The case for Canada going it alone on carbon emissions

Yes, Canada’s share of global carbon emissions is small, writes economist Joel Wood, but that’s not a valid argument against taking action

Emissions are released from a smokestack at the Teck Mining Company’s zinc and lead smelting and refining complex in Trail, B.C. THE CANADIAN PRESS/Darryl Dyck

Share

The Trudeau government has drawn praise and scorn for its plan to impose a national carbon price floor of $10 per tonne of CO2 in 2018, rising to $50 per tonne by 2022. I have seen several commentators criticize the plan claiming that Canada is such a small emitter (less than 2 per cent of global emissions) that any reductions we make will have no impact on slowing climate change. It seems that this critique gets repeated every time climate policy is discussed in Canada (I have even fallen victim to its allure in the past); however, I am not convinced that this argument holds water.

It is true that Canada cannot achieve the 2 degrees Celsius target or avoid triggering catastrophic outcomes alone; this requires global cooperation and commitment. However, this does not preclude our emission reductions providing benefits on the margin. Basically, there may be benefits to unilateral Canadian reductions.

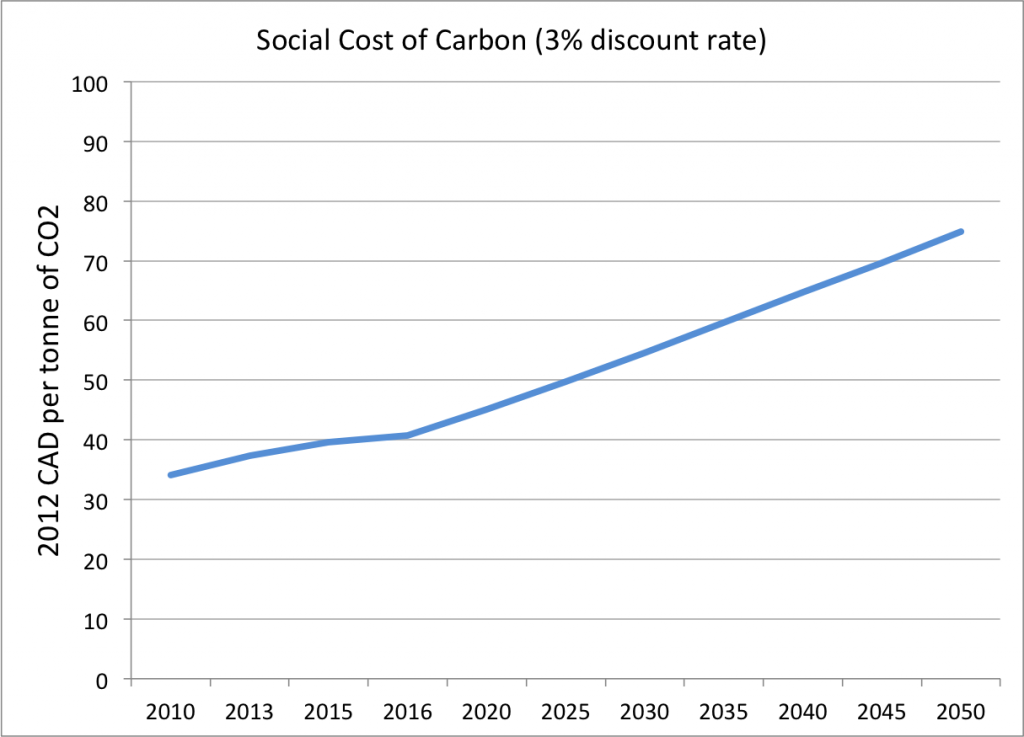

In fact, we have a readily available measure of these benefits that is regularly used by governments when evaluating climate policies. The Social Cost of Carbon (SCC) is an estimate of the marginal (incremental) external cost of increasing global emissions by 1 tonne in a specific year above what they would be otherwise. This marginal increase leads to a stream of costs into the future that are then discounted back to present values. It is a net-cost, i.e., it includes benefits of higher CO2 concentrations and warming. If we reduce global emissions on the margin, we avoid these costs; therefore, the SCC can be used as an estimate of the global benefits of our reductions. Environment Canada’s selected values for the SCC are displayed in the figure below. In 2020, their central estimate of the SCC assuming a 3 per cent discount rate is $40.7 per tonne of CO2 in 2012 dollars.

The SCC is estimated using Integrated Assessment Models (IAM) which combine an economic growth model of the world economy and a model of the earth’s climate system. A disadvantage of these models is that they make a lot of assumptions about parameter values leading to a lot of uncertainty in the resulting SCC estimates. Just varying a few parameter values across the three IAMs leads to a wide range of SCC estimated values. These models have been critiqued for this uncertainty and for not including the potential for catastrophic outcomes. However, they are still somewhat useful to provide a lower bound for the damages from emissions.

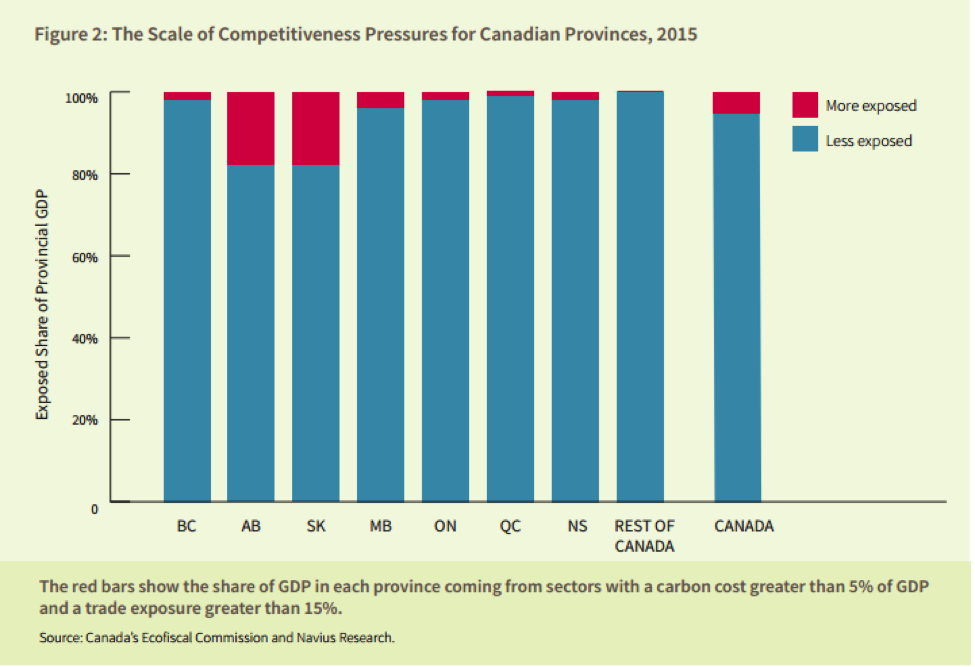

On the other hand, if an open economy like Canada enacts climate policy unilaterally, some economic activity may shift to countries without climate policy, leading to increased emissions elsewhere. So Canadian emissions reductions may not lead to an exact reduction in global emissions due to these related increases in other jurisdictions. This phenomenon is called emissions leakage and it is especially a problem in sectors of the economy that are emissions intensive and trade exposed. Emissions leakage is a bigger problem in some provinces (e.g., Alberta, Saskatchewan) more so than in others (e.g., British Columbia). A recent ecoFiscal report highlighted which provinces have large GDP shares of emissions intensive, trade exposed sectors.

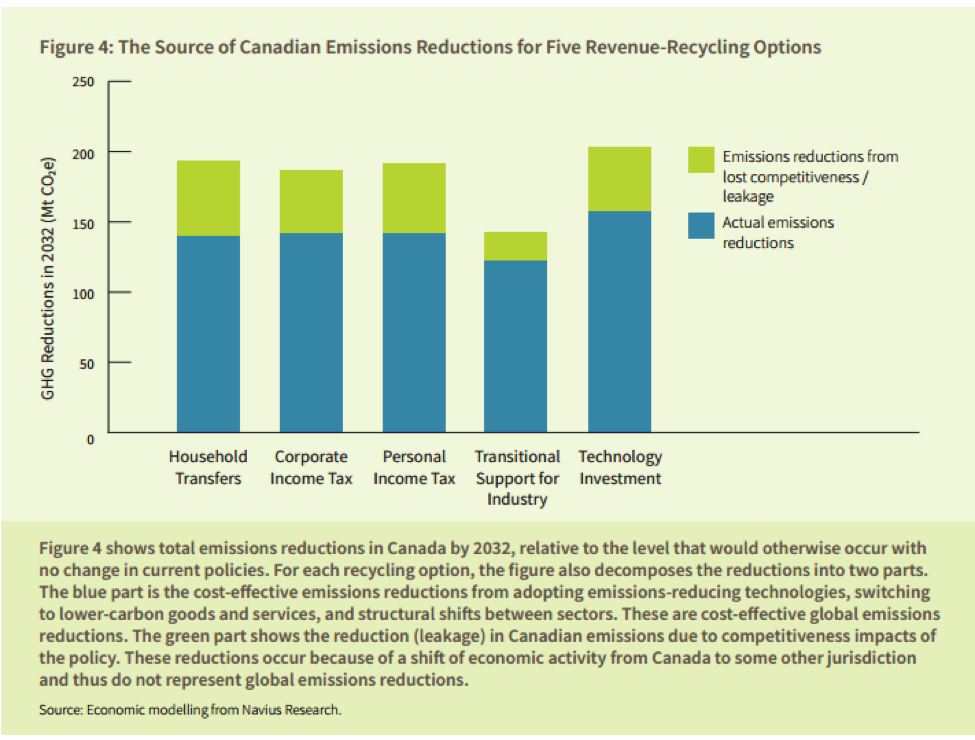

Emissions leakage depends critically on carbon pricing policy design and what is done with any revenue collected. Another ecoFiscal report provides estimates of emissions leakage under different revenue recycling options for a national carbon price. They assume a $30 per tonne carbon price starting in 2015, rising to $50 in 2021 and $100 in 2027. The next figure shows the share of emissions reductions that leak to other jurisdictions under five different revenue recycling options.

Eyeballing the chart, emissions leakage appears to be less than 25 per cent of the Canadian reductions and depends on what we do with the revenue. Temporary output based subsidies to emissions intensive, trade exposed sectors reduces emissions leakage a lot (but also reduce our post-leakage reductions).

To measure the benefits that accrue from Canadian unilateral emissions reductions, take the number of emissions reductions in a given year, adjust for emissions leakage, and multiply by the SCC for that year. This number will be positive since emissions leakage is not 100 per cent and the SCC is positive. For example, if Canada reduces CO2 emissions by 12 Mt in 2020 below what they otherwise would be, emissions leakage is 25 per cent, and the SCC is $40.7, the benefits of those reductions are just over $366 million (2012 CAD).

The point of this post wasn’t to dismiss the need for international cooperation and action; these efforts are important for reducing emissions leakage and avoiding catastrophic outcomes. For example, emissions leakage from Canadian climate policies is reduced substantially if the U.S. takes similar action. The point was to highlight that although Canada is a relatively small total emitter, our emission reductions can matter and provide benefits in foregone climate damages. It may be convenient to ignore the benefits of marginal emissions reductions, but it is wrong.

Joel Wood is an assistant professor in the School of Business and Economics at Thompson Rivers University in Kamloops, B.C.