Ch-ch-ch-changes

Government student loans are changing. Get schooled on how they affect you

Share

You may get a surprise in the mail this year. Upon opening that fateful letter that tells you how much student loan funding you’ll receive, you might find yourself the recipient of a non-repayable grant from the Federal government that you never asked for. If free money seems to good to be true, fear not: it’s part of a new Canada Student Grant Program that is being implemented for the first time this semester and means that you will receive extra dough you won’t have to pay back later.

In the 2008 budget, the federal government announced big changes to federal student aid, including a new national grant program, the scrapping of the Millennium Scholarship Foundation (the previous source of national bursaries and scholarships) and new programs to help student loan borrowers having trouble repaying their loans after graduation. So how exactly do these changes affect you?

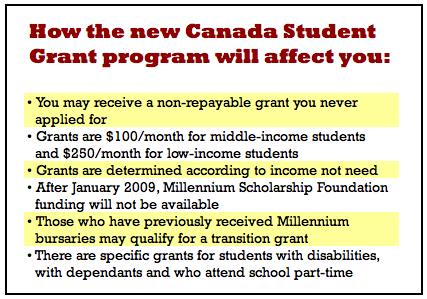

Starting this year, when you apply for a national student loan, you are automatically applying for a grant as well. Full-time students who are deemed by the Canada Student Loan Program to be from low-income families will receive an extra $250 per month up to a maximum of $3000 per year. Those from middle-income families will receive $100 per month up to a maximum of $1,200 per year. To find out what your family’s income level is click here.

An important distinction between the previous bursary program and the new grant program is that grant funding is determined according to your family’s income, not your need (expenses minus resources). This means that no matter whether you have savings from your summer job or you borrowed money from your uncle, you will get the grant as long as your family’s income is low enough. It may seem like an inconsequential difference, but it affects who gets these grants.

In other words, while getting a part-time job or otherwise improving your financial circumstances decreases the amount of funding you qualify for in the form of student loans, it does not affect your grant funding. Take this example: Student A is from a low-income family and, after subtracting his meager savings from his total university costs, he needs $3,500. He will receive $2,000 in grants and $1,500 in student loans. Student B is also from a low-income family and, having sold her car and working her butt off during the summer, she only needs $1,400. She will receive a $2,000 grant and won’t have to take out student loans. If you qualify, you get the grant—simple as that.

This seemingly small distinction means that the grants are more likely to go to students from low-income backgrounds, who traditionally experience the most barriers to going to university, according to non-profit research body Educational Policy Institute.

The program’s predictability is one of its biggest benefits, according to Katherine Giroux-Bougard, National Chairperson of the Canadian Federation of Students; everyone who qualifies as being from a low- or middle-income family will receive a grant, whereas the previous qualifications for receiving Millennium bursaries were unclear. Being able to count on receiving the grant will help students plan financially, says Giroux-Bougard. “I remember one student calling [the Millennium Scholarship Program] a bit of a lottery.”

Giroux-Bougard is also praising the Canada Student Grant Program for being easier to use, since it is now consolidated under a single national student aid program.

Other major changes include the eligibility of first-year students for grants, which were not available to them under the Millennium Scholarship Program, and new special grants designed for students with unique needs, such as those with disabilities, with dependants or who attend school part-time. You can learn more about those programs here.

With all of these new grant programs in place, many more students are going to receive non-repayable funding this year. Human Resources and Social Development Canada estimated that 245,000 college and university student qualify for a grant —100,000 more than the number that received Millennium bursaries last year. But Alex Usher, a consultant with the Educational Policy Institute, pointed out that because there is no additional overall aid funding for the program, it really boils down to smaller cheques for more students.

If you are one of those lucky students who did receive a Millennium bursary that was larger than the Canada Student Grant you are now eligible for, don’t fret. The Canada Student Grant Program has implemented a transition grant to fill that gap in funding for up to three years. Contact the National Student Loans Service Centre to see if you qualify.

Next: Having trouble paying back your loans? There are some new programs that could help.

New programs for borrowers having trouble paying back their loans

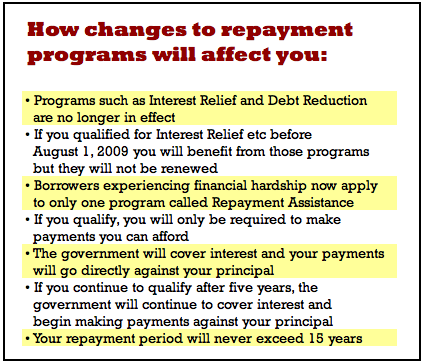

This new school year will also bring changes to programs designed for student loan borrowers who are having difficulty paying back their student loans after graduation. Before August 1, those who were experiencing financial difficulty could apply for a myriad of programs, including interest relief and debt reduction. Now, all that has been canned in favour of a consolidated plan called Repayment Assistance.

This new school year will also bring changes to programs designed for student loan borrowers who are having difficulty paying back their student loans after graduation. Before August 1, those who were experiencing financial difficulty could apply for a myriad of programs, including interest relief and debt reduction. Now, all that has been canned in favour of a consolidated plan called Repayment Assistance.

Under the new plan, borrowers will not required to make payments on their loans they can’t afford—payments will never exceed 20 per cent of their family income. Ability to pay will be calculated from the borrower’s family income and family size and the repayment period will never exceed 15 years.

If you qualify for Repayment Assistance, whatever payments you are judged to be able to afford will be applied directly to your principal while the federal government covers your interest. If after five years you are still experiencing financial difficulties, the government will cover your interest and start to make payments towards the principal amount of your loan, so that you will owe nothing at the end of 15 years.

Keep in mind that enrolment in this program is not automatic. To find out if you qualify and to apply, contact the National Student Loans Service Centre.

Laurie Campbell, executive director of Credit Canada, a non-profit credit counselling service, believes that the new program will help student loan borrowers who are in default. “The changes are great for students in financial difficulty making it easier to negotiate repayment of that debt even though they may be in default,” she said.

Borrowers who were approved for interest relief or debt reduction before August 1 2009, will continue to benefit from those programs for the remainder of the period for which they were approved.

To find out what your payments would be if you applied to the Repayment Assistance program, go to canlearn.ca’s Repayment Assistance Estimator.

Erin Millar and Ben Coli are writing an advice book about going to college and university in Canada. Have a question about anything to do with university? Email us at [email protected]