Corporate income tax rates vs corporate income tax revenues

Not the way to go to replenish public coffers

Financial center, Bay Street, Toronto, Canada

Share

Duanjie Chen and Jack Mintz have released their latest Global Tax Competitive Ranking, and iPolitics picks up on on a point with which more people should be familiar:

If the Conservatives hadn’t touched the federal corporate tax rate when they took office in 2006 – if they’d kept it at 21 per cent instead of lowering it to 15 per cent – government revenues would be $13 billion higher, the Canadian Labour Congress argued in a paper last January.

“Each one percentage point cut to the corporate income tax rate costs the federal government about $2 billion in annual revenues,” wrote the authors, one of whom was CLC chief economist Andrew Jackson…

But are they right?

No, argues a new paper written by tax expert Jack Mintz and Duanjie Chen, and released by the University of Calgary’s School of Public Policy on Tuesday.

Chen and Mintz are quite right. The CLC estimate is what you get if you assume that the only behavioural response to an increase in corporate tax rates is that firms’ CFOs will grit their teeth and put bigger numbers on the cheques they send to the Receiver-General. But in a world in which multinationals file 57,000-page tax returns, one can only marvel at the faith in human nature among those who would make policy based on such a belief. People respond to incentives, and if you make it more costly to report profits in Canada, firms will do less of it. Partly because they will make less profits as investments decline, partly because firms will shift income away from Canada.

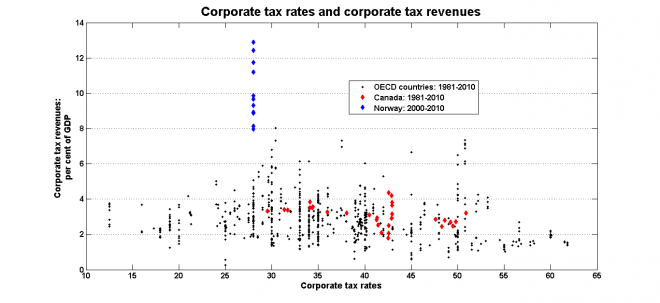

The short-run effect of a corporate tax increase in revenues is surprisingly small (Chen and Mintz provide the references; see here for how they apply to Canada), and a good estimate for the long-run effect is zero. Here is a graph of CIT rates and CIT revenues for OECD countries over the last 30 years (click on the graph to open a larger version in another window):

If you’re a government looking to generate a noticeable increase in revenues, you may as well forget about corporate taxes.