California comeback

California got hammered by the recession. Now Gov. Jerry Brown has it roaring back — with help from America’s biggest oil field

RAMIN RAHIMIAN/The New York Times/REDUX

Share

Gabe Essoe is back to his busy self. “It’s eight days a week,” says the 67-year-old real estate broker from Pittsburg, Calif., a Bay Area town of 63,000 northeast of San Francisco. This year, he says, is going to be a good one. “I feel very optimistic in 2013.” Among Californians, Essoe is far from alone, something no one would have believed possible even two years ago.

Few states fell further than California during the great recession. The Golden State’s housing market collapsed amid a storm of foreclosures, but it wasn’t just housing. Public finances—both at the state and municipal level—were a mess. A host of cities, from Vallejo to Stockton to San Bernardino, unable to pay their bills, gave up and declared bankruptcy. But now, against all odds, California is racing back, golden, once again. California is adding jobs faster than any other state. And the state that in 2011 faced a budget hole of US$27 billion, announced in January that it will wipe out its deficit this year. Silicon Valley is booming, with twentysomething entrepreneurs snapping up vertiginously priced Bay Area property.

California’s revival comes thanks to a combination of factors: Silicon Valley, a surging housing market and oil. California, believe it or not, could soon become the U.S.’s biggest oil producer, topping North Dakota and even Texas. A recent estimate by the U.S. Energy Information Administration found that a mineral formation stretching more than 320 km southeast of San Francisco contains at least 15.4 billion barrels of shale oil, more than four times the reserves of North Dakota’s famed Bakken Shale formation.

But while oil may fuel the future of California’s economy, for now the tech industry is doing the heavy lifting. The average salary of tech workers in Silicon Valley passed the $100,000 mark in 2011, amid excitement about the revenue potential of mobile and social media, as well as heightened competition among cash-rich behemoths like Google and Microsoft to snatch up promising start-ups. Last year, Silicon Valley, Sacramento and San Diego attracted some $12 billion in venture capital investments, 45 per cent of all such investments in the U.S.

As a result, real estate in the Bay Area is once again red hot. Home prices in the region are up 32 per cent from December 2011, growing at the fastest rate in 25 years. All this is “a big positive for the economy,” says Ken Rosen, chair of the Fisher Center for Real Estate and Urban Economics at the University of California at Berkeley. San Francisco is leading the housing recovery, he adds, but things are looking up across the state, where house prices dropped a staggering 54 per cent between 2007 and 2009.

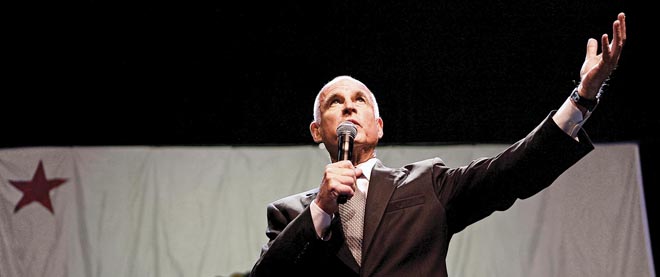

Another big positive is the improving health of state finances. “California has once again confounded [its] critics,” Gov. Jerry Brown, announced triumphantly in his January budget speech. The once debt-ridden state might even register a surplus of $1 billion by the end of 2014, according to government forecasts that, for once, actually agree with independent analysts’ projections.

Brown, certainly among America’s most colourful politicians, governed from 1975 to 1983 before returning to Sacramento two years ago, at age 72. Known for his asceticism, the former actor refused the governor’s mansion in 1975, renting a cheap downtown apartment and replacing the state limousine with a Plymouth he insisted on driving himself. Hollywood handsome, guided by his love of Zen Buddhism and balanced budgets, he is in many ways a pure product of California. In 2011, voters, searching for a manager and visionary to help fix a state so broke it was reduced to paying its bills with IOUs, chose Brown over eBay CEO Meg Whitman. In two years, the Democrat balanced the books, something the Governator, his Republican predecessor Arnold Schwarzenegger, never could.

Crucial to the feat was Proposition 30, a package of temporary sales and income tax hikes to which California voters agreed in a November referendum. The measure, which increased tax rates on incomes over $250,000 and raised sales taxes by 0.25 percentage points, is projected to add $6 billion annually to state coffers until its expiration in 2019. The money, the governor promised, will serve primarily to avoid further spending cuts to education programs—welcome news for California’s public universities, which have seen their funding drop by 28 per cent since 2007, forcing them to double undergraduate fees.

Brown, despite his tax-the-rich legislation, has managed to earn some approving nods from conservative quarters. Much of California may be dreaming of a world free of fossil fuels—the hybrid Toyota Prius recently became the state’s bestselling car—but Brown has shown no inclination to allow the state’s massive shale-oil reserves, which were first discovered years ago, to go untapped. Shortly after assuming office in 2011, he sacked state regulators who’d overseen a sharp drop in drilling permits, a decline driven, critics say, by overzealous safety and environmental concerns. And in December, 18,000 acres of the state’s biggest shale-oil deposit were auctioned off to oil companies. Brown may have his eye on the enormous tax windfall that some predict will come from accessing the state’s gargantuan shale-oil reserves: back-of-the-envelope calculations put potential tax receipts as high as $250 billion.

Brown is moving cautiously, proposing new disclosure laws for energy firms using the controversial drilling technique known as fracking, that allows oil companies to access oil and gas trapped between layers of rocks. New rules would force operators to maintain detailed product information for chemicals used in the process, and to make this available to first responders and medical providers in cases of emergency.

Still, for all the tales of riches—present and future—there’s a darker side to California’s roaring comeback. For one, says Enrico Moretti, a professor of economics at UC Berkeley, the speed of the recovery has been uneven. Unemployment in San Francisco may be down to six per cent, well below the almost eight per cent national rate, but in Stockton, a 90-minute drive east, the jobless make up more than 14 per cent of the workforce. And several small Central Valley communities are seeing 20 to 25 per cent unemployment.

The housing market shows much the same divide. “There are at least two Californias,” developer William Witte explained in a June address: “Coastal California, which for the most part is in the process of recovering from the recession, and inland California, which is still overbuilt and facing an uncertain future.” Economic growth in oceanfront counties will do little to bring down poverty in the rural parts of the state, says Ann Stevens, chair of the economics department at UC Davis, and director of the school’s Center for Poverty Research. California, according to a recent U.S. Census Bureau study, has the highest poverty rate in the nation.

Even the story of the Golden State’s new-found fiscal discipline has its detractors. To say that California has tackled its budget figures is “incredibly irresponsible,” says Stanford economist Joe Nation, who describes himself as “a Democrat who can do math.” State and local authorities face $500- to $800-billion in long-term debt, mostly due to public employees’ pensions and retirees’ health benefits, he says. None of these unfunded liabilities factor into the state’s or cities’ short-term budget accounting.

Even the stop-gap measures California adopted to pay its bills in the next few years are misguided, according to Nation. The tax increase on high incomes could lead more of the state’s top earners to migrate to friendlier tax climates, continuing an exodus of the rich that has already deprived California’s coffers of some of its wealthiest taxpayers. And the state is becoming increasingly reliant on income taxes, which are a notoriously volatile source of revenue, as they fall when wages and employment do. “When California gets a cold,” says Nation, state revenues take “an even bigger dip.”

There are plenty of reasons why not all of California is golden. But despite the inequalities, contradictions and potential pitfalls, the traumatic years of the subprime mortgage meltdown are finally behind it. In 2011, the economy grew two per cent, 0.5 per cent above the national average; and economists believe California outperformed the U.S. average again last year. All this has California dreaming once again.