Is America in a depression?

What to call the current crisis has always been a difficult task

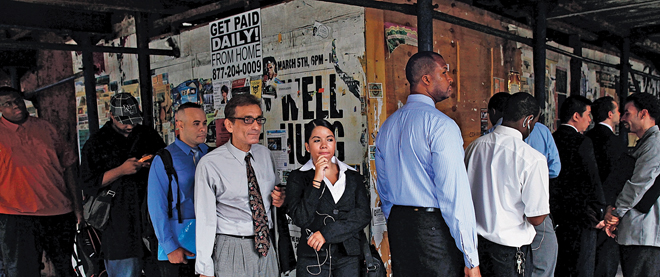

Shannon Stapleton/Reuters

Share

Everywhere Darren Enns looks these days he sees the devastation wrought by America’s grinding employment crisis. As the treasurer of a construction union in southern Nevada, the state with the highest unemployment in the country, Enns has watched as friends and colleagues—the bricklayers, electricians and drywallers who thrived during Las Vegas’s housing boom—struggle to move on to other careers. Few succeed. Many have simply given up hope. “When you look at the unemployment rate during the Great Depression, we’re beyond that in the construction industry here in Las Vegas,” he says. “We’ve got close to 70 per cent unemployment, so for us, the economy is extremely depressed.”

When the financial crisis tipped America into a deep recession in 2007, it was tempting to draw comparisons to the Great Depression of the 1930s. Those fears subsided once the stock market pulled out of its nosedive and America’s economy began to grow again, albeit at a crawl. It was a brief respite. Four years later, American towns and cities remain overrun with millions of unemployed workers even as the economy risks slipping back into reverse. It raises the question whether the U.S. ever really emerged from recession in the first place. Instead, some are suggesting those early fears may have been justified after all: the United States appears to be in the throes of an outright jobs depression.

Earlier this month, Robert Reich, a professor of public policy at Berkeley and the secretary of labour in the Clinton administration, said the current crisis is an extension of the “depression” that began in December 2007. Meanwhile, Richard Posner, a high-profile judge in the United States Seventh Circuit Court of Appeals and regular political and economic commentator, said it’s time for America to give up any false hopes that the economy is on a path to recovery. “If we were being honest with ourselves, we would call this a depression,” he wrote in the New Republic. “That would certainly better convey both the severity of our problems, and the fact that those problems have no evident solutions.”

What to call the current crisis has always been a difficult task because there is no set definition for what constitutes a depression. The National Bureau of Economic Research in Washington is the organization tasked with identifying the official start and end of recessions—loosely defined as two or more consecutive quarters of negative growth—but it steers clear of identifying depressions. That’s partly because depressions are as rare as they are terrible. Yet there are similarities to what is happening now, and what America went through in the decade after 1929.

Most people don’t realize the Great Depression was in fact two separate recessions that history blended into one long malaise. The first and deepest recession lasted from 1929 to 1933 and was followed by a period of slow but positive economic growth. Then in 1937 the U.S. tipped back into recession for another 13 months. Many economists have warned that the U.S. is at risk of a double-dip recession, similar to what happened in the 1980s, when a brief recession in 1980 was quickly followed by another downturn from 1981 to 1982. If America’s economy does shrink for a second time this decade, though, the gap between the two recessions would bear more likeness to the calamity of the 1930s.

To be clear, the downturn that occurred in 2007 was neither as deep or as devastating as the recessions of the 1930s, when the economy shrank by a staggering 25 per cent. (The recession in 2009 involved a correction of just four per cent.) But there are other worrying parallels, and they have to do with the brutal state of America’s job market.

The world got a sense of how grim the situation is when the latest job numbers for August were released, showing the country created zero net jobs. The unemployment rate remained unchanged at 9.1 per cent, roughly where it has been stuck since mid-2009. Most worrisome of all, as Reich, the Berkeley professor, pointed out, as of August America’s total available labour force has expanded by seven million people since the start of the recession in 2007 thanks to population growth, yet the number of working Americans has actually shrunk by 300,000.

Across the nation scenes of desperation are playing out each day. When a baby food company in Fresno, Calif., held a job fair to fill 40 openings last week, 600 job seekers turned out with resumés. In New York, troubled Bank of America confirmed it would axe 30,000 jobs, though it has yet to say how many pink slips will go out to workers in the U.S. versus overseas.

The employment situation is arguably far worse than the official unemployment rate shows. That’s because it doesn’t include those workers who have simply given up looking for work, or those who have settled for part-time jobs. When those individuals are factored in, the true unemployment picture jumps to 16.2 per cent, which is unnervingly closer to the 21 per cent peak reached in 1934.

Buried within the ugly jobs data is an even uglier reality—the crisis in America’s job market began long before the current recession, and it could be years before it ends. It’s well known that men have been particularly hard hit by the jobs crisis, but only now are economists realizing how bad the situation is. For one thing, only 63.5 per cent of men have any type of job whatsoever, full- or part-time, which is the lowest level since records began in 1948, according to Bloomberg. Worse still, with so many men shut out of work, incomes have been pushed down to levels not seen in decades. In a recent report, the Hamilton Project at the Brookings Institution found real wages for men have fallen 28 per cent since 1969. For men without a high school degree, real wages plunged 66 per cent.

Economists can’t agree on what’s behind the malaise. Some argue high unemployment is the result of low demand brought on by the recession, so the answer is more government stimulus. Others point to structural changes in the job market, such as the eradication of low-skilled jobs through automation and globalization, that have left workers ill-prepared for what employers need. Surprisingly, in some parts of the country companies are screaming for workers, despite the glut of job hunters. As of July there were 3.2 million job openings in the U.S., with companies in the tech sector and even plastics manufacturing struggling to fill positions.

Alan Berube, a research director with the Brookings Institution, says persistent high unemployment is the result of both weak demand and deeper shifts in the economy. In a new study, Berube and his colleague Jonathan Rothwell examined the education gap in 366 U.S. metropolitan areas, meaning the difference between the years of schooling needed for the average local job and the years of schooling job seekers actually have. They found that cities with a wider gap experienced higher unemployment levels than those without. “This gap is not a new phenomenon, the recession just put a point on it,” says Berube. The housing bubble masked the deeper problems in the economy by providing an abundance of temporary low-skilled jobs in the construction industry. “When that mask was peeled away after the housing crisis hit, that education gap and the impacts of it were revealed once again.” The solution, he says, is to boost the number of people completing post-secondary educations and to retrain workers. Both tasks will be difficult at a time when governments are under pressure to slash spending.

Critics charge President Barack Obama’s jobs plan, which would direct $100 billion to infrastructure projects, is just more of the same and doesn’t fix long-term problems. Instead of building houses, workers would build schools, but they’ll still be unsuited for the economy of the future after the stimulus money dries up.

Berube disagrees. “The needs are great, the question is, does the nation have the willingness to invest in things that we’re going to need for long-run economic growth,” he says. “If we need these [infrastructure investments] then I don’t think it’s masking a problem, it’s taking advantage of the skills that are already there.”

Amid the uncertainty and political wrangling in Washington, one thing is certain—for the long-term unemployed, this crisis has all the hallmarks of an outright depression, whether anyone wants to call it that or not.