What do doctors really have to fear from the feds’ tax crackdown?

Opinion: Doctors are howling over Bill Morneau’s proposed closing of tax loopholes—but few of them would actually be significantly affected

Finance Minister Bill Morneau makes an announcement on housing in Toronto Monday, October 3, 2016. The federal government has announced measures intended to stabilize the real estate sector amid concerns that pockets of risk have emerged in some housing markets, particularly those in Toronto and Vancouver. (Nathan Denette/CP)

Share

Michael Wolfson is an expert advisor with EvidenceNetwork.ca and a member of the Centre for Health Law, Policy and Ethics at the University of Ottawa. He was a Canada Research Chair at the University of Ottawa. He is a former assistant chief statistician at Statistics Canada and has a PhD in economics from Cambridge.

Among the most insistent critics of the recent proposals by Finance Minister Bill Morneau to tighten up the use of private companies to avoid taxes have been Canada’s doctors.

Canadians generally do not begrudge doctors their above-average incomes. They spend many years training for their jobs, and then sometimes literally hold our lives in their hands. Still, valid questions remain about how much they make and how much tax they pay. Despite some claims, are doctors really in the middle class?

Muddying any clear answer is the fact that there’s no official definition of “middle class” in Canada. But one indicator is that, of the 15.1 million income tax filers in 2011, the halfway point along the income spectrum was at about $50,000. Only about one-fifth (21.9 per cent) of all tax filers reported incomes of at least $100,000. So anyone receiving an income of more than $100,000 could be considered at least upper-middle class.

In that same year, 52,160 doctors—or, more precisely, individuals working in doctors’ offices—reported incomes above $100,000.

But the story is more complex than this. Many doctors—30,280 of them in 2011—also owned a private company (technically, a Canadian Controlled Private Corporation or CCPC). These companies offer tax-planning possibilities not open to salaried or unincorporated individuals. For starters, they include a provision that permits up to $500,000 in income received via the private company to be taxed at a rate of about 15 per cent—far lower than the top individual income tax rate of about 50 per cent.

Such private company income will be further taxed when it is paid out to individuals and their families to use, though it can still end up being taxed at effective rates well below doctors facing the top rate of 50 per cent by using what Morneau calls “income sprinkling,” also known as income splitting. That refers to the practice of using a private company to channel income to other family members who are generally in lower income-tax brackets in order to avoid having to pay tax in that top 50-per-cent tax bracket.

In a study published in the Canadian Tax Journal in 2015, my colleagues and I estimated that this income sprinkling via CCPCs was costing federal and provincial governments at least half a billion dollars in foregone revenue every year. We also showed that doctors in particular had dramatically increased their use of these private companies in Ontario after the provincial government made an obscure change to their legislation in 2005, which allowed doctors’ and dentists’ spouses to be shareholders in their companies.

This apparently minor legislative change was introduced explicitly as part of fee negotiations with the Ontario Medical Association in order to avoid having to make public a more dramatic increase in doctors’ incomes.

Its main effect was to allow doctors to flow money out of their private companies to their spouses as dividends. The result was about a tenfold increase in the number of private companies owned by doctors since this 2005 change. With such a rise, despite its obscurity, it must have been a pretty attractive opportunity to increase their after-tax incomes.

But the benefits of this substantial back-door bump in income did not flow evenly to all doctors with CCPCs, nor across CCPCs more generally, as shown in this report.

Figuring out what was really earned isn’t a straightforward matter. Doctors rightly claim that their incomes are not nearly as high as the gross figures paid out by provincial governments in fees for each medical service they provide. Among other costs, they have to pay their staffs and office expenses.

But based on individual and corporation income tax return data from 2011, I have estimated the net (after staff and office costs) family incomes of individuals working in establishments classified as “doctors’ offices” and with income over $100,000 on their individual income tax return, including the money retained that year within their CCPCs.

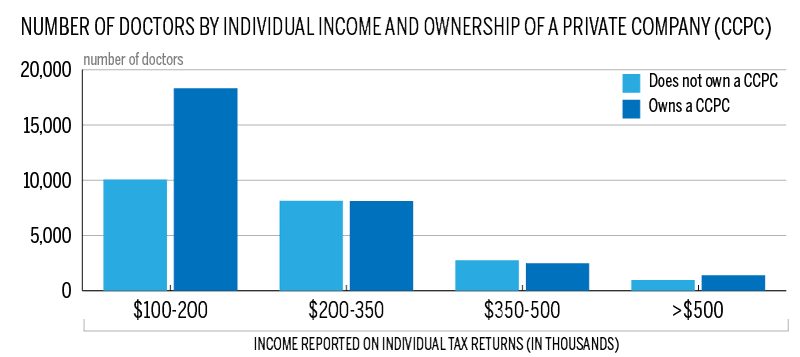

The chart below indicates that 21,880 doctors did not own a private company. They will be completely unaffected by the federal government’s proposals to tighten up on the tax-planning uses of these CCPCs. In contrast, 30,280 doctors did own a CCPC. These doctors might be significantly affected by the proposed tightening of these tax preferences, especially to the extent that they engaged in aggressive tax planning.

Those most likely to face considerable tax increases would be the 3,870 doctors with incomes over $350,000 and who owned a CCPC. These individuals made up less than one-tenth of all doctors with incomes over $100,000, and they were the most likely to exploit the tax preferences on which Morneau is now proposing to clamp down.

As shown in the table below, these doctors’ effective family incomes were substantially higher than what they had reported on their individual income tax returns. (To be clear, some portion of this family income likely came from sources other than the doctor’s CCPC. On the other hand, not all income sprinkling to other family members is captured in these figures if the other individual is, for example, a student living on their own). For example, the 1,390 doctors who had an individual income over $500,000 and owned a CCPC had an average family income plus income made that year but kept within their private company of about $1.4 million.

This amount is about twice the average family income of the 960 doctors who were also in the over $500,000 income range, based only on their individual incomes, but who did not own a private company.

And the 2,480 doctors who owned CCPCs and had individual incomes in the $350,000 to $500,000 range actually averaged $673,000 in 2011 when these other sources of income were included. (It’s important to keep in mind that this is not their gross income from medical practice; it includes only their net income, after deducting allowable expenses such as those for staff and their office.)

| Income reported on individual tax returns (in thousands) | ||||||

|---|---|---|---|---|---|---|

| $100-200 | $200-350 | $350-500 | >$500 | |||

| Does not own a CCPC | $240 | $337 | $483 | $730 | ||

| Owns a CCPC | $378 | $498 | $673 | $1,402 | ||

No reasonable definition of “middle class” would include doctors with family plus company incomes over $250,000 or $300,000, though more than 80 per cent of these doctors appear to be in this high-income range when measured by their family plus retained company income (all but the 10,050 in the upper-left corner of the table)—both those on salary, who have no choice, and those using a private company who can choose to channel their income in more “tax-efficient” ways.

There is a growing outcry from some doctors about the proposal to tighten up on the way they are taxed. But the numbers show there are many doctors who would not be affected at all, particularly those not owning a CCPC; they appear to be largely remaining silent. A clearer understanding of how much doctors really earn shows the gap between doctors with the special privilege of being able to use private companies, and those who cannot, whatever their income. Morneau’s proposed tax changes are not an attack on middle-class doctors: They’re a bid to restore fairness in tax treatment.