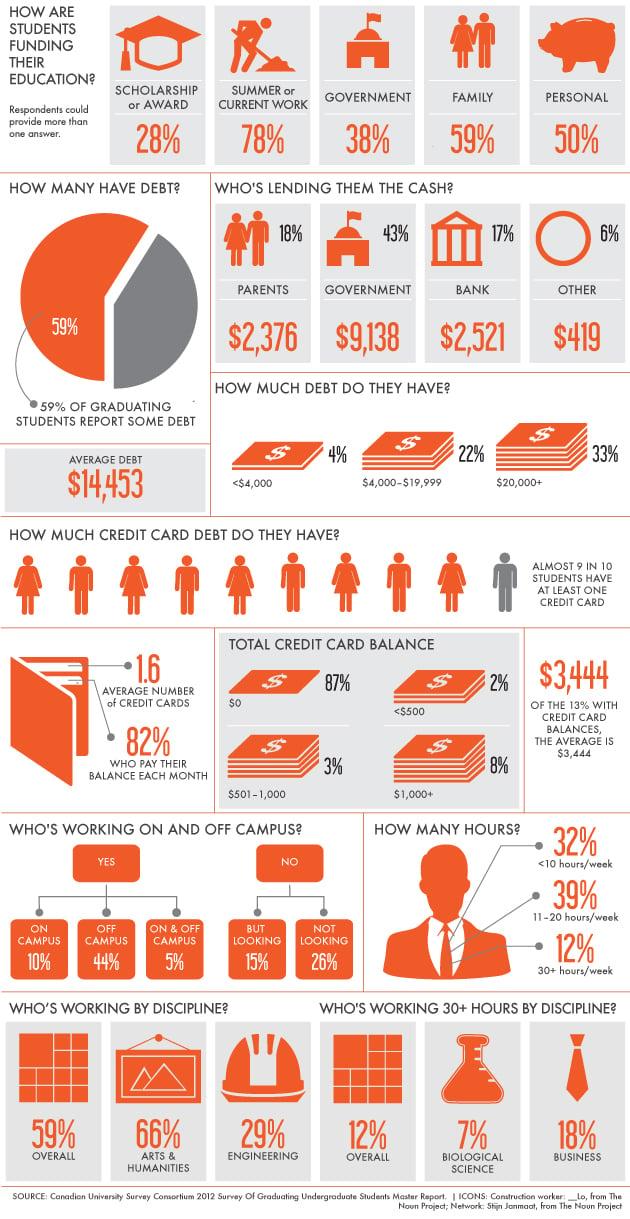

Infographic: How Canadian university students are paying their bills

Stereotype of Canadian student spending isn’t the reality

Students savings

Share

The typical Canadian university student spends four years blowing borrowed money on clothes, music and liquor, right? That may be the stereotype, but it’s not the reality. The Canadian University Survey Consortium’s 2012 study of more than 15,000 graduating students shows that six in 10 are working, the vast majority pay off their credit card bills each month and only one-third have more than $20,000 in debt. Here’s an infographic that shows how students are paying their bills, via Maclean’s On Campus: