 Pacific countries representing close to 40 per cent of the world’s economy may soon become much easier.

To most economists, this is cause for (cautious) celebration. Of course, there is a wide variety of complex issues being negotiated. Reasonable people can debate the intellectual property-rights provisions or the dispute-settlement mechanisms, but, broadly speaking: Trade is good for the economy.

But is it good for every sector? Not in general. The benefit of trade is that it allows us to focus on what we are relatively good at. That’s comparative advantage. Some sectors may shrink, while others grow. Recently, the discussion of the TPP is dominated by fears that Canada’s auto sector, in particular, may be one of those destined to shrink if the TPP goes through. “Canada’s auto sector ‘nervous’ about TPP talks” reads one headline. “Auto-parts makers make plea to save sector as TPP talks resume” reads another.

What, specifically, is the concern? It appears likely that the TPP will make it easier to bring in auto parts from outside of North America. For this (and likely other) reasons, the federal NDP recently announced its opposition to the deal. As has Unifor, a union representing approximately 30,000 motor-vehicle-manufacturing workers (see here). In particular, Unifor economist Jim Stanford estimates that more than 26,000 jobs may be threatened. These concerns are not crazy, but are far too pessimistic.

Economists typically point out that trade-induced losses in one sector are outweighed by gains elsewhere. But, in the case of autos, we can do even better: Canada’s auto sector itself stands to benefit from freer trade, not lose. As such, calls to maintain import barriers reflect an old way of thinking about trade, and will actually harm the very sector they are meant to protect.

How? The key is to think seriously about imported inputs—the bits and pieces brought in from outside the country that are used to manufacture goods here at home. More competition from abroad may be bad for some producers, but cheaper access to imported parts is good for most. Let’s see which effect is likely to dominate.

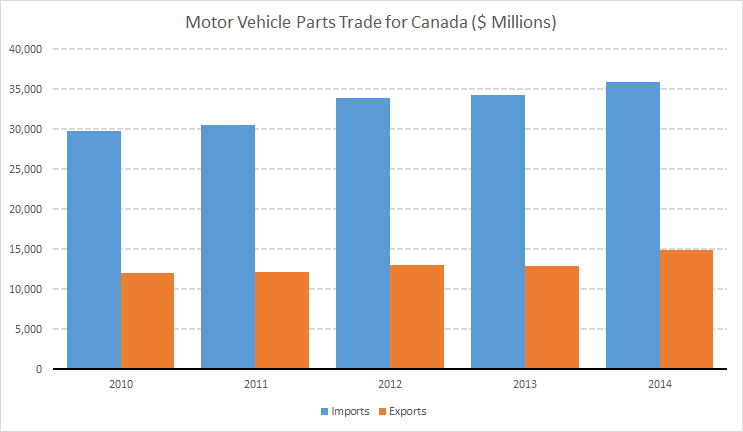

First, some key facts. About 55 cents of every dollar in auto production is spent on parts (see Canada’s Input-Output Data). While it isn’t surprising that cars need parts, what may be surprising is that most of these parts are imported. In fact, about 80 per cent of all parts used by motor-vehicle manufacturers are imported from abroad (two-thirds from the U.S. and one-third from the rest of the world). We see this fact manifest itself in the trade data:

Canada’s massive trade deficit in auto parts is surely cause for alarm, right? Wrong. Access to cheap inputs lowers the price of the end product (the car). With lower costs of producing cars, not only do consumers benefit, but our producers expand their export opportunities.

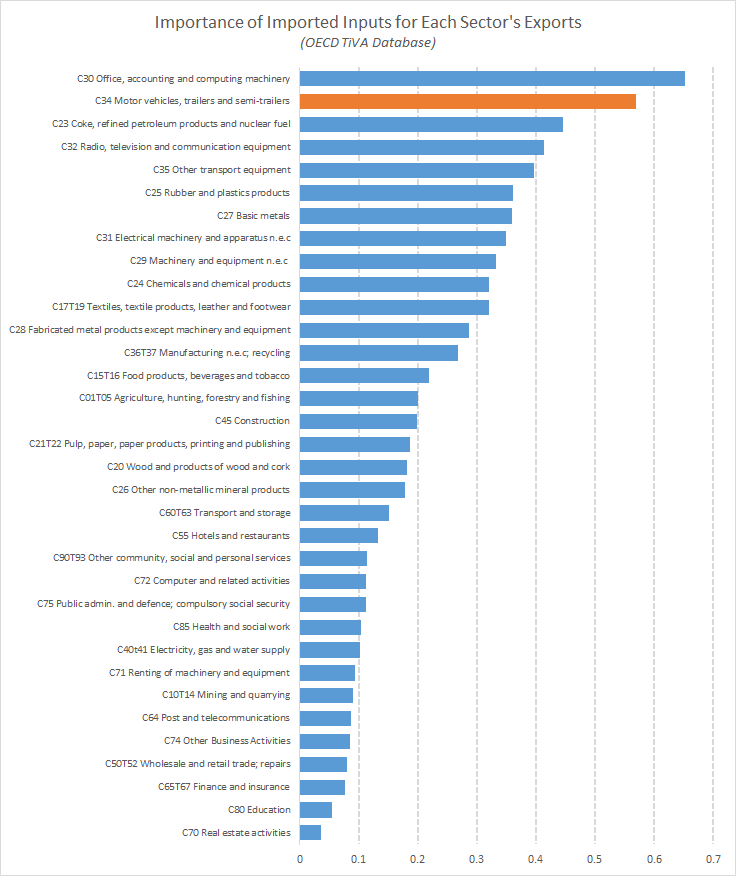

Conveniently, the OECD calculates just how important these imported inputs are to the success of each of Canada’s sectors. The graph below plots the contribution of imported inputs to the production of exports for each of Canada’s broad sectors. Autos is well above all but one other sector, with over half the value of exports accounted for by imported inputs. For export success in this sector, access to (cheap) imported inputs is critical.

So, with all this in mind, how can we quantify the effect of freer trade on Canada’s auto sector? While there are many (many, many, many) empirical estimates of the gains from trade overall, they do us little good in this specific setting. After all, the trade liberalization under the TPP hasn’t happened yet. Luckily, trade economists have a wide variety of tools to estimate the consequences of changing trade costs.

One of the most recent workhorse models allows us to simulate how a change in trade costs will affect output, productivity, employment, exports, and a variety of other metrics for any of Canada’s sectors (details here or here or one of my own papers here). We then fit the model to data from the World Input-Output Database. (These data, unfortunately, aggregate auto parts and auto manufacturing within a broader Transport Equipment sector, but it’s the best we have, and this broader sector displays the same heavy reliance on imported inputs as discussed above.) Once it’s all set up, we can use the model to simulate the effect of trade policy changes.

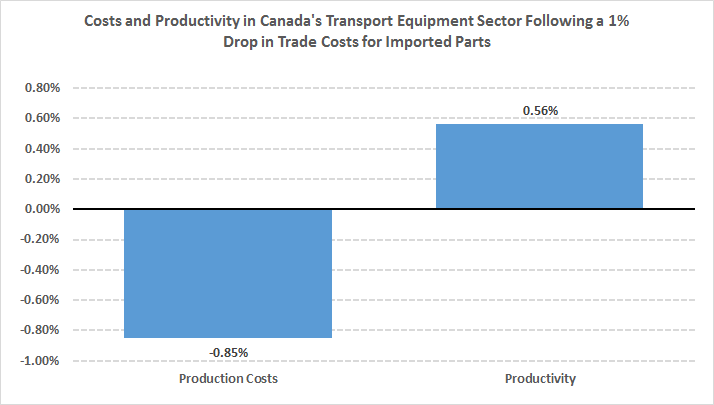

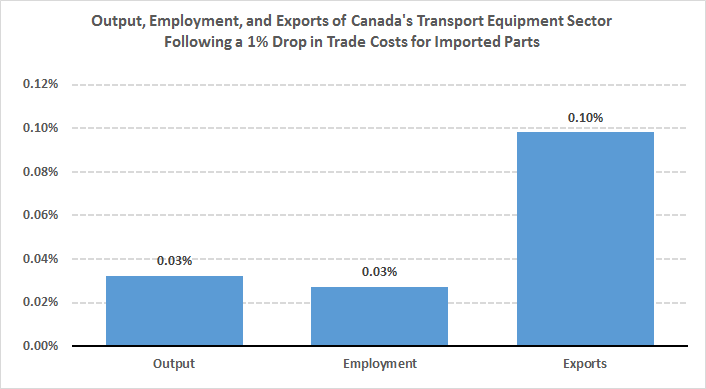

Let’s simulate a modest one per cent decrease in the cost of importing goods from the transport equipment sector into Canada. What does the model predict? Well, cheaper access to transport equipment inputs from abroad lowers the share of those inputs sourced locally—that is, auto manufacturers will source more of their inputs from abroad. This is not surprising. But, with cheaper access to inputs, production costs fall and productivity rises.

With lower production costs, the sector’s output becomes more competitive. It exports more and hires more workers as a consequence! Instead of costing jobs in the auto sector, lower import costs actually increase employment there.

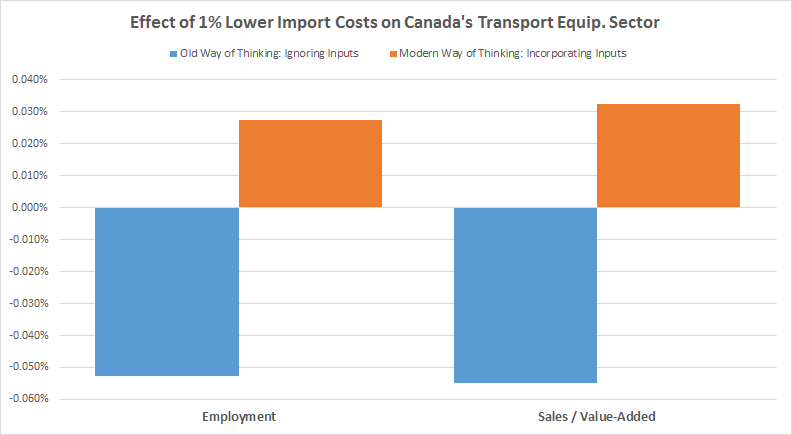

If there are such gains, why is there opposition among certain groups in the auto sector? One can only speculate, but perhaps their intuitions are guided by old ways of thinking about trade. To illustrate this, let’s simulate the same model, but without tradeable inputs. That is, we ignore trade in auto parts. The results are in the following graph.

Without thinking about imported inputs, we would have concluded that lower import costs are bad for Canadian auto producers—the exact opposite conclusion we get when we think about imported inputs. It may seem counterintuitive at first, but this sector uses so many imported inputs, it’s in a unique position to benefit itself from freer trade.

But, it gets even better! Trade agreements don’t just force Canada to lower its import costs while other countries do nothing. Exports from Canada also become easier as other countries open their markets. Let’s take a look by simulating a one per cent reduction each of export costs and import costs in Canada’s transport equipment sector.

These are large gains. If import and export costs each fall by one per cent, employment and production in Canada’s transport equipment sector increases by about 0.3 per cent. The overall effect on Canada’s real GDP is about 0.05 per cent—or $1 billion in increased GDP for each one per cent reduction in trade costs in the transport equipment sector. That’s a lot of money to leave on the table if we don’t succeed in liberalizing international trade.

Of course, these numbers are only illustrative. While they do represent the newest techniques in international trade research used to quantify the effect of policy changes at the sector level, I don’t want to hang my hat on any specific number. The key result to take away from this analysis is that Canada’s auto sector likely stands to gain—not lose—from lower international trade costs. Some in the auto sector support the TPP (see here). Perhaps they realize the opportunity that free trade presents. Policymakers and public commentators should recognize this as well, and support freer trade in general—and in the auto sector in particular.

Trevor Tombe is an assistant professor in the department of economics at the University of Calgary. Follow him on Twitter: @trevortombe

![Tombe fig6[1]](https://cms.macleans.ca/wp-content/uploads/2015/09/Tombe-fig61.png)