What the analysts say: Canada and the U.S.’s trade balance

We bought tons of cellphones. The auto industry is well. But why can’t we export like China?

FILE- a stevedore move shipping containers at the Fairview Cove container terminal in Halifax on in this Feb. 11, 2009 file photo. The strong Canadian dollar is flexing its muscle, squeezing Canada’s exports and shrinking its trade surplus. THE CANADIAN PRESS/Andrew Vaughan

Share

To recap:

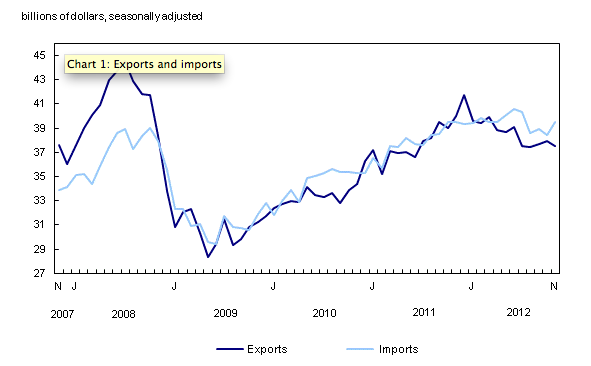

- Canada’s trade balance: The deficit grew nearly fourfold in November compared to October, rising to $2bn. Canada imported more (largely electronics—and particularly cellphones—and cars) and had to sell abroad for cheaper due to falling prices for many of our key exports.

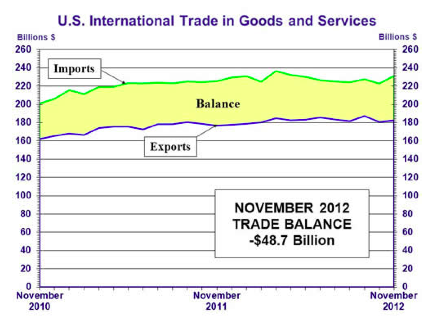

- The U.S.’s trade balance: The U.S. trade deficit also widened (to nearly $49bn, up nearly 16 per cent from October), also largely on the back of strong imports of cars, smartphones and other electronics. Exports inched up by only one per cent, hurt by weak demand from Europe.

What the analysts are saying:

- Canada: Though the widening trade deficit bodes ill for GDP growth in the last three months of the year, the silver-lining in having rising import volumes is that consumer demand, apparently, is still alive and well, writes RBC’s David Onyett-Jeffries. Adam Button at ForexLive points out that Canadian exports to the EU have fallen 27.5 per cent year over year. Despite the euro crisis, China has recently managed to increase its outgoing trade flow to Europe: so is Canada losing its competitive edge there? Back to North America and on a more positive note, the auto industry on both sides of the border seems to have kicked into high gear, notes CIBC’s Emanuella Enenajor—and with U.S. annualized motor vehicle sales up by nearly 15 per cent on an annual basis in the last six months of the year, there is plenty more to come.

- U.S.: CIBC’s Andrew Grantham suspects the strong increase in import volumes reflects the re-opening of east coast ports after superstorm Sandy. Still, he notes, the performance of exports, which were flat in terms of volume, was disappointing. A slur of economists lowered their forecast for economic growth in the last quarter of 2012, writes Ruth Mantell at MarketWatch.

Canada: Exports and Imports