personal finance

The pandemic has ramped up students’ money woes

There are no jobs. But there are bills to pay. And there are online classes to attend. Luckily, there are some lifelines.

How the pandemic blew my family budget

Brianna Bell: We bought a house, got a dog and are splurging on groceries. In these stressful pandemic times, maybe a little debt isn’t so bad.

Are Canadians being left behind or benefiting from a thriving economy?

For this election, it’s both. There is evidence that people’s partisan identification changes the way they see changing economic conditions.

13 ways the 2019 Ontario budget could affect your wallet

Doug Ford’s Conservatives offer tax credits for childcare, free booze at casinos and more.

Some Canadian universities are offering practical personal finance courses

U of T’s new class has seen enrolment triple in the year since its inception

Best budgeting apps for university students

Four apps to help save money—and one to help spend it

The max you can contribute to your TFSA for 2018

Find out your cumulative room

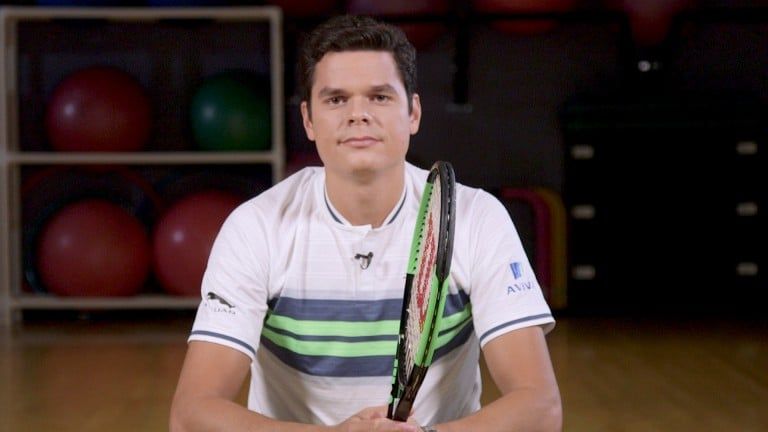

Milos Raonic explains interest rates

Recently the Bank of Canada raised interest rates. How will that impact you? Let pro tennis player Milos Raonic take a swing at explaining it.

Ten things we learned about Canadians and their money

What we think about credit cards, taxing foreign home buyers and giving to charity

These are the most common myths about bankruptcy in Canada

When it comes to personal bankruptcy, Canadians have a lot of mistaken beliefs that need clearing up, writes insolvency expert Scott Terrio

How to keep from drowning in credit card debt

Ways to manage your debt before you’re under for good

Ten top RRSP questions answered

Are RRSPs a good idea? What are the differences between RRSPs and TFSAs? A MoneySense expert answers all