Is owning a home the best job in town?

The gains from soaring house prices in Toronto and Vancouver are dwarfing paycheques from even the best-paying jobs in those cities

A sold home is pictured in Vancouver, B.C., Thursday, Feb. 11, 2016. Canada Mortgage and Housing Corporation says there is mounting evidence that house prices in a number of Canadian cities are out of whack with incomes and other economic fundamentals.The latest report from CMHC says there is evidence of overvaluation in nine of the 15 real estate markets included in the research. THE CANADIAN PRESS/Jonathan Hayward

Share

What pays more: owning a home in Toronto or Vancouver, or working in those cities? For homeowners in either of Canada’s hottest real estate markets, there’s a very good chance their digs netted them far more money over the past year than did their jobs.

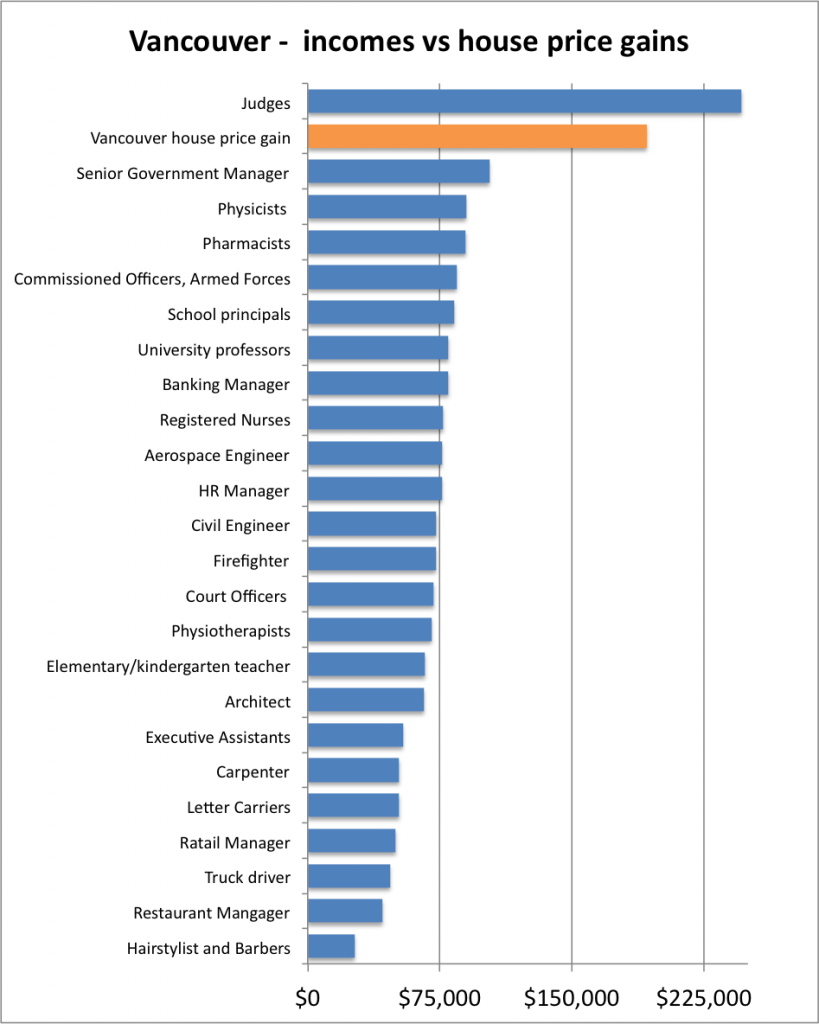

Here is how the average annual price gain of $193,000 for a home in Vancouver stacks up against the typical pay for a variety of jobs in the city.

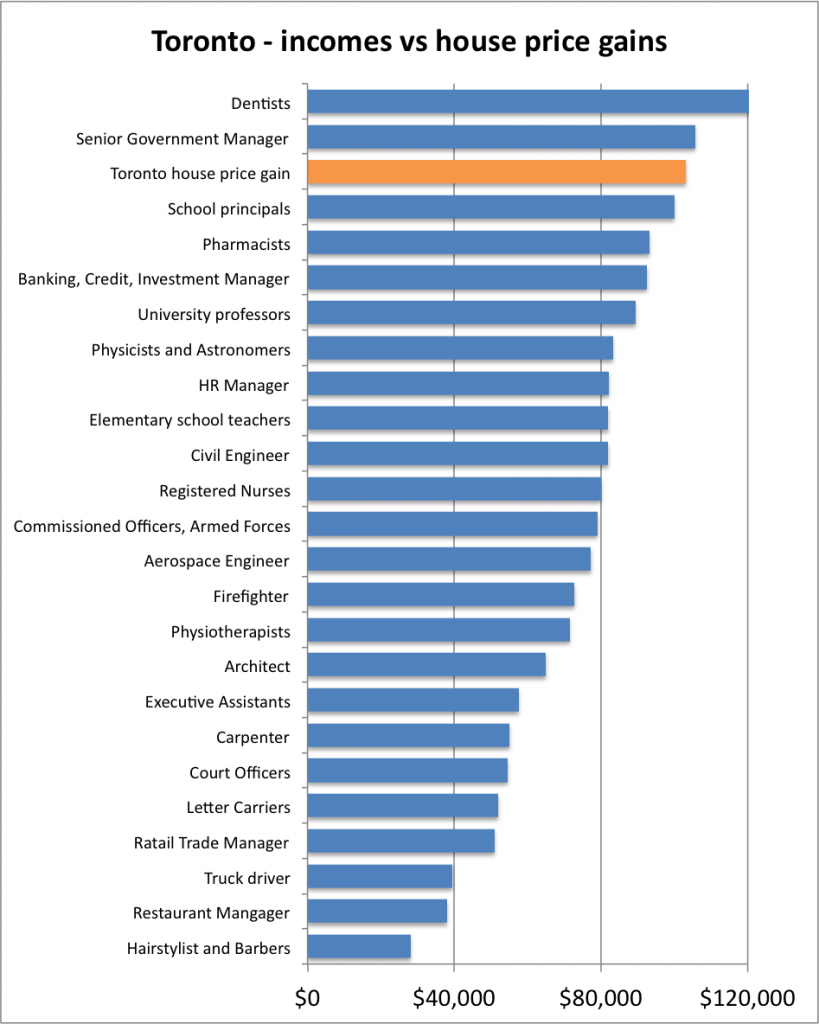

Now here’s the same chart for Toronto, where the average home price jumped $103,000 over the last year. (House price figures for both cities are from the Canadian Real Estate Association, while income data was taken from the federal Job Bank site.)

Now of course there is a huge caveat to this comparison. A primary residence is an asset, and any appreciation in value can’t be direct deposited into your bank account like paycheques from a job. You can’t buy groceries with your house—unless you sell it. But then you’d forgo any potential future gains and still have to find somewhere else to live.

Yet the dynamic between incomes and soaring house prices has been top-of-mind lately. Earlier this month, research from Jens von Bergmann, a B.C.-based mathematician, gained attention after he showed that the owners of roughly 79,000 detached homes in Vancouver enjoyed a bigger haul from rising land values—$25 billion in 2015 alone—than the total employment income of everyone in the city last year, which was estimated at around $18 billion. As von Bergmann wrote on his site: “[Single family home] property owners alone earned more by twiddling their thumbs than the entire population of the City of Vancouver did—by actually working.”

This is obviously problematic because soaring house prices need to be underpinned by an abundance of well-paying jobs and rising paycheques. And while those two cities currently account for all new job gains, wage growth has been meagre. Indeed, Bank of Canada Governor Stephen Poloz warned recently that the economic fundamentals in Toronto and Vancouver, including job growth, immigration and incomes, in no way support the current pace of house-price appreciation. “Home buyers and their lenders should not extrapolate recent real estate performance into the future when contemplating a transaction,” he said.

Here’s another way to look at the widening gap between house prices and incomes, courtesy of The Economist‘s global house-price tracker. Since the 1980s, the affordability measure followed a similar trajectory in Canada and the U.S. until the American housing market crashed. After a brief pause, the ratio of house prices to average incomes in Canada resumed its sharp climb.

Owning a home might appear like it beats working right now, but don’t give up that nine-to-five job just yet.