The verdict is in: Stocks beat real estate as an investment

Fewer Canadians are in the stock market, even though that’s the best place to generate big returns

Shutterstock

Share

This week Statistics Canada released a study showing Canadians are a whole lot wealthier than they were seven years ago. The gains in net worth were overwhelmingly due to soaring house prices, which have risen faster than our ability to pile on debt (though we’re sure trying).

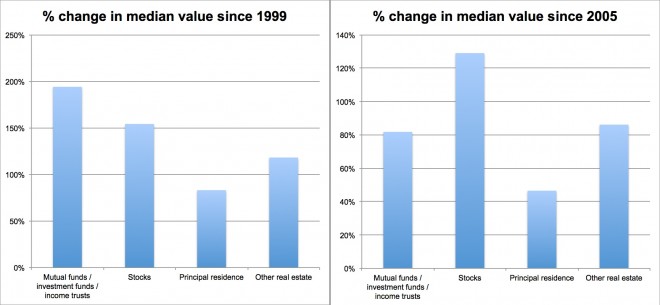

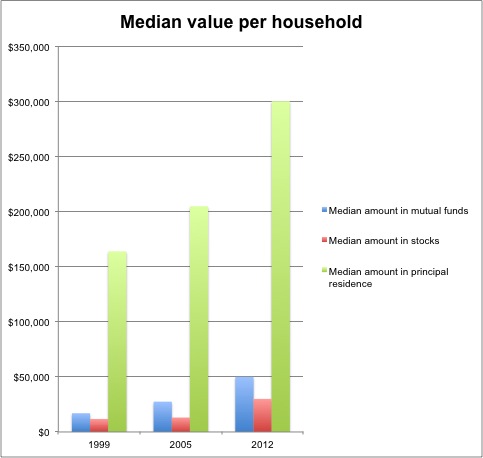

But buried in the data is a breakdown of household assets into categories like bank deposits, mutual funds, stocks and bonds. And they show that while the value of peoples’ homes have soared, their investment portfolios have risen faster. (Returns reflect the change in the median value for family units holding those assets.)

Of course, next to real estate, stocks and mutual funds make up a tiny portion of peoples’ assets.

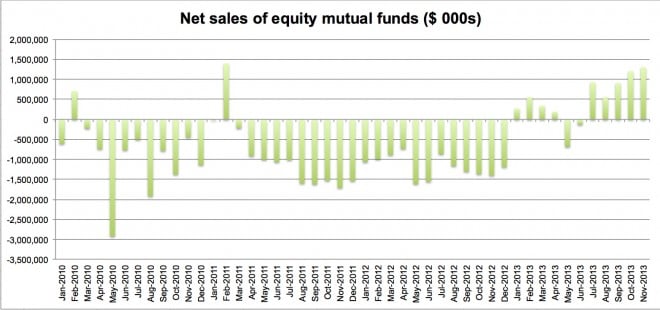

In fact, StatsCan’s data show that between 1999 and 2012, the percentage of Canadian families holdings mutual funds and stocks has been dropping. The share of families investing in mutual funds fell from 14 per cent to 11. 6 per cent, while those owning stocks dropped from 9.9 per cent to 8.5 per cent. As I wrote recently, stats from the mutual fund industry suggest Canadians have largely sat out the incredible bull market that’s occurred since 2009, only buying in recently at elevated prices.

What’s that you say? A house is different than a stock and shouldn’t be treated like an investment? You’re right, but try telling that to the 49 per cent of Canadians who plan to sell their home to pay for their retirement.

This latest batch of figures confirm something that’s been known for a long time, which your average real estate agent is loath to admit—over the long term, the best bet for wealth creation is the stock market.