Mark Carney talks fiscal cliff, Fed policy and housing bubble

A departing governor shares his views and dodges one tricky question

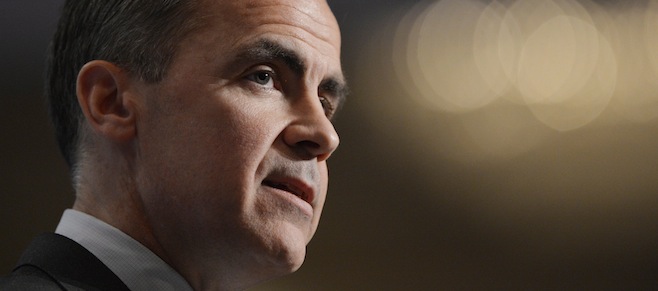

Bank of Canada Governor Mark Carney speaks to the CFA Society Toronto on global and Canadian economies and the stability of the global financial system in Toronto on Tuesday, Dec. 11, 2012. THE CANADIAN PRESS/Nathan Denette

Share

In his first public speech after being named head of the Bank of England, Mark Carney, governor of the Bank of Canada, deftly dodged the question of what lesson he might take with him to Europe from his experience shielding Canada from the depths of the global recession. He did, however, give some hints about his approach and touched on a range of other issues, from what the debate over the U.S. fiscal cliff means for Canada, to how we’re not yet out of the woods when it comes to the country’s housing bubble.

Here are a few excerpts from the Q&A that followed Carney’s speech at the CFA Society in Toronto this morning:

On what lessons he plans to take from Canada to the Bank of England:

I think my comments about the Bank of England are best first delivered to the Treasury select committee given their role and we’re working right now with the committee to find a date in the new year that works for both of us.[That said] there are experiences of crisis management that we had here in Canada. Much is made in Canada that we didn’t have bank failures and we didn’t have other issues. In part, we didn’t have those because we made tough decisions in a timely fashion…The first thing is transparency. You have to level with people on the scale of problems. It does no good to try to spin your way out of a crisis.

…I would say on monetary policy and financial stability policy writ large, I think one the strengths of the Bank of Canada is the breadth and dept of talent in the institution and, as the governor, the importance of listening to diverse points of view and synthesizing within that institutional structure either a path for monetary policy or a path financial reform for other things. Those are some of the aspects that worked here in Canada.

The last thing I would reinforce is basically the power of the flexible inflation targeting framework, which we and many others practices…In order to get the most benefit from that framework, transparency and communications is absolutely crucial. There’s a way to use communication to potential amplify that power in extraordinary circumstances, which may be appropriate in some jurisdictions, not appropriate in other jurisdictions.

Those are general lesson, which are not necessarily directly applicable to the Bank of England.

On European economic woes, the U.S. fiscal cliff and the Bank of Canada’s sunny views on both:

Our view, and it is shared by many others, is that if there were not to be a resolution of the fiscal cliff, the U.S. economy would go into recession and that would have a very direct impact on Canada and it will also have a material financial market impact. The combination of the two…might necessitate a policy reaction.[A major downturn in both the U.S. and the European economies] are relatively extreme events that would adjust our path of policy and are not incorporated into our expectations of the optimal path of policy right now. In other words, if we had a forecast that included material deterioration in the European situation, or a forecast that incorporated the U.S. going over the fiscal cliff, we would have a different policy path. We do have a forecast which has basically stagnation in Europe — containment of the situation there — and the U.S. situation that is continuing to recover because some resolution of the fiscal cliff is involved.

On why loose monetary policy in the U.S. is good for Canada:

It is in the interest of everybody on this planet that the major advanced economies are growing. The major advance economies, U.S. and Europe, Japan, have disinflationary — potentially deflationary — pressures that can only be expanded by very expansive monetary policies. Directionally, those central banks are doing exactly the right thing that’s in the interests of their economies and in the interests of the global economy. Canada is the largest trading partner, we’re the largest financial intermediary of the United States. If anyone gets the spillover from loosening up the Untied States monetary policy, it’s us. We unambiguously, unreservedly recognize the appropriateness of the stance of the Federal Reserve policy given the forces that are hitting that economy. We recognize that even with the impact that it has on our current — and it does have an impact on our currency — that it is a net positive for the Canadian economy and we manage our monetary policy accordingly.

On how to get financial institutions to stop behaving badly:

You can fix the controls, you can change the processes, but alongside that there needs to be a cultural shift in some organizations, and I’m not going to cash aspersions on specific ones. That is a longer [process] that I believe has begun. But it needs fully cascade down through the institutions to remember in the end what a financial institution is for. It doesn’t exist for its own purpose. It ultimately exists to serve the real economy and ultimately everyone’s actions in these institutions ultimately have effects on the real economy.

On why more needs to be done to avoid a replay of the 2008 financial crash:

The global financial system is safer than it was, but it’s not as safe as its needs to be or resilient as it needs to be. There has been substantial capital raised by the core of the banking system, $600 billion, substantially greater than losses thus far; $70 billion in capital raised here in Canada. The shadow-banking sector has fallen by about 20 percentage points of GDP back to 2004 levels. We’ve seen substantial changes in market infrastructure including to derivatives and repo markets. There’s a variety of things that have been done that directly address some of the shortcomings of the system that existed then. That said, the macro environment is much more challenging in major economies: potentially even the United States, but certainly in Europe. There are institutions that need to continue to build capital. We haven’t finished the reforms to derivative markets. Very importantly, we have not yet finished the series of measures that are necessary to end “Too Big to Fail” and fully reinsert market discipline into the current system the current system.

On positive signs that the Canadian housing bubble is deflating:

We’ve seen starts coming down. They’re now down around where we see household formation. We’re seeing some overbuilding still in condos and we’ve been pretty clear about that. We have seen the pace of household debt accumulation slow as hoped for, as intended, from about 10 per cent to just [about] more than four per cent. We’ll see if that persists, but that is a positive. We’ve seen some adjustments in the resale market, which again is positive.But I would just caution we have seen in the past when there have been policy measures taken, movement in these variables that are then followed by a reacceleration. [We have] not necessarily seen anything that would be consistent with that, we just have to be vigilant about these aspects and adjust if necessary to that if there were clear signs of a reacceleration [in household debt]. So we’re somewhat encouraged by what we’re seeing that the economy is moving and household are moving toward a more sustainable path, both in the housing sector and the accumulation of household debt.