crisis

Japan’s nuclear crisis explained

Answers to frequently asked questions about the situation in Japan [UPDATED]

Which country is right?

US vs. UK: Stimulus spending vs. hard-nosed austerity

‘We are living in hell’—Haiti six months later

Can a 10-year, $10-billion rebuilding plan turn this country around?

UPDATED: Constitutional NON Crisis

Is Jean is declaring war on Harper? Or did he declare war first?

Econowatch

The new normal: Call it frugality if you like. We call it sanity.

Lend…or else

STEVE MAICH ON ALL BUSINESS

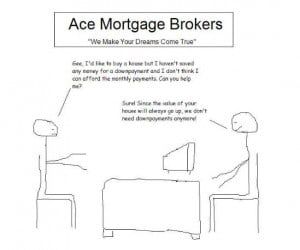

So a banker walks into a bar…

Financial reporters (including this one) have tortured countless metaphors in their quest to explain what the heck is going on in the economy. But sometimes funny does a better job. And at a time of falling markets and uncertainty, it helps to hold on to a sense of humour. So without further ado, here are some of the best financial crisis jokes, sketches and comic strips that have hit our inbox or been scavenged from the Interweb. (Note to viewers: a couple contain profanity.)

Bailouts now, damn the consequences

When you’re standing in the midst of an economic storm, it’s hard to see more than a few feet in front of you. The actions officials take to stem a crisis can have deep and profound consequences in the long run, but at the time, they may seem absolutely necessary. Following the Dot-Com crash and the 2001 terrorist attacks, the Federal Reserve under Alan Greenspan slashed interest rates to keep the economy from slipping into a long and painful recession. By 2004, the short-term rate was hacked to just 1 per cent. As we all know now, the move inflated the massive debt bubble that triggered the current economic crisis. It’s a common refrain to say Greenspan kept rates “too low, too long.”

“Capitalism as we know it will be wiped out”

Since the economic crisis kicked into high gear this month, many pundits have tried to convey how serious it is by describing it as the worst crisis they’ve ever seen.

When the next domino falls, look out Canada

Via Paul Kedrosky’s blog, I came across this column by Nouriel Roubini, whose predictions about this financial crisis so far have come true with astonishing precision. He address where he sees the contagion spreading next. In short, first the hedge funds will fall, then private equity firms will crumble:

Paulson’s folly

I’ll be writing a lot more about this in the upcoming issue, but at the risk of getting ahead of myself, I have to express my sadness at the goings on south of the border right now. The U.S. government is in the process of negotiating a bailout plan which will likely come in at close to double the cost of the Iraq war so far. We are told that this is regrettable but necessary in order to prevent worldwide financial Armageddon.