Why the U.S. can’t ‘just do it’ and implement austerity

Brian Lee Crowley and Robert Murphy have some advice for US policy-makers on how to deal with its government budget deficit: do what Canada did in the mid-1990s.

Share

Brian Lee Crowley and Robert Murphy have some advice for US policy-makers on how to deal with its government budget deficit: do what Canada did in the mid-1990s.

Canada faced an even larger fiscal crisis in the mid-1990s than America does today, and our achievement dwarfs anything being proposed in Washington. By acting decisively, Canada resolved its crisis quickly and with surprisingly little pain. Since the memory of this momentous achievement is fading, or is unknown to the younger generation, it is worth recalling how it unfolded.

It is indeed. Unfortunately, the authors don’t mention the parts of the story that show why telling the US to follow the Canadian example of the 1990s is recklessly bad advice.

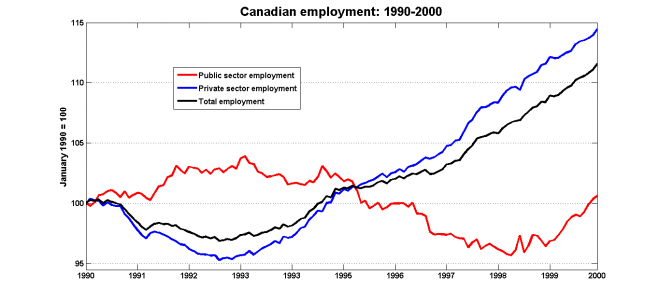

Firstly, the Canadian austerity program was implemented after the labour market had recovered from the recession of the early 1990s:

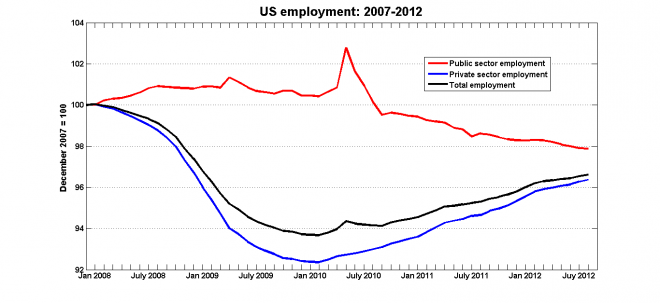

Public sector employment – quite sensibly – increased during the recession. But Paul Martin didn’t bring his austerity budget until the spring of 1995, well after private-sector employment had recovered the losses from the recession. This story in no way fits the current US experience:

Setting aside a short-lived jump in temporary hiring during the 2010 census, US public sector employment has been on a downward trend for almost four years now, and is now significantly lower than it was at the start of the recession. Moreover, private-sector employment is still well below pre-recession levels. If we’re going to ask the US to follow our example, then it’s far too early to start cutting yet.

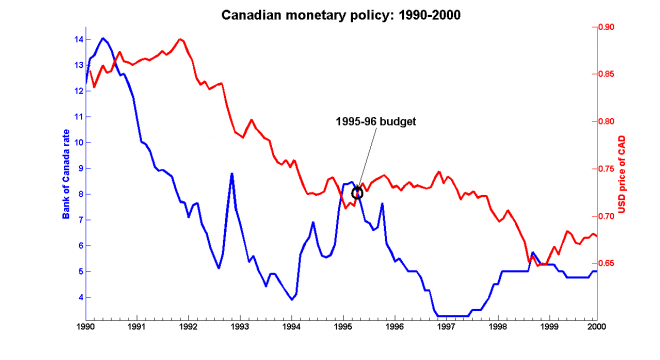

The other important point is the significant role monetary policy played in offsetting the effects of the fiscal contraction.

In the months following the 1995 budget, the Bank of Canada cut its policy rate by more than 5 percentage points – a significant level of monetary stimulus that Federal Reserve is struggling to reproduce. Until we know more about how effective this next round of quantitative easing will be, it’s probably not a good idea to assume that QE3 will provide enough stimulus to bring the economy out of recession and offset a fiscal contraction at the same time.

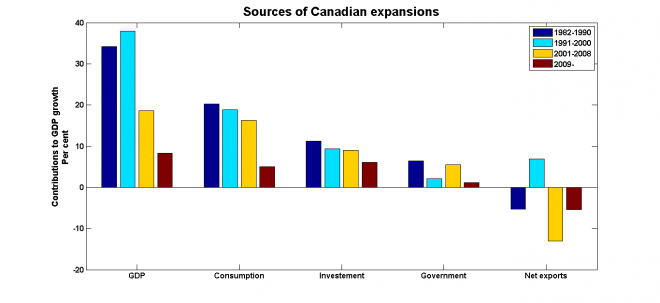

But the biggest reason why no-one should expect the US to handle fiscal austerity as well as Canada did in the 1990s is that we had what the US doesn’t: a rapidly-growing trading partner with an economy 10 ten times as large. A consequence of the Bank of Canada’s accommodative monetary policy stance was a long, sustained depreciation in the Canadian dollar. This made it possible for exports to take up the slack in domestic demand created by government cuts in spending:

The expansion of 1991-2000 was the only one in the last 30 years to have been driven by exports. Although one of the goals of QE3 is to depreciate the US dollar, there is no way that the US can repeat the Canadian experience of the 1990s. The US economy is so large that there simply isn’t anyone who can absorb the sort of export growth needed to offset a fiscal contraction.

Canada was extraordinarily lucky to have implemented its austerity program in almost-ideal conditions: the recession was over, and a fast-growing trading partner that could – and did – make up for weakened domestic demand. The US is not nearly so fortunate.

There’s no point in telling the US to ‘just do it’. They can’t.